For all new claims

Claim Online

Do it instantly online – it’s Faster & Easier.

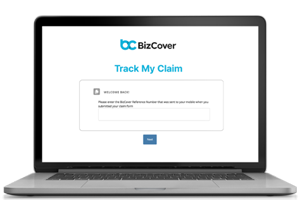

For all existing claims

Track Online

Via ‘Track My Claim’ portal – so you’re always in the loop!

To log-in to the portal click the link sent to you via email and enter your BizCover reference number (sent to you via SMS).

What type of claim are you here to make?

Let’s get the claims process started:

Choose an insurance

It’s important to notify your insurer as soon as possible of all compensation claims made against you for third party personal injury or property damage.

Public Liability Insurance covers you when your business accidentally damages something that belongs to someone else or injuries suffered by a third party such as a customer, supplier, or member of the public.

- A customer trips over a display in your store and gets injured.

- A delivery driver slips on a wet floor at your premises.

- A hairdresser spills hair dye on a client’s designer handbag.

- Your equipment scrapes a client’s wall during a job.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the incident and your comments regarding the allegations made against you.

Attach all supporting documents, such as:

- Photos of damage

- Any written demands or emails you may have received from the third party

- Contracts between you and the claimant

- Investigation reports or repair quotes, if applicable.

Do not:

- Admit guilt, fault, or liability

- Offer or negotiate to pay a claim without your insurer’s consent.

It’s important to notify your insurer as soon as possible of all actual and potential claims. A potential claim is an event that could later result in a claim.

Professional Indemnity Insurance helps protect your business if a client claims your advice or service caused them a financial loss. This applies whether the claim is due to an actual mistake or simply an allegation.

Examples:

- An accountant provides financial advice that a client claims led to a significant monetary loss.

- A consultant gives strategic recommendations that don’t deliver the expected results, and the client initiates legal action.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the event and your position on the allegations, when you first became aware of the situation, and when the work was done.

Attach all supporting documents, such as

- Any written demands or emails you may have received from the third party

- Any court proceedings

- Written contracts between you and the claimant

- Any Email communication between you and the claimant

Do not:

- Admit guilt, fault, or liability

- Offer or negotiate to pay a claim without your insurer’s consent.

It’s important to notify your insurer as soon as possible of a circumstance.

Contents Insurance covers business equipment, such as furniture, stock, office equipment, and tools against fire, storm, or other specific events listed in your policy at the specific insured location.

Examples:

- A fire breaks out in your store, damaging your furniture and stock.

- A severe storm causes flooding, ruining your office equipment.

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a list of items being claimed and a detailed description of the incident.

Attach all supporting documents such as:

- Photos of the damaged item(s)

- Police report ((if theft or criminal activity is involved))

- A repair or replacement quote

- Original purchase receipts

Do not:

- Approve any repairs or arrange replacements other than emergency repairs that may be necessary to minimise or prevent further loss or damage

- Dispose of any damaged property (unless it poses a risk to health and safety).

Building insurance cover helps protect your business premises, the actual building you own from damages caused by events like fire, storms, malicious activity, or other incidents listed in your policy for the specific insured location.

Examples:

- A fire damages your office space, leaving you with major repair costs.

- A severe storm causes roof damage and water leaks into your premises.

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

Attach all supporting documents such as:

- Photos of the damage

- Building report

Do not:

- Approve any repairs or arrange replacements other than emergency repairs that may be necessary to minimise or prevent further loss or damage

- Dispose of any damaged property (unless it poses a risk to health and safety).

Portable Equipment Insurance also known as General Property insurance, this cover helps protect your essential business equipment when you’re on the move. It applies to portable items like tools, laptops, mobile phones, stock, and other work gear used outside your main business premises.

Examples:

- Your toolbox is accidentally dropped at a job site, damaging important equipment.

- Your securely locked work vehicle is broken into overnight, and valuable business items are stole

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a list of items being claimed and a detailed description of the incident.

