How much does Professional Indemnity Insurance cost?

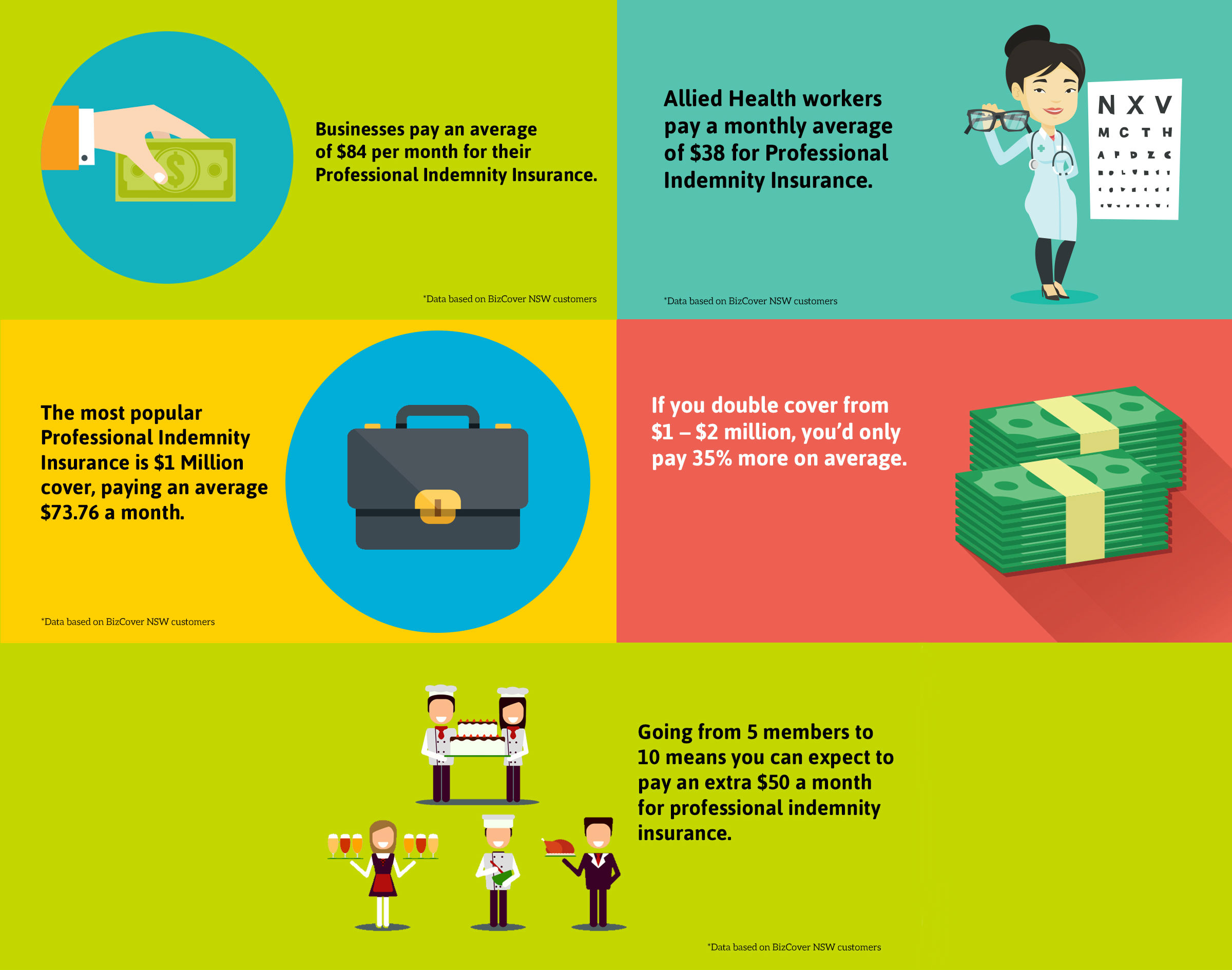

Professional Indemnity insurance costs a small business owner $84 per month on average.

Asking how much PI insurance costs is like asking what the length of a piece of string is, as generally the cost is heavily influenced by the types occupation it provides cover for. The riskier the occupation, the higher the cost.

Other key factors that play a part in determining the cost are:

- Your business turnover and size

- The amount of insurance cover you require

- The individuals being covered – are they qualified for the job they are performing, and do they have a previous history of claims?

- Your individual claims history

Professional Indemnity (PI) insurance is an essential form of protection for businesses that provide specialist services or advice, It provides protection should any legal action be taken against that business as a result of their client suffering a loss as a result of that service or advice.

Traditionally, Professional Indemnity insurance was only considered necessary for occupations such as doctors, lawyers and accountants. However, these days it is often a mandatory requirement, for a wide range of professionals including architects, IT contractors, management consultants, real estate agents and other allied health professionals. Even professional photographers should consider holding Professional Indemnity insurance.

