The Naked Truth of Australia’s Adult Industry Hot Spots

When it comes to the adult industry, Australia really does turn on the lights. From the neon glow of Sydney’s Oxford Street to unexpected corners of small country towns, adult businesses aren’t just a capital city affair, they’re dotted right across the map.

To get a cheeky but insightful look into this landscape, BizCover analysed more than 26,000 adult industry businesses using Australian Business Number (ABN) data. By tracking 40 common industry keywords in business names (like “Adult”, “Pleasure” and “Escort”), we mapped how many adult businesses exist, where they cluster, and how they brand themselves.

To make it fair, we didn’t just count adult businesses. We also calculated how many exist for every 10,000 people, highlighting where adult businesses are most concentrated relative to local populations.

The findings reveal a mix of predictable hotspots and some eyebrow-raising local pockets, showing that Australia’s adult industry is as diverse and widespread as the communities it serves.

Key takeaways

- NSW, Victoria, and Queensland host 81% of all adult businesses, with Sydney CBD & Inner Harbour leading in total numbers.

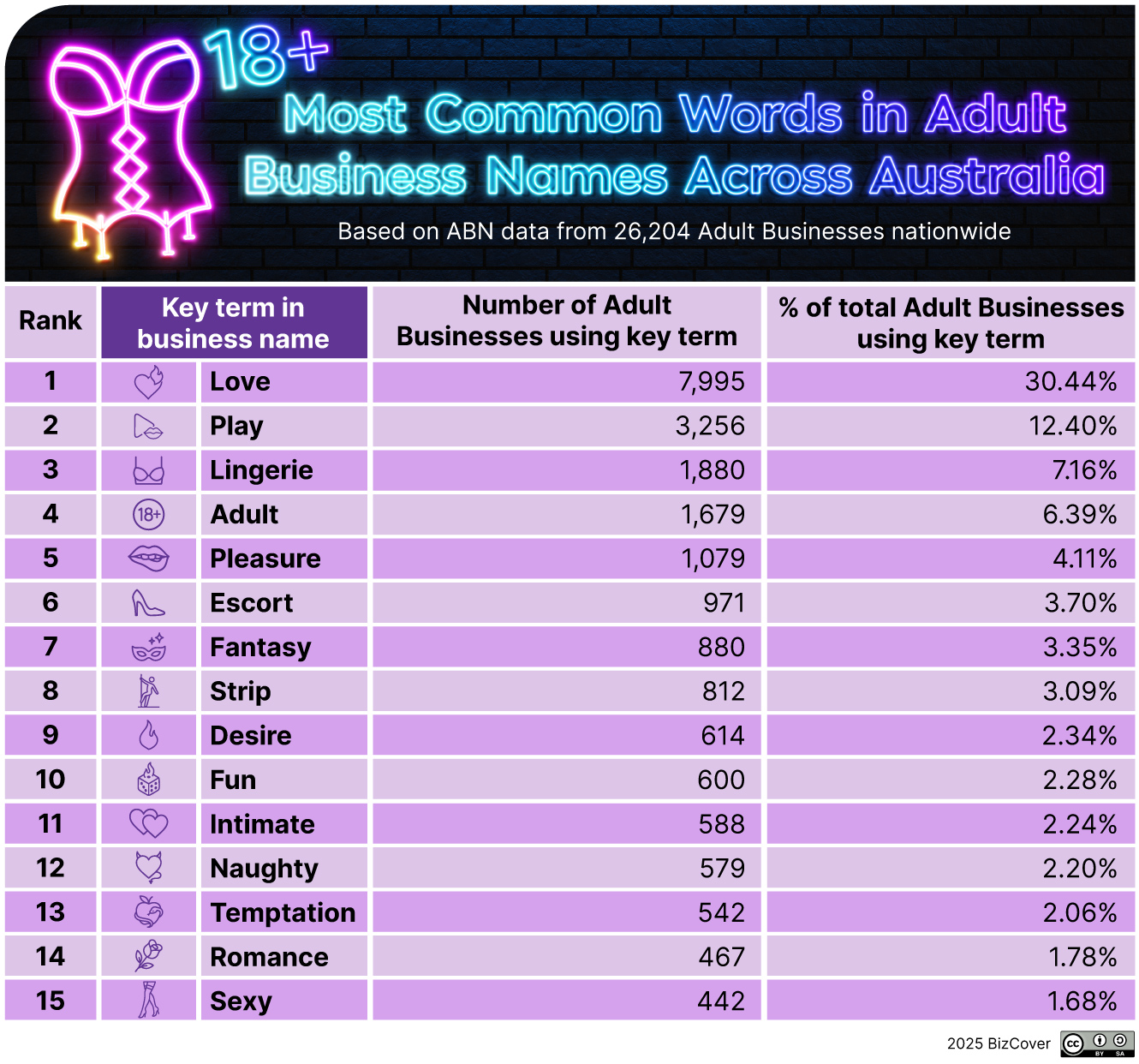

- “Love” and “Play” dominate business names nationwide, while “Lingerie,” “Adult,” “Pleasure” and Escort show strong regional variation.

- NSW has the highest volume of adult businesses, while Queensland leads in businesses per capita.

- Some smaller towns have more adult businesses per 10,000 people than major cities, showing strong local concentration despite their size.

- Regional and suburban hotspots include East Canberra (ACT), Parafield/Salisbury South (SA), Ambania/Tenindewa (WA), and tourist hubs like Byron Bay.

- High-density suburbs reveal local quirks: Bankstown adult businesses lean heavily on “Strip”, while Cockburn has a strong showing of “Escort” within their adult business names.

Adult industry in Australia: Keyword-based business hotspots

When it comes to naming, the adult industry has clear national favourites. Using a curated list of 40 adult-industry-related keywords, BizCover identified 26,204 businesses across Australia whose names contained at least one of these terms.

Some words dominate the landscape, reflecting both popular business types and wider industry and cultural trends.

And it turns out Australians are romantics at heart with “Love” being by far the most common, appearing in 7,995 business names – that’s 30.4% of the entire sector. In second place, “Play” features in 3,256 names (12.4%) – proof that Aussies are serious about having fun.