Attach all supporting documents such as

- Proof of Ownership

- Photos of the damage/photos of forced entry point (if applicable)

- Replacement quotes

- Police report ((if theft or criminal activity is involved))

- List of stolen/damaged items

Glass claims can be urgent, as you may need to perform make-safe repairs to prevent further loss or damage. But before you do, make sure you take photos of the damage, as this will help speed up your claim

This cover protects your business from the cost of replacing broken glass, both internal or external windows, mirrors, signage, and other glass fixtures you own or are responsible for. It can also extend to certain porcelain and ceramic items, such as toilets and hand basins, depending on your policy.

Examples:

- A customer accidentally knocks over a display, shattering a large mirror in your store.

- A storm sends debris flying, smashing your shopfront window.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

Attach all supporting documents such as

- Photos of the damage

- A repair or replacement quote

- Any make safe repair quotes

- Police report number (if theft or criminal activity is involved)

- Copy of your lease agreement.

Theft Insurance helps protect your business if your contents or stock are stolen. This includes theft, attempted theft, or even incidents like armed hold-ups at the specific insured location.

In most cases, for a claim to be accepted, there needs to be evidence of forced or violent entry, and the stolen items must have been securely stored.

Examples:

- A burglar breaks into your store overnight and steals valuable stock.

- Someone smashes a locked display case and takes expensive items.

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a list of items being claimed and a detailed description of the incident.

Attach all supporting documents such as

- Photos of the damage / photos of forced entry point (if applicable)

- CCTV

- Original Purchase receipts

- Police Report number

- Replacement costs

Do not:

- Approve any repairs other than emergency repairs that may be necessary to minimise or prevent further loss or damage

- Dispose of any damaged property (unless it poses a risk to health and safety).

Machinery Breakdown Insurance helps cover the cost of repairing or replacing essential equipment if it suddenly stops working. This includes items like refrigerators, air conditioners, or other machines that are critical to your daily operations.

Examples:

- Your commercial fridge suddenly stops working, putting fresh stock at risk.

- The air conditioning in your office breaks down during a heatwave.

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a list of items being claimed and a detailed description of the incident.

Attach all supporting documents such as

- Causation report

- Original Purchase receipts

- Replacement quote

- Serial number (If applicable)

- Images of the item/damage

Electronic Equipment Insurance cover protects your business if essential electronic devices break down or are accidentally damaged. It applies to items like computers, printers, and other electronic tools you rely on to keep your operations running.

Examples:

- Your office computer suddenly crashes, stopping you from completing client work.

- Your printer breaks down, delaying important business documents.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a list of items being claimed and a detailed description of the incident.

Attach all supporting documents such as

- Causation report

- Original Purchase receipts

- Replacement quote

- Serial number (If applicable)

- Images of the item/damage

Money Insurance cover protects your business money, whether it’s cash, cheques, money orders, or even lottery tickets, if it’s stolen, lost, or damaged. Coverage applies while the money is on your premises, in transit (e.g., on the way to the bank), or temporarily stored at a private residence.

Examples:

- Your business takings are stolen during a break-in at your store.

- You’re robbed while transporting the day’s earnings to the bank

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- Provided a detailed explanation of what occurred

Attach all supporting documents such as

- Police report number (if theft or criminal activity is involved)

- Evidence of earnings

Business Interruption insurance helps cover the loss of income and increased operating costs if your business is disrupted by an insured event, such as a fire, storm, or major property damage. It’s designed to help your business stay afloat during the recovery period by covering ongoing expenses, like wages and rent, even if you’re not able to trade as usual.

Examples:

- A fire damages your store, and while repairs are underway, the policy covers lost income and essential expenses.

- A storm damages your premises, and this cover helps you continue paying staff wages during downtime.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- Provided a detailed explanation of what occurred.