By analysing the data of almost 5,000 BizCover policies during the 2016/17 financial year, we are able to provide an indication of how much you could expect to pay for a Professional Indemnity policy for your occupation and business size. However, the quickest and easiest way to find out is to get a quote.

| We know, sometimes you just want a quick idea of how much your insurance is actually going to cost. However, it’s important to note that the data included within this article was sourced from BizCover customer data during 2016/2017 and is intended as a guide only. It may not reflect pricing for your particular business as individual underwriting criteria will apply. Get a hassle-free quote for your business here. |

What is the average monthly premium for Professional Indemnity insurance?

From our analysis, we have found that 38% of customers are paying between $51 and $100 per month for their PI insurance, with the average policy costing $84 per month.

Below is the full breakdown:

*Data based on NSW BizCover customers

What is the average cost of Professional Indemnity insurance by industry?

Similarly to Public Liability insurance, your occupation type is one of the greatest influencing factors when it comes to the cost of your Professional Indemnity cover. The higher the associated risk of service or advice you provide, or the higher a potential claim could end up costing, the higher the insurance premium will most likely be^.

Essentially, when you apply for a Professional Indemnity policy your insurer will assess your business activities and determine the potential for loss or damage that could result from your negligence.

For example, you can see from the graph below that the average premium for a real estate agent (high risk) is much higher than the average premium for a migration agent (low risk). This is because real estate agents are far more likely to have a claim for negligence brought about them compared to migration agents*. Also, the value of a claim for a real estate agent is likely to be much higher. Think about the potential monetary loss to a client purchasing a multi-million dollar property if a real estate agent failed to disclose a significant defect in the property.

Again, this is a general rule of thumb and it is important to note that each insurance company has their own formula for assessing risk. Therefore, what one insurer may consider a high risk occupation may not necessarily be considered as risky by the next.

*Data based on NSW BizCover customers

^source from Understand insurance Identifying and managing your risks

*source from REINSW article Avoid professional negligence claims, 16 February 2017

How much do Consultants pay for Professional Indemnity Insurance?

When it comes to consultancy occupations, the list is endless. So it’s no surprise that premiums vary greatly among the many different types of consultants.

We have extracted the most common consultancy occupations to obtain insurance through BizCover and looked the difference in premiums between them. You can see from the graph that PI insurance for an Environmental Consulting service is a great deal higher at $156 per month compared to the other consultancy occupations .

This is most likely due to the potential loss or damage that could be caused if an Environmental Consultant provided incorrect advice which could in turn, not only have an impact on their client, but has the potential to cause catastrophic consequences for entire cities or geographical areas. For instance, incorrect advice given to a water treatment plant could then affect the water supply of hundreds of thousands of people.

On the other hand, PI premiums for Business Coaching and Education Consultants are considerably lower at around $90 per month due to the low risk associated with these occupations. It is likely that far less claims arise from these fields, in addition to the cost of a potential claim being much lower.

What is the average monthly premium of our top 10 Consultancy occupations?

*Data based on NSW BizCover customers

Does the size of my business affect the premium?

The higher your revenue and the higher number of staff you employ; the higher the cost of your policy.

A high turnover is an indication that you do a greater volume of work, and the more work you do, the greater the chance of something going wrong and a claim being made against you. A larger turnover could also indicate that you take on high value contracts which would mean expensive settlements if things don’t go to plan.

Likewise, the number of employees you have is also an indication that you take on a larger volume of work, and more people with more fingers in the pie means greater propensity for things to go belly up.

*Data based on NSW BizCover customers

Does the level of cover affect the premium?

Unfortunately, yes. Fairly obviously, the higher the level of cover you take, the more it’s going to cost.

The comforting thing to know however, is that the increments in which you increase your cover by isn’t reflective of the increments in price. For example, if you double your cover from $1 million to $2 million it doesn’t double the cost. In fact, increasing cover from $1 – $2 million would only see you paying 35% more on average.

When deciding on how much cover you need there’s a number of things to consider, such as:

- Legislative and/or industry association requirements – often set minimum amounts are required for some types of occupations

- The size of the contracts you accept – think of how much you could be liable for if something was to go wrong, i.e. are you a structural engineer consulting on multi-million dollar developments; or a graphic designer consulting to small-scale organisations?

- Do you have contracts with customers which require you to have a specific level of cover?

- The worst case scenario from the advice or service you provide – what are the maximum damages a client could claim for if they suffered financial or health losses?

- How many employees you have – generally, the more employees you have, the higher the cover limits you need. Imagine if you were unfortunate enough to end up facing multiple claims at once. Highly unlikely, but it could happen!

What is the average monthly cost of Professional Indemnity insurance by level of cover?

| Coverage level | Number of customers with this level of cover | Average Professional Indemnity premium (Monthly) |

| $250,000 | 640 | $38.60 |

| $1 Million | 2303 | $73.76 |

| $2 Million | 599 | $99.12 |

| $5 Million | 523 | $127.39 |

| $10 Million | 352 | $143.34 |

*Data based on NSW BizCover customers

Professional Indemnity Insurance Cost Infographic