Together, these two words consistently rank first and second as most common keywords in adult business names in every state and territory, signalling a wide trend that stretches from coast to coast.

Other frequently used keywords include:

- “Lingerie” (1,880 businesses, 7.2%)

- “Adult” (1,679 businesses, 6.4%)

- “Pleasure” (1,079 businesses, 4.1%)

- “Escort” (971 businesses, 3.7%).

Mapping these terms reveals more than just the expected big city hotspots. While Sydney, Melbourne, and Brisbane light up as you’d expect, the data also points to surprising regional clusters. From bustling mining towns to quieter regional hubs, the adult industry is a part of communities right across the country.

Keyword prevalence among states

While some adult industry branding trends are consistent nationwide, each state and territory has its own unique flavour. The below list shows the states with the highest percentage of businesses for each chosen keyword:

- Love: New South Wales leans towards the romantic side of things, with 32% of adult businesses including the word “Love” in their name. Queensland is a close second at 31%.

- Play: Down south, Victoria is all about fun and games, with 20% of businesses choosing the word “play” in their name. Victoria leads the pack, with Tassie coming in at second place with 15%.

- Lingerie: Another Tasmanian favourite is “Lingerie,” with 9% of adult businesses using this word.

- Adult: South Australian adult businesses prefer to be more direct, with 11% of businesses using the word “Adult” in their name.

- Pleasure: Continuing to keep things classy, Tasmania is home to 7% of adult businesses with the word “Pleasure” in their name.

- Escort: The Northern Territory stands out with 12% of businesses featuring the word “Escort.”

Local hotspots for adult business name trends

Taking a closer peek reveals some interesting local trends – pockets where certain keywords dominate far more than elsewhere:

- Cockburn, WA: Living up to its cheeky name, this area has a striking 27.3% of adult businesses featuring “Escort” in their branding.

- Fremantle South, WA: It’s all about enjoyment in beautiful Fremantle, with 15.4% of businesses using “Pleasure” in their name.

- Surfer’s Paradise, QLD: True to its sun-soaked, sexy reputation, 31.7% of businesses feature the word “Love.”

- Bankstown, NSW: Things get a little raunchy out west in NSW, with 17.3% of adult businesses featuring “Strip” in their names.