Attach all supporting documents such as

- Evidence of earnings prior and after the incident

- Photos of damage (if theft or criminal activity is involved)

Transit Insurance protects your goods or goods you’re responsible for while they’re being transported within Australia in a vehicle owned or operated by you. It covers loss or damage caused by specific insured events, such as collisions, fire, or theft, while your goods are on the move.

Examples:

- Your delivery vehicle is involved in a crash, damaging the goods inside.

- A fire breaks out during transit, damaging your stock.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- Provided a detailed explanation of what occurred.

Attach all supporting documents such as

- Photos of the damage

- Invoices

- If there was a collision, details of the at fault driver.

Tax Audit Insurance helps take the stress (and the cost) out of the process! It covers the professional fees of accountants and other specialists needed to guide your business through an audit.

Examples:

- The ATO selects your business for a random audit, and you need an accountant to manage the response.

- A tax office review leads to detailed questions, and you need expert advice to prepare the required documentation

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

Attach all supporting documents such as

- Document received from the ATO

- Invoices from your accountant

It’s important to notify your insurer as soon as possible of all actual and potential claims. A potential claim is an event that could later result in a claim. Cyber incidents can be time sensitive. Your insurer will have emergency response resources available to help you minimise further loss.

Please select your insurer to get more information on the emergency response resources available or refer to your own policy wording.

Cyber Liability Insurance helps protect your business if something goes wrong, such as a data breach, cyber attack or online scam. It covers costs related to responding to the incident, defending legal claims, notifying affected parties, and recovering lost data or systems.

Examples:

- A hacker gains access to your systems and steals customer data, requiring legal and IT support.

- An employee clicks on a phishing email, leading to financial loss and compromised accounts.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the event and your position on the allegations, when you first became aware of the situation, and when the work was done.

AIG’s CyberEdge policy provides access to a cyber-incident response team.

Clyde & Co

AIG Cyber Edge Hotline: 1800 290 982

The relevant Clyde & Co contacts are:

Dean Carrigan – Partner, Sydney Nitest Patel – Senior Associate, Sydney

Matthew Pokarier – Partner, Brisbane

Please refer to your PDS for the current and up-to-date contact details.

Whether you have used these resources or not, please complete a claim form so we can track and monitor your claim as it’s processed.

Chubb’s Cyber Policy provides access to a cyber incident response team.

In the event of an actual or reasonably suspected Cyber Incident or Business Interruption Incident, you can instantly report a cyber incident through any of the following:

Examples:

- Find the “Chubb Cyber Alert” app on the Apple store for iOs devices and the Android store for Android devices

- Access the Chubb Cyber Alert Website: www.chubbcyberalert.com

- Or Call the Chubb Cyber Alert Hotline: 1800 027 428

Please refer to your policy schedule and Product Disclosure statement for more information about the resources available to you.

Whether you have used these resources or not, please complete a claim form so we can track and monitor your claim as it’s processed.

DUAL Australia has partnered with Cyber Incident Response Team (Atmos) to manage all cyber incidents from first notification through to resolution.

They work with a dedicated breach response team which includes specialist lawyers, IT forensic investigators, forensic accountants, and consultants. Their experience helps ensure the best outcome for your business.

Policies incepting before 01/11/2025:

In the event of a Claim or Loss, please phone the following number in the first instance:

Cyber Incident Management Team (CIMT)

24/7 monitored email: [email protected]

Telephone: 1300 004 880

Address:

Suite 25.04

Level 25, 52 Martin Place

Sydney NSW 2000, Australia

Policies incepting on or after 01/11/2025:

In the event of a Claim or Loss, please phone the following number in the first instance:

Atmos Group

Australia: +61 1800 33 DUAL (1800 333 825)

Please refer to your Policy Schedule and PDS for the current and up-to-date contact details.

Whether you have used these resources or not, please complete a claim form so we can track and monitor your claim as it’s processed.

It’s important to notify your insurer as soon as possible of all actual and potential claims. A potential claim is an event that could later result in a claim.

