Compare quotes from our trusted insurance partners:

On this page:

What is Cyber Liability Insurance?

Every business with an online presence is at risk of a cyber attack. Cyber Liability insurance is designed to help protect you from claims and support your business in the event of a cyber breach or attack. Costs associated with defending a cyber claim are also covered.

Examples of the types of risks Cyber Liability insurance can assist with are inadvertent loss or release of customer personal information, cyber crime, cyber extortion/ransomware and business interruption due to a cyber event.

What does Cyber Insurance cover?

Data breaches

Theft or loss of client information.

Legal costs

Some fines and penalties resulting from a third party claim for data or network security breach.

Crisis Management

Costs to protect or mitigate damage to your business’s reputation following a cyber incident.

Business interruption

Loss of income due to a temporary stoppage of business activities caused by a cyber breach.

- Bodily injury or property damage.

- Upgrading of an application, system or network

- Damage to computer hardware

- Prior known facts or circumstances Intentional or fraudulent acts

Why might you need Cyber Liability insurance?

You may need Cyber Liability insurance if you use smart devices or the internet to operate your business.

Respond to a cyber breach

Meet legal obligations

Pay legal costs

How much does Cyber Liability insurance cost?

Cyber Liability insurance costs $134 per month* on average for BizCover customers, but every business is unique.

The cost of a policy can vary based on your business’ size, risks, industry and other factors.

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to Jun 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select different levels of cover to suit your needs.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

How is the cost of insurance calculated?

Risks of the industry

Cover level amount

Annual turnover

Number of employees

Claims history

*Customer Average Monthly Payment Report is based on 1 July 2023 to Jun 2024 and presented as a guide only. It may not reflect pricing for your particular business, as individual criteria will apply.

Click here to check industry wise average prices

Get cover that works with the risks of your business

You can select from different levels of cover.

This is the most you will be paid out if you need to make a claim. Choosing different cover levels may impact the cost of your policy.

Unsure how much to choose? Think about:

Statutory professional requirements

Cover required by contracts

Number of employees being covered

Your contract value

Worst case scenario claim size

Underinsurance

We know it’s tempting to select a lower level of cover to reduce premiums, but this can leave businesses shocked and insufficiently covered when making a claim.

Ways underinsurance catches business owners out:

Inflation

With inflation, the cost of living and doing business increases. Remember to cover you, your tools and assets for the rising costs of replacing or covering them, not what you paid for them – you may be surprised at the difference.

Not covering the full cost of your risks

If you select cover levels for less than the value you may be found liable – left out of pocket when it comes to claims time. It’s important to review your risks and determine how much you will need to cover any claim that may come your way.

Let’s cover your small business on the go

Start a quote to see how much you can save and buy online in minutes.