These clusters highlight how certain words can take hold in specific suburbs, shaping distinct mini-identities within Australia’s wider adult industry. Whether it’s love on the Central Coast, pleasure in Fremantle, or something a little more risqué in Bankstown, local flavour clearly plays a big part in how Australia’s adult industry presents itself.

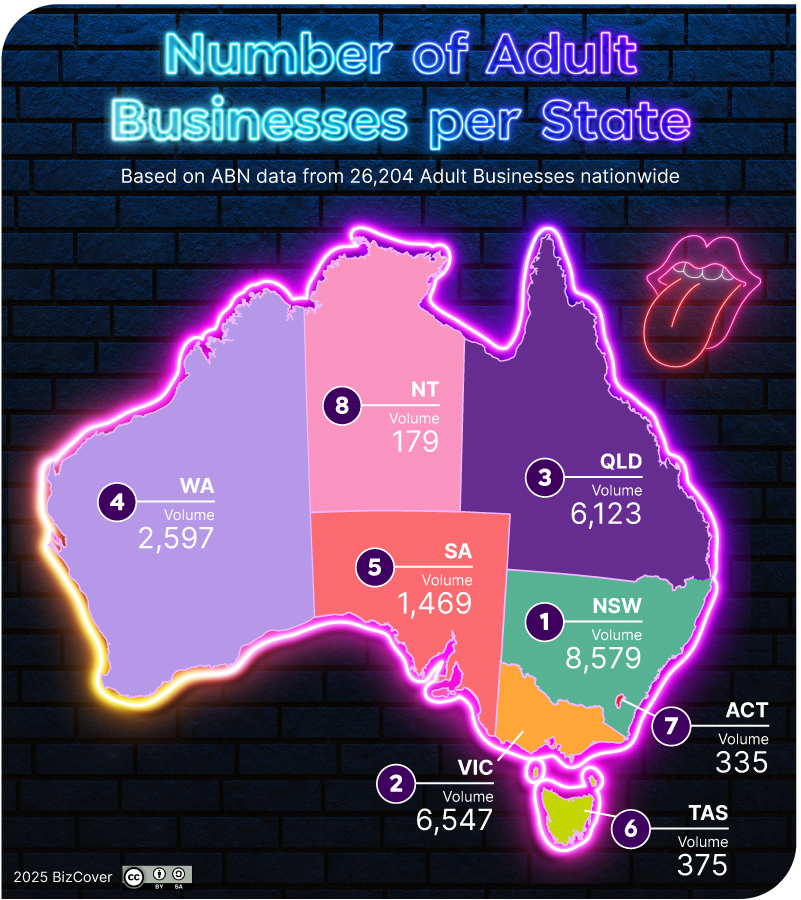

The adult industry in Australia: National overview

Australia’s adult industry is vast and varied, with an estimated 26,204 businesses spread across the country. That works out to be an average of about 10.4 adult businesses for every 10,000 people, meaning whether you’re in the heart of a major city or a quiet regional town, chances are you’re never too far from one.

Where are adult businesses located in Australia?

When it comes to sheer volume, three states dominate the national picture:

- New South Wales: 8,579 businesses (33%)

- Victoria: 6,547 businesses (25%)

- Queensland: 6,123 businesses (23%)

Together, these states account for a staggering 81% of all adult businesses in Australia. The remaining share is spread across:

- Western Australia: 2,597 businesses (10%)

- South Australia: 1,469 businesses (6%)

- Tasmania: 375 businesses (1%)

- ACT: 335 businesses (1%)

- Northern Territory: 179 businesses (1%)

