Risky behaviour: the things keeping small business owners up at night

Even though many small business owners have a remarkably brave outlook for 2022, they know there are plenty of risks ahead. But what are they worried about, and are they taking the proper steps to ward off these dangers?

Despite a general sense of optimism in their future, many small business owners are still concerned about the risks of external factors they can’t control. But there are some risks they could better protect themselves against, as BizCover’s 2022 Small Business Bravery Report found.

Of the 1,327 respondents surveyed across 20 industries, 62% of small business owners said they were optimistic their company will grow or recover in 2022. Two-fifths also believe external factors, such as climate change or future COVID responses, would be their biggest business challenge of 2022.

And while they also identified some common threats they could control, the research highlighted a significant gap between risk awareness and mitigation.

The risks small business owners face

COVID disruption forced many small businesses to shift to digital. And that comes with a new set of potential risks.

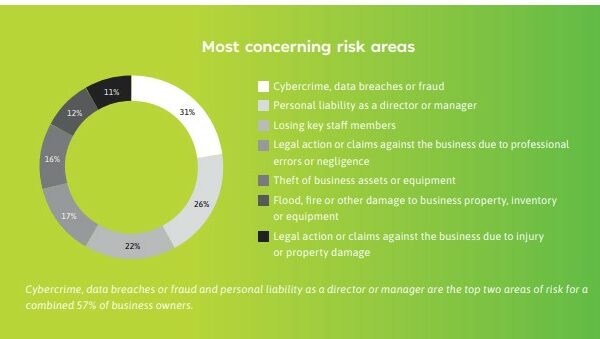

Nearly one in four (23%) business owners said they developed new products or services to meet market opportunities, and 17% developed new online solutions or adopted new technology. At the same time, cybercrime, data breaches and fraud has emerged as one of the most concerning risk areas for nearly a third (31%) of small business owners.

City-based organisations in the Accounting, Bookkeeping & Taxation, Consultant and Information Technology industries were particularly concerned about potential disruption from these tech-related issues.

The next two major worries for small business owners were personal liability as a director or manager (26%) and losing key staff members (22%).

The latter is a growing risk for businesses of all sizes, with the Great Resignation already reportedly impacting employee turnover amongst Australia’s small businesses.

One consultancy owner knows having the right people around will be important for their business.

“The excellent work and support of my staff is critical for feeling brave about planning and decision making as our business returns to usual capacity,” they told BizCover in their survey response.

Armouring up against risk

Identifying potential risks is an important step in any business strategy. But it’s concerning to see some business owners have not taken the next step: mitigating that risk so they have more peace of mind.

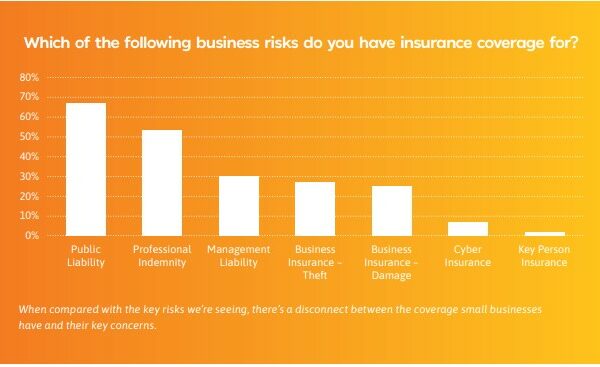

Take those digital dangers that worried nearly a third of the small business owner we heard from. Just 7% of survey respondents said they have Cyber insurance in place.

One fifth of owners said having a great team was a key driver of confidence in their business in 2022, with nearly the same percentage worried about losing key team members. Yet only 2% of businesses have Key Person insurance to help replace revenue and/or cover recruitment costs if their best people leave.

On a positive note, 67% of small businesses said they have Public Liability cover, which is important as organisations continue to welcome customers and staff back to physical premises. Here we saw industries built on in-person interaction, such as Hospitality, Manufacturing and Trade, lead the way. But the fact a third of small businesses don’t have Public Liability insurance is still concerning.

Also concerning is the fact that, while more than half (53%) of small businesses have Professional Indemnity insurance, the least likely industries in our survey to take out this cover were Architecture, Engineering & Technical Services and Health Services. These businesses are built on giving professional advice, which opens them up to potentially being charged with negligent acts or omissions regardless of how accidental they might be.

The confidence to move forward

Small business owners are continuing their journey of recovery and growth with their eyes open – they know what dangers lie ahead. And some of them are facing the future with reinforcements at their side.

“I feel brave about 2022 knowing I have insurance in place and that I’ve put together a strong crew to help me build a solid client base,” said one tradesperson.

And a Queensland health services business owner is looking forward to turning their shift to digital into more success in the coming months.

“I feel fearlessly brave stepping into a new year with my business, knowing I’m going to grow my clientele and extend on my digital presence. 2021 was extremely hard with a lack of customers, but with my insurance with BizCover I feel less cornered and more protected. I am ready to be brave and show the world my business.”

Being able to see hazards in the road ahead is important for small business owners. But being prepared to navigate those pitfalls – especially when they appear without warning – is just as important. And after all the hard work recovering from an uncertain couple years, small business owners could use all the security and peace of mind they can get.

To learn more about how Australian business owners plan to recover and grow in 2022, download the 2022 Small Business Bravery Report.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2025 BizCover Limited.