What is Statutory Liability insurance?

Statutory Liability insurance covers the company, senior management and employees for allegations of wrongful breaches of key legislation in the course of the insured’s business. The policy will meet fines and penalties payable in specified circumstances and related legal expenses.

What does Statutory Liability insurance cover?

Costs and expenses from official investigations and inquiries

Pollution Liability defence cost

Fines and penalties

- Civil liability

- Wrongful breach of air, marine or motor traffic regulation

- Dishonest, wilful, intentional or deliberate wrongful breach

- Gross negligence or recklessness

- Joint ventures

- Prior or pending claims

- Criminal offences

- Asbestos

- Fraud and dishonesty

- Failure to comply with law enforcement

- Requirement to pay taxes, rates, duties, levies, charges or fees

- Pollutants

- Property damage

Let’s cover your small business on the go

Start a quote to see how much you can save and buy online in minutes.

How much does Statutory Liability insurance cost?

Statutory Liability insurance costs can vary based on your industry, business operations, insurance requirements and other factors. Every business is unique, and so is the type and cost of its policy.

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Your business size

Nature of your business operations

State jurisdiction

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Flexible Cover

Pick from 3 levels of Statutory Liability cover

Unsure how much to choose? Think about:

Statutory professional requirements

Your business size

Nature of your business operations

State jurisdiction

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

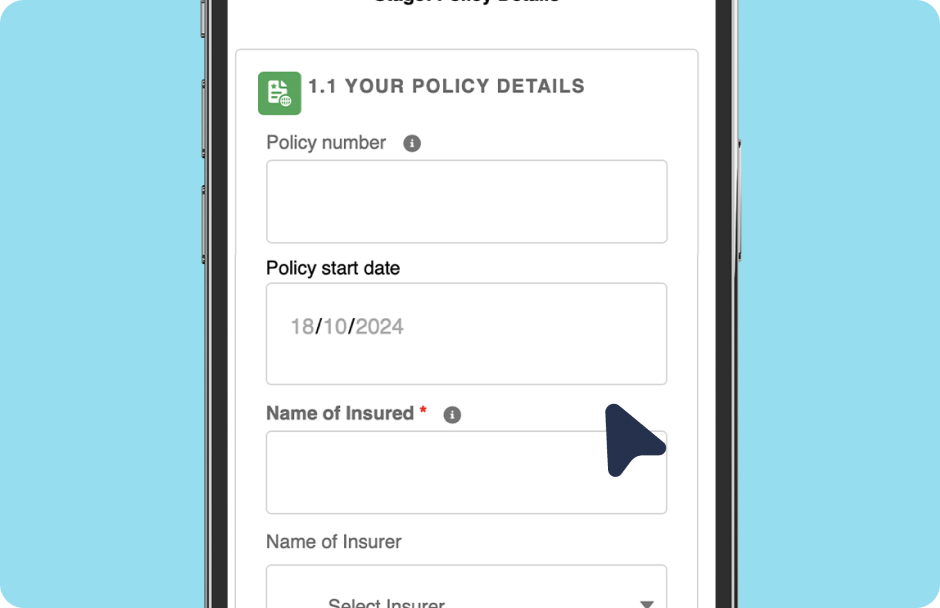

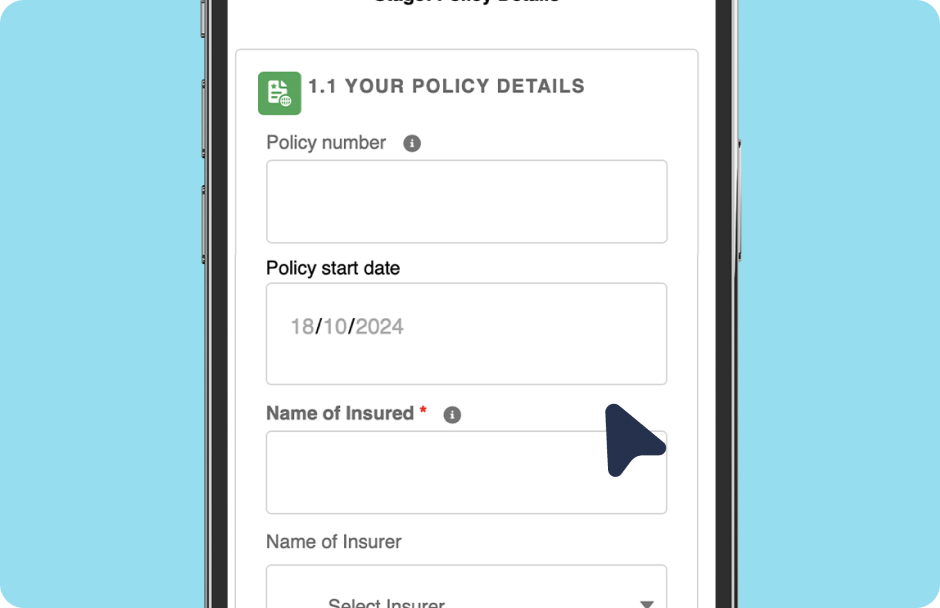

How it works – buying online

5 easy steps to get instant cover online today

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

How to make a claim online

We’ll assist you through the claims process & manage the claim directly with the insurer.

Let us know Fill out our

claims form and provide info

to support the claim

Receive extra support We

will assist you with your claim

Claim results We will notify

you of the claim outcome.

See how much others have saved while purchasing policy through BizCover

^ Savings made from January 2024 to April 2025. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Frequently asked questions

If your business is at risk of fines or penalties from breaching Australian laws or regulations, you may consider Statutory Liability. For example, if you own a construction business, you could be at risk for not meeting on-site safety standards. Statutory Liability insurance helps cover legal defence costs and associated fines, so you’re not left out of pocket if something goes wrong.

Real-life customer reviews verified by Feefo