Despite Insurers Talk, Premiums Won’t Walk

SME Insurance Premiums Stay Flat

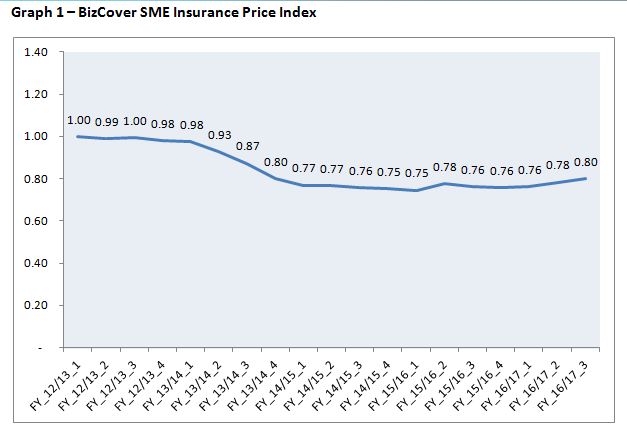

Over the last 5 quarters the BizCover Small Business Insurance Price Index (Graph 1) has shown that despite the ‘want’ of insurers to increase prices, there has been very little movement in SME insurance pricing, with any price increases being mainly observed in the retail sector.

A high level view of this quarter’s index shows that insurers are still trying to increase prices, however they have only achieved a 2 point gain over the quarter and no substantial gains in the past 3 years, which means competition is still winning and prices are staying low. The insurers are talking about price increases, however in practice these increases seem to be lower than expected.

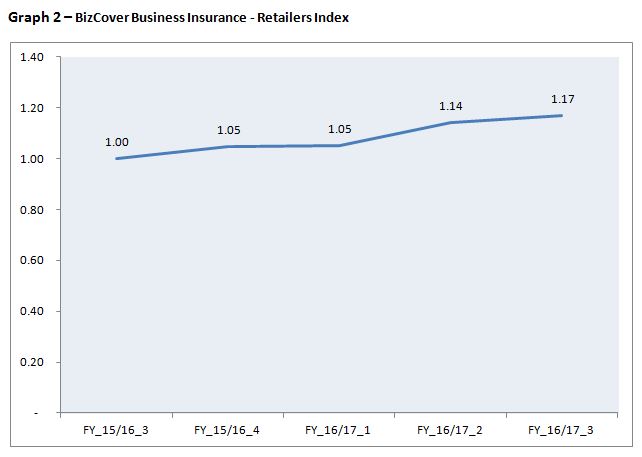

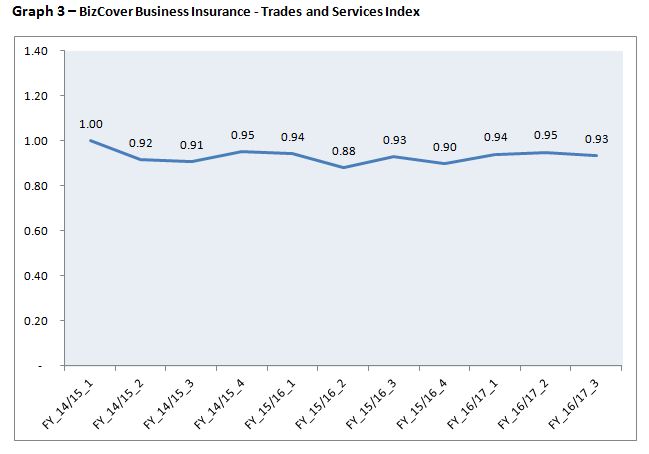

Looking further into the index, Business Packs in the retail sector have risen over 17 points over the last year (Graph 2), where as Business Packs in the Trades and Services sector have seen very little change (Graph 3). The likely reason for this is the increased premiums for property related insurance which is more commonly bought by those businesses with stock.

Another area starting to show price increases is in the new business book, as insurers are more willing to push prices up with new clients, in order to protect their existing book.

Michael Gottlieb, Managing Director of BizCover commented: “there is still an abundance of competition that will generally keep prices low. While across the board price increases are unlikely, insurers may see some relief in 3 specific segments; property located in areas exposed to catastrophe events, commercial motor and Directors and Officers for listed companies. Other than these 3 areas we expect the majority of customers to continue to benefit from strong competition.”

Whilst the insurers are talking up prices, the changes are minimal and there is no evidence to show that prices will increase across the broader SME sector, instead they will be contained to areas that insurers feel more confident in increasing prices without harming existing business.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.