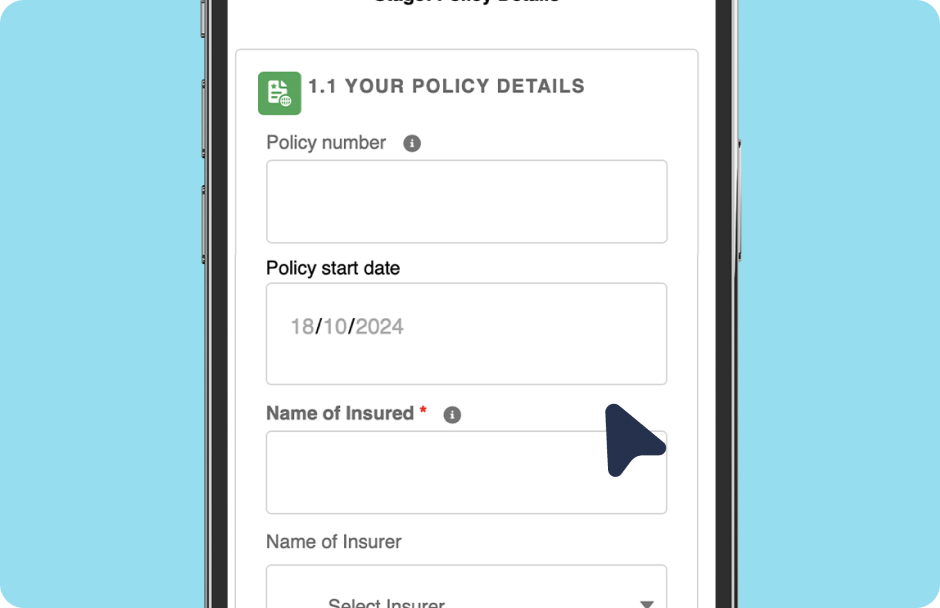

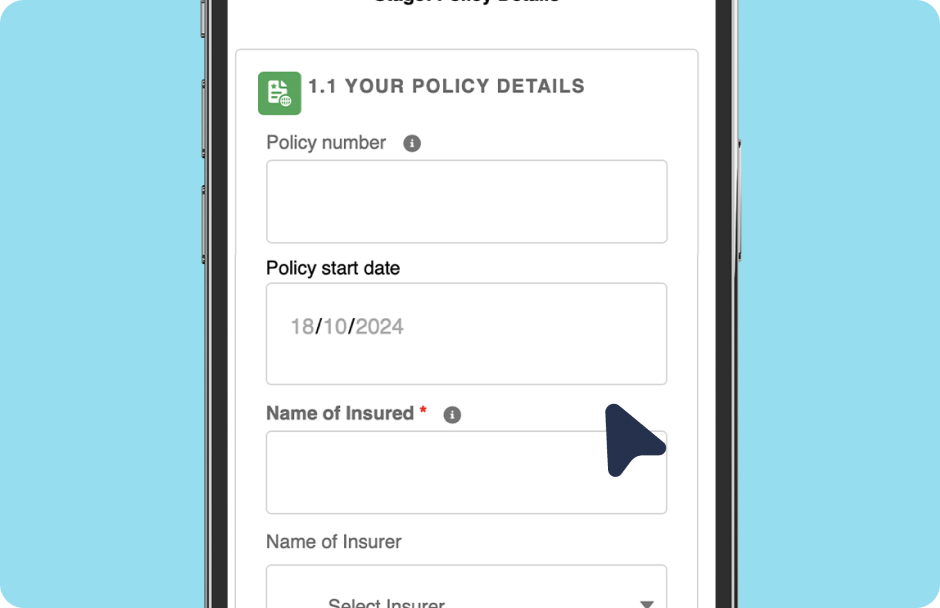

How it works – buying online

5 easy steps to get instant cover online today

Select Profession

Pick Your Covers

Add Business Details

Compare Quotes

Get Covered Online

How to make a claim online

We’ll assist you through the claims process & manage the claim directly with the insurer.

Let us know Fill out our

claims form and provide info

to support the claim

Receive extra support We

will assist you with your claim

Claim results We will notify

you of the claim outcome.

Award-Winning Tech & People

We’re not ones to blow our own trumpet, but we are pretty proud of our innovative insurance platform, outstanding team, and stellar workplace.

Cyber Liability insurance claims examples

Could this happen to your business?

Here is an example of real BizCover customers who had to make a Cyber Liability claim.

Incident

An employee accidentally misplaced a company laptop that contained a list of 1000 client tax records and credit card details.

Outcome

A policy payment was made to cover the costs involved with notifying the affected individuals and the Privacy Commissioner of the data breach. The cost of hiring a Public Relations firm to assist the insured with re-building their business reputation was also included.

Amount Paid

$250,000

The provision of the claims examples are for illustrative purposes only and should not be seen as an indication as to how any potential claim will be assessed or accepted. Coverage for claims on the policy will be determined by the insurer, not BizCover.

See how much others have saved while purchasing policy through BizCover

^ Savings made from January 2024 to April 2025. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Frequently asked questions

Cyber liability insurance is a type of business insurance which protects your business against both the legal costs and expenses related to cybercrime incidents. Your coverage may generally include cover for expenses and restoration costs relating to the following:

- Data breaches, including theft or loss of client information

- Network security breaches

- Business interruption costs

- Forensic investigation into the cause or scope of a breach

- Data recovery costs

- Cyber extortion

- Crisis management costs (to protect or mitigate damage to your businesses reputation resulting from a cyber event)

- Loss and legal costs, including fines and penalties resulting from a third party claim for data or network security breach against your company

Businesses with an online presence is at risk of a cyberattack. You may wish to consider Cyber Liability insurance if you fit into any of the following categories:

- Businesses that trades via a website or online platform.

- Businesses that use email.

- Businesses that deals with customer data.

- Retailers who use EFTPOS machines.

- Companies reliant on IT systems to conduct business.

Cyber Liability insurance is designed to help protect you from claims made against you and support your profitability in the event of a cyber breach or attack. It does not offer the same protection against malicious cyberattacks as cybersecurity for small businesses. However, it can be considered a key part of a cyber risk mitigation plan, and can help your business remain operational and profitable in the event of a breach.

A single cyber incident can cost a small business approximately $49,600. However, the fallout from a cyberattack is not just financial. It may also cause reputational damage to a business as well. The Office of the Australian Information Commissioner found that 47% of people surveyed said they would stop using a service if their data was involved in a breach. Many Australians place a high level of importance on their privacy when choosing a product or service, with 70% saying it is extremely or very important.

If you are a small business that uses smart devices or the the internet to conduct business, then you may wish to consider Cyber Liability insurance.

Cyber Liability insurance is not a legally mandatory form of insurance in any industry. However, if you are a contractor, your employer may wish to know what kind of insurance policies you hold before they agree to work with you.

Real-life customer reviews verified by Feefo