Are you a trusted advisor for small businesses?

Become a Referral Partners

Register online

Already a Referral Partner?

Log-in

What is the BizCover referral portal?

The BizCover referral portal allows trusted business service providers like bookkeepers and accountants to offer an additional service to your SME clients by referring them to BizCover for their business insurance, helping save time and money for your clients and creating an additional passive revenue stream for your business.

The portal creates a centralised place to refer your clients, track the progress of your referrals and track your commission in real-time, streamlining the referral process and eliminating the need for manual follow-ups to see how your leads are progressing, meaning you can get back to what you do best.

Need help? Reach out to our specialist

Chris Vikas / Partnership Manager (AU/NZ)

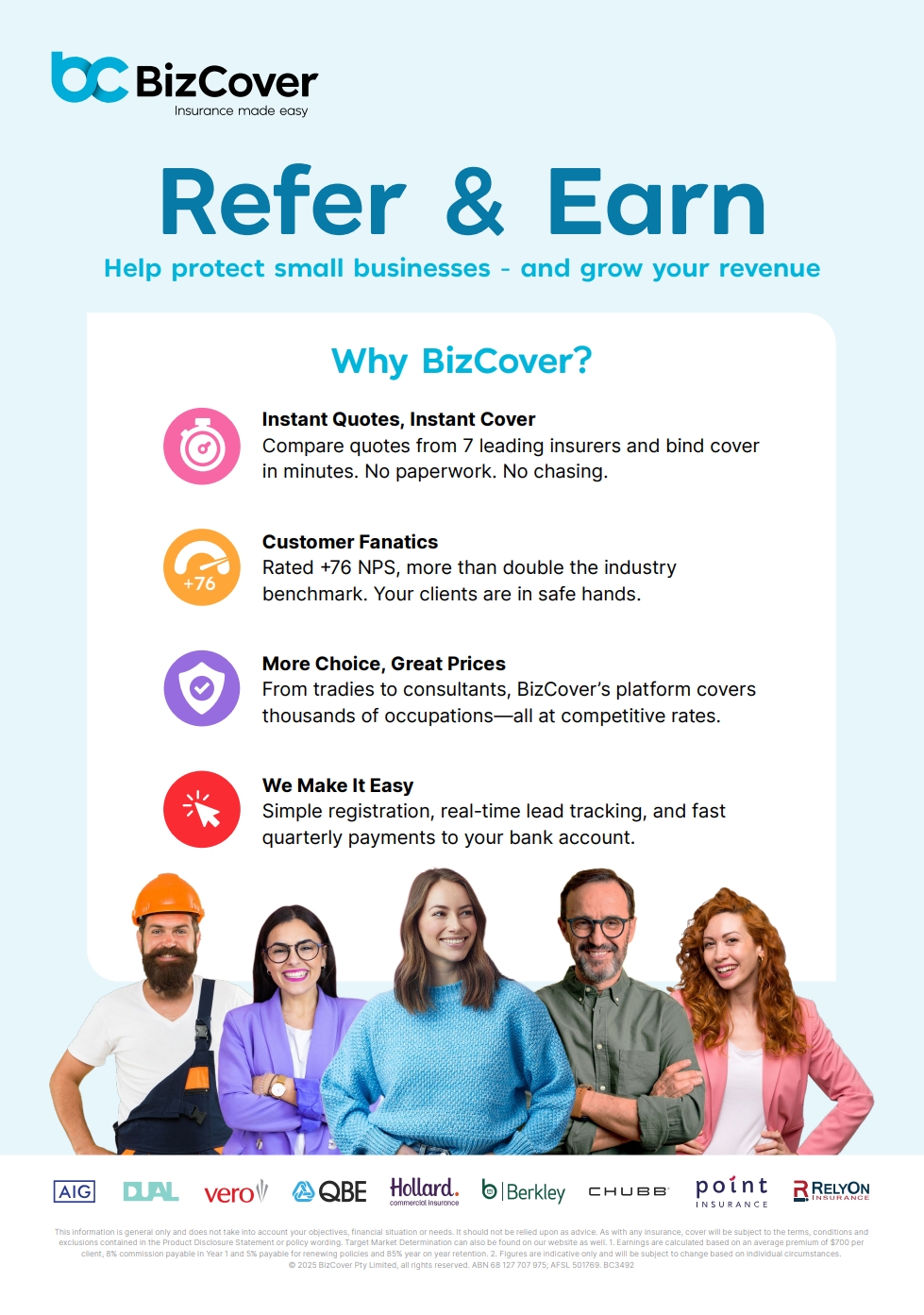

Why join the BizCover Referral Partner Program?

By joining the program, you’ll be able to:

Simple registration

Fill out your registration form – We’ll reach out of we need any extra information

Refer

Once approved, we will send you an activation email, and you can start referring

Track & Earn

Use the partner portal to keep track of your leads, and get real-time commission updates

Get paid

Commissions will be paid quarterly into your nominated bank account

What insurances can I refer my clients for?

Professional Indemnity (PI) insurance* is an important form of protection for businesses that provide specialist services or professional advice. It is designed to respond to claims against your business for losses as a result of actual or alleged negligent acts or omissions in the provision of your professional service or advice. PI Insurance will also assist with the legal costs associated with responding to or managing claims which are covered by the policy

Public Liability *– covers legal fees and compensation costs if a customer, member of the public, or a supplier claims against you for injury or damage to their property as a result of your alleged negligent business activity.

Cyber Liability Insurance* – Protects and supports your small business from claims associated with a cyber breach or attack.

Business Insurance*– a package designed to provide cover for your business contents, stock, tools and commercial premises when an insured event occurs (such as fire, storm, theft or even accidental damage). You can add other optional forms of cover to suit the specific needs of your business.

Tax Audit Insurance* – If you’re accounts are audited by the Australian Tax Office, you may need to hire external accountants to assist in the process. Tax Audit Insurance covers a business for specified costs in responding to an official tax audit, including accountants’

Management Liability* –protects directors and officers and the insured company itself from the many exposures relating to the management of a company. Owners and those responsible for the management of a company have specific responsibilities which can result in personal liability for alleged or actual wrongdoing.

Personal Accident and Illness* – provides a weekly income benefit following an accidental injury or illness once signed off from work by a medical practitioner for a set amount of time.

Why recommend BizCover?

Compare & Save

It’s completely free to get multiple quotes from leading Aussie insurers.

No paperwork no hassles

No paperwork. Immediate coverage. We know your clients are busy

Trusted

Trusted by over 270,000 Australian businesses.