Personal Accident and Illness insurance covers injuries you suffer yourself, whether on the job or outside of work. If you’re unable to work because of the injury, this cover may help compensate for your lost income. It also covers you if you fall ill and are unable to work (Subject to the cover you hold)

Examples:

- you hurt your back lifting heavy stock at work

- You slip and fall while hurrying to a meeting and sprain an ankle.

We want to get this claim off to a good start and a speedy finish, so please

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the circumstance.

Attach all supporting documents, such as:

- Claim form

- 3 year Medicare History, Bas/Tax statements, Superannuation Statement, Medical reports (if applicable)

It’s important to notify your insurer as soon as possible of a circumstance.

Management Liability Insurance helps protect business owners, directors, and managers from claims of wrongdoing, whether the claims are based on actual events or are simply allegations. It covers a range of risks related to how a business is run, including employee disputes, regulatory investigations, and financial mismanagement claims. This cover can help with legal costs, penalties, and compensation payouts – giving peace of mind when navigating the complexities of business leadership.

Examples:

- An employee claims unfair dismissal and takes legal action against the business.

- A government regulator investigates your company over a possible compliance breach.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the event and your position on the allegations, when you first became aware of the situation.

Attach all supporting documents, such as:

- Any written demands or emails you may have received from the third party

- Any court proceedings

- Employment Contract

- Any internal investigation reports

- Termination notices of any claimants

Do not:

- Admit guilt, fault, or liability

- Offer or negotiate to pay a claim without your insurer’s consent.

Statutory Liability Insurance helps protect your business, its directors, and employees from the costs of defending against certain alleged breaches of the law.

Examples:

- Your business is investigated for a workplace health and safety violation.

- A regulatory body fines your company for unintentionally breaching industry compliance rules.

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the event and your position on the allegations, when you first became aware of the situation.

Attach all supporting documents, such as:

- Documentation you received regarding the allegations

- Any court proceedings

Do not:

- Admit guilty

- Offer or negotiate to pay a claim without your insurer’s consent.

Employment Practices Insurance helps protect your business against claims made by employees relating to issues such as unfair dismissal, harassment, discrimination, or breach of employment law. It covers legal defence costs and, where applicable, compensation payouts.

Examples:

- An employee claims unfair dismissal and initiates legal proceedings.

- A staff member alleges workplace discrimination and lodges a formal complaint

We want to get this claim off to a good start and a speedy finish, so please:

- Complete all relevant sections of the claim form with as much detail as possible.

- This includes a detailed description of the event and your position on the allegations, when you first became aware of the situation.

Attach all supporting documents, such as:

- Any written demands or emails you may have received from the third party

- Any court proceedings

- Any internal investigation reports

- Employment contracts

- Termination notices of any claimants

Do not:

- Admit guilt, fault, or liability

- Offer or negotiate to pay a claim without your insurer’s consent.

How the claim process works

We’re here to assist you through the claims process and support you every step of the way.

- Track your Claim

We’ll manage your claim with the insurer on your behalf. Log-in to the ‘My Claims Tracker’ for updates.

- Claim Results

We’ll notify you of the claim’s outcome directly via email and phone

To complete the form

you will need to have the following information:

Your policy details

Including Policy Number and Start Date (this can be found on your insurance certificate of currency).

Details of the incident

Police report number (if there is one)

Details of any claimants or witnesses

If you are claiming for property damage or loss

if you are claiming for property damage or loss.

Your bank details

for settling the claim

If you have any questions

Get in touch – our friendly Claims staff are always ready to help.

Call Us

*While we remain at all times an agent of the insurer, our claims facilitation service is designed to prompt the insurer to efficiently manage and resolve claims by providing customers with general information and support management in connection with lodging a claim, together with following up on information that needs to be exchanged between the customer and their insurer. However, we do not ourselves manage the claim or determine whether it is covered by the policy and cannot represent the customer in any disputes with the insurer.