Compare quotes from our trusted insurance partners:

On this page:

What is electricians’ insurance?

Electricians’ insurance (the many types of business insurance made for electrical contractors) helps you manage the cost of different risks, like mistakes in your work, accidental property damage, and stolen tools.

When you’re working with clients, suppliers, and on construction sites, there is plenty of potential for things to go wrong. Fires, injuries from live wires, accidental damage to a customer’s home, tool theft… these are just some of the potentially expensive risks that could create unplanned bills for sparkies.

That’s why many electricians think business insurance is a bright idea—helping you manage out-of-pocket expenses that might short circuit your finances.

Why do electricians need insurance?

Electricians may need business insurance to get licensed, meet contractual obligations and manage unplanned bills.

Enter a jobsite

Lease a workshop

Become licensed

Work as a contractor or sub-contractor

Pay legal costs if you face a liability claim

Let’s cover your small business on the go

Start a quote to see how much you can save and buy online in minutes.

Who needs electricians’ business insurance?

Most electrical contractors consider business insurance to protect their businesses, including electricians, cabling installers, and appliance installation services:

Electricians

Cabling Installation

Garage Door Installation & Maintenance

Antennae Installation

Pay TV Installation

Household Appliance Installation

What types of insurance do electricians need?

BizCover has a range of business insurance options designed to protect your business operations, professional reputation, and much more. Build an insurance package that suits your needs and buy online in minutes.

Popular cover for electricians:

Electricians may also consider: :

How much does electricians’ insurance cost?

The average cost of business insurance for electricians is $85 per month* with BizCover.

However, the price you pay may depend on factors such as the size, risks, and needs of your business.

Factors influencing cost

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Factors influencing cost

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

Customer Average Monthly Payment Report is based on 1 July 2023 to 30 June 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Get cover that works with the risks of your business

Select different cover amounts for each policy listed below.

This is the most you will be paid out if you need to make a claim.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

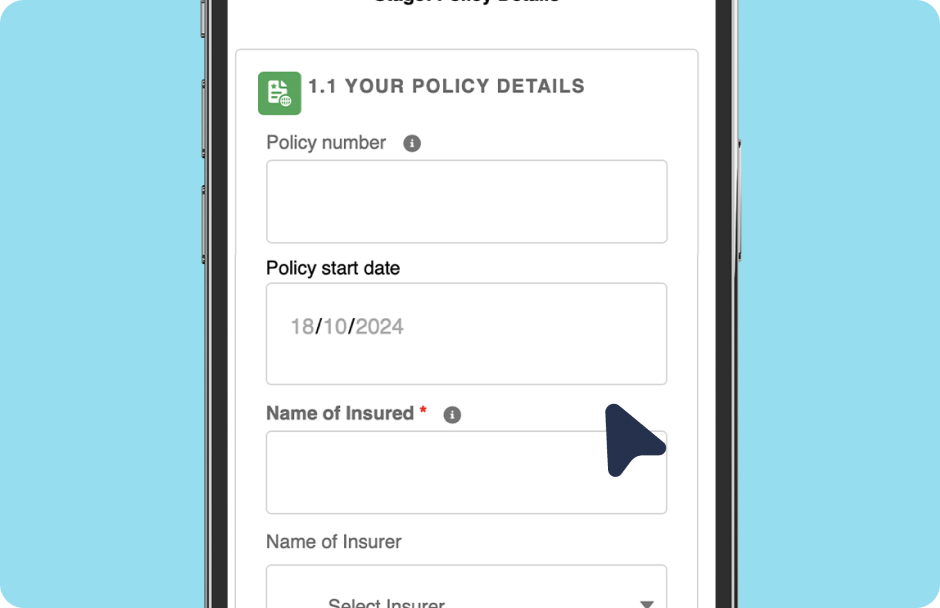

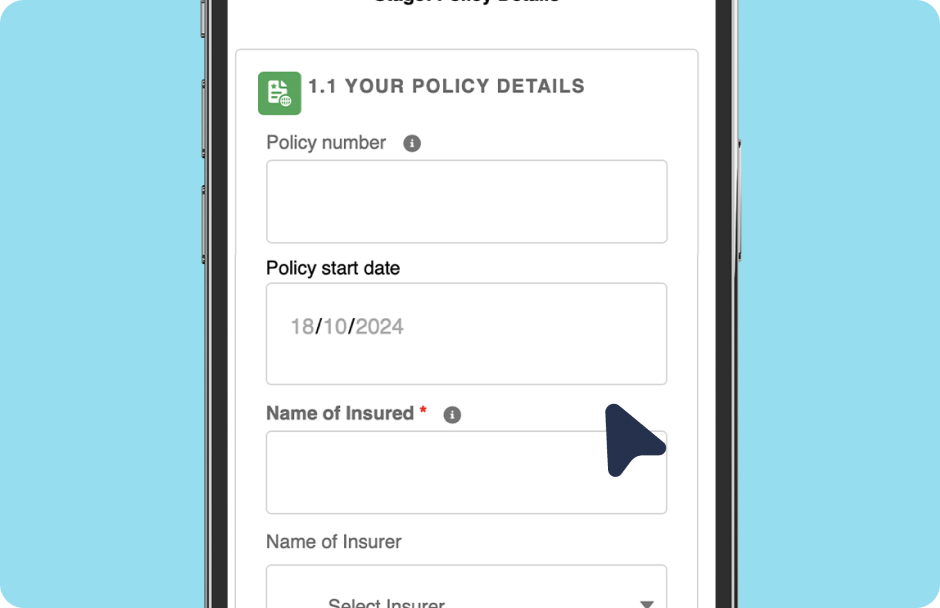

How it works – buying online

5 easy steps to get instant cover online today

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

How to make a claim online

We’ll assist you through the claims process & manage the claim directly with the insurer.

Let us know Fill out our

claims form and provide info

to support the claim

Receive extra support We

will assist you with your claim

Claim results We will notify

you of the claim outcome.

Award-Winning Tech & People

We’re not ones to blow our own trumpet, but we are pretty proud of our innovative insurance platform, outstanding team, and stellar workplace.

See how much others have saved while purchasing policy through BizCover

^ Savings made from January 2024 to April 2025. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Frequently asked questions

Public Liability insurance is required for electricians to become licensed in most states and territories of Australia. Electricians are usually required to have a minimum cover level. For example, Victorian sparkies must have a minimum of $5 million in Public Liability cover.

If you work in Queensland, you’ll also be required to hold the Consumer Protection extension with a minimum level of $55,000 of cover to provide protection to consumers for defects in electrical work, non-completion of electrical work and liability resulting in an electrician testing their own work.

Real-life customer reviews verified by Feefo