Tradies urged to review insurance heading into ‘tougher months’

Small tradie businesses are being urged to review their risk exposure amid tough conditions going into the new year.

The Australian trades sector experienced a boom in building and construction throughout 2020-22 on the back of significant government infrastructure projects, record-low interest rates, and strong Covid-19 stimulus measures.

But a toolbox of problems – namely surging inflation, labour shortages, and lingering supply chain issues – have dampened the prospects of the bumper season continuing into 2023.

“The party is over, and many small businesses in the trades sector may struggle before things pick up again,” says small business insurance expert Jane Mason.

“As business conditions change, it’s the perfect time to review your business insurance to ensure you are protected from risks in the year ahead.”

Turbulent times

The Australian trades sector has had a turbulent time of late.

In June, more than 104,000 residential buildings were under construction across Australia – a record 81% higher than pre-pandemic levels, according to the Housing Industry Association.

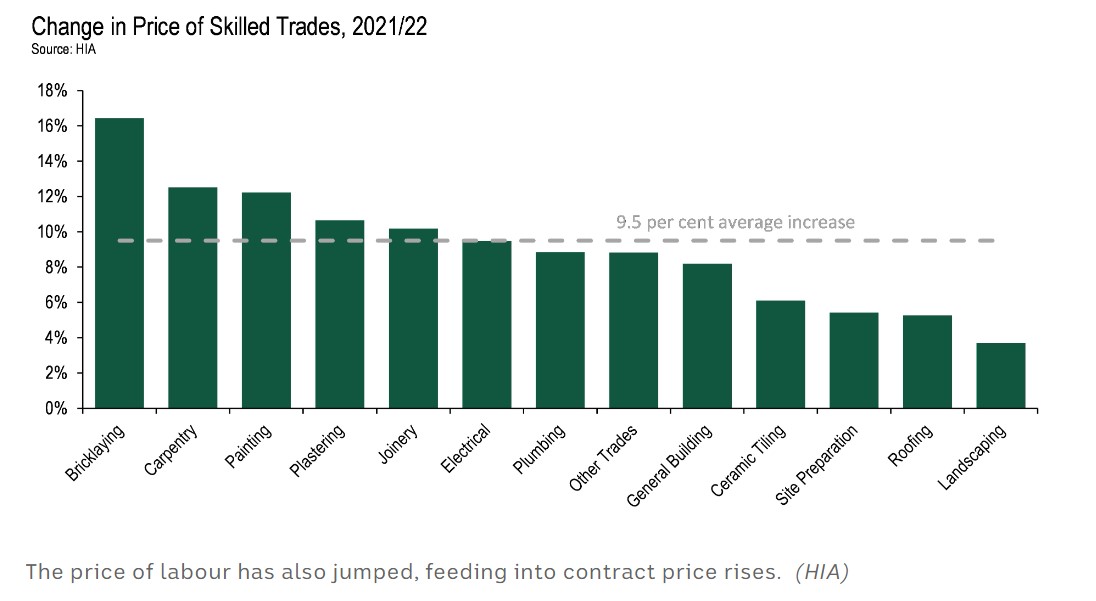

This pushed wages up as the price of labour increased by double-digit percentages for many small tradie businesses as employers struggled to meet demand.

Table originally published by the ABC

The price of materials also continued to rise during this period due to ongoing supply chain issues exacerbated by the pandemic.

For builders that were already locked into existing contracts with prices fixed, the price increases were disastrous. Many were forced to shut down after delays and costs ate away at their profits.

For the rest of the construction sector, costs were simply pushed onto the end consumer.

But now, the price of buying new homes has increased by so much in such a short time (20.4% in a year – another record) the volume being built has started to decrease.

Demand has slipped and all the issues are still there, leaving tradies vulnerable to increased competition and less work.

Denita Wawn, CEO of peak industry body Master Builders Australia, recognises these challenges, urging government and industry to band together as they head into “tougher months”.

“We must not be complacent in addressing some of the systemic challenges on the supply-side which continue to ripple through the economy and will have realised impacts in the coming months,” Wawn said in a press release.

Safeguarding your tradie business from risk

As market conditions change, small businesses in the trades sector should consider their risks and how they plan to mitigate them.

But many will likely have little cover in place to protect them if something goes wrong.

Research by QBE found that while 87% of small businesses admit that a business liability claim could put them out of business, make them lose revenue, or dry up cash flow, nearly two-thirds were unlikely to have the right insurance in place.

And it seems that the most at risk of having inadequate insurance will be those struggling the most.

Vero’s Bonus Chapter of the 2022 SME Insurance Index showed that only just over one-third of businesses with declining revenue are completely covered against a negative scenario.

Even more worrying, the same report found 34% of small business owners have no plan in place if something bad happens.

While these surveys are across all small businesses and not the trades sector specifically, they point to the fact that small business owners look to cut costs during challenging economic conditions.

Given that the trades sector is entering a difficult period, it’s important tradies don’t reduce their coverage and increase their risk exposure in order to save a few bucks.

“Rather than cutting your insurance, consider switching insurers and saving money on your policy,” says Mason.

“Nearly 82% of customers who switched through BizCover saved on their insurance*.”

Even if you’re not looking to cut your insurance to save costs, Mason says it’s still critical to review whether your business insurance reflects your current business.

“Business insurance is not a set-and-forget product. As we head into a potentially difficult year ahead, it’s important to ensure that if your tradie business changes, your policy changes with it,” she says.

**According to a survey conducted between 1 April and 31 October, 2022 of new business customers that switched insurers through BizCover.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2022 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2025 BizCover Limited.