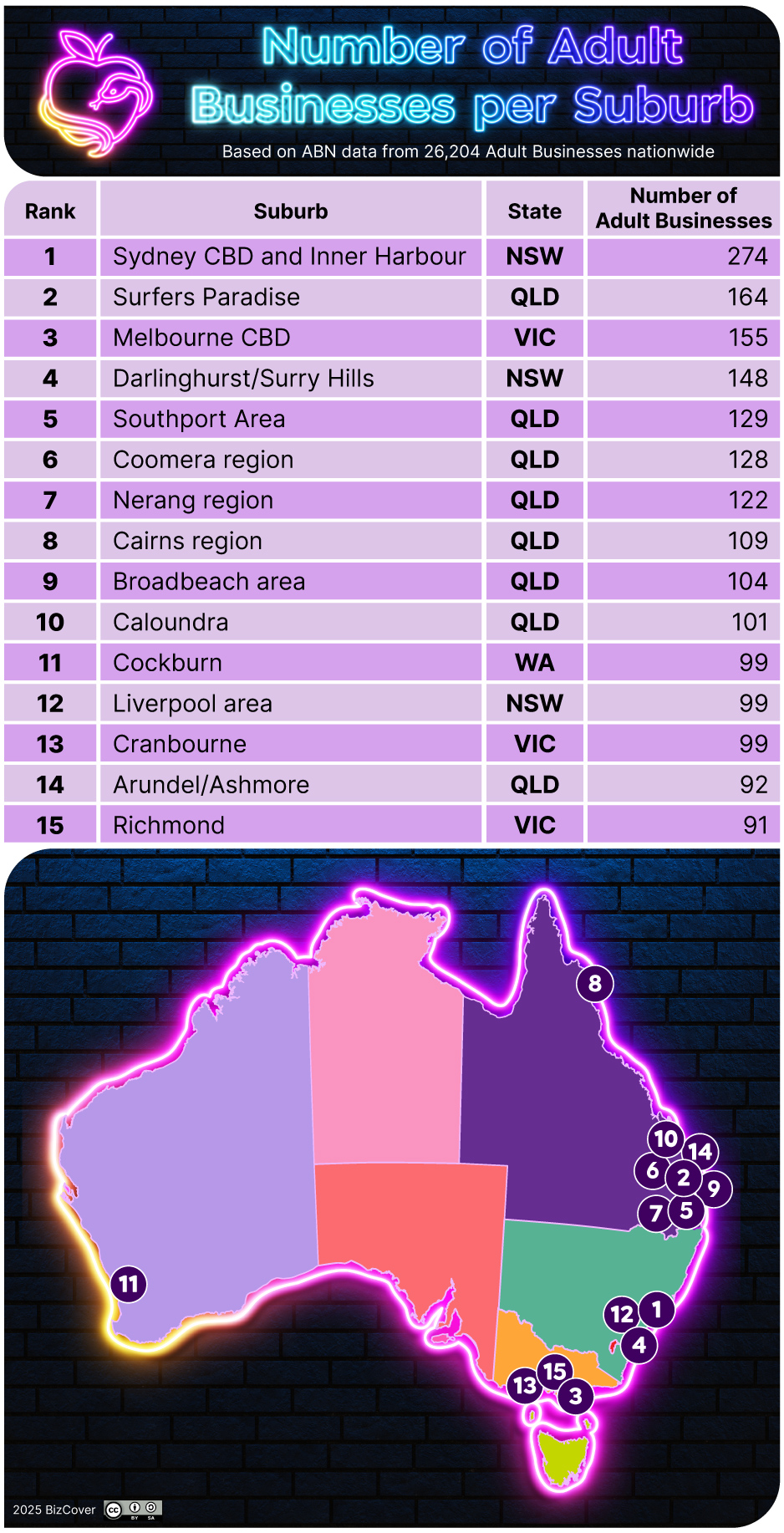

Which Australian suburbs have the most adult businesses?

When it comes to local concentrations, a few suburbs stand out as major adult industry hubs.

Sydney CBD and Inner Harbour take the crown with 274 businesses, almost double its nearest rival, Surfer’s Paradise, which has 164, followed by Melbourne CBD at 155.

Queensland dominates the top ten list, with seven suburbs located across the state’s coastal and regional areas, highlighting the strength of the industry beyond major cities. Regional areas like Coomera region (128 businesses), Nerang region (122 businesses), and Broadbeach area (104 businesses) prove that the adult industry thrives well beyond city centres.

While Melbourne’s CBD is a clear hotspot, several outer suburbs also show strong volumes, including Richmond (91 businesses), Western Melbourne Suburbs (85 businesses), Craigieburn (78 businesses), and Werribee (78 businesses).

Per capita hotspots for Australia’s adult industry: States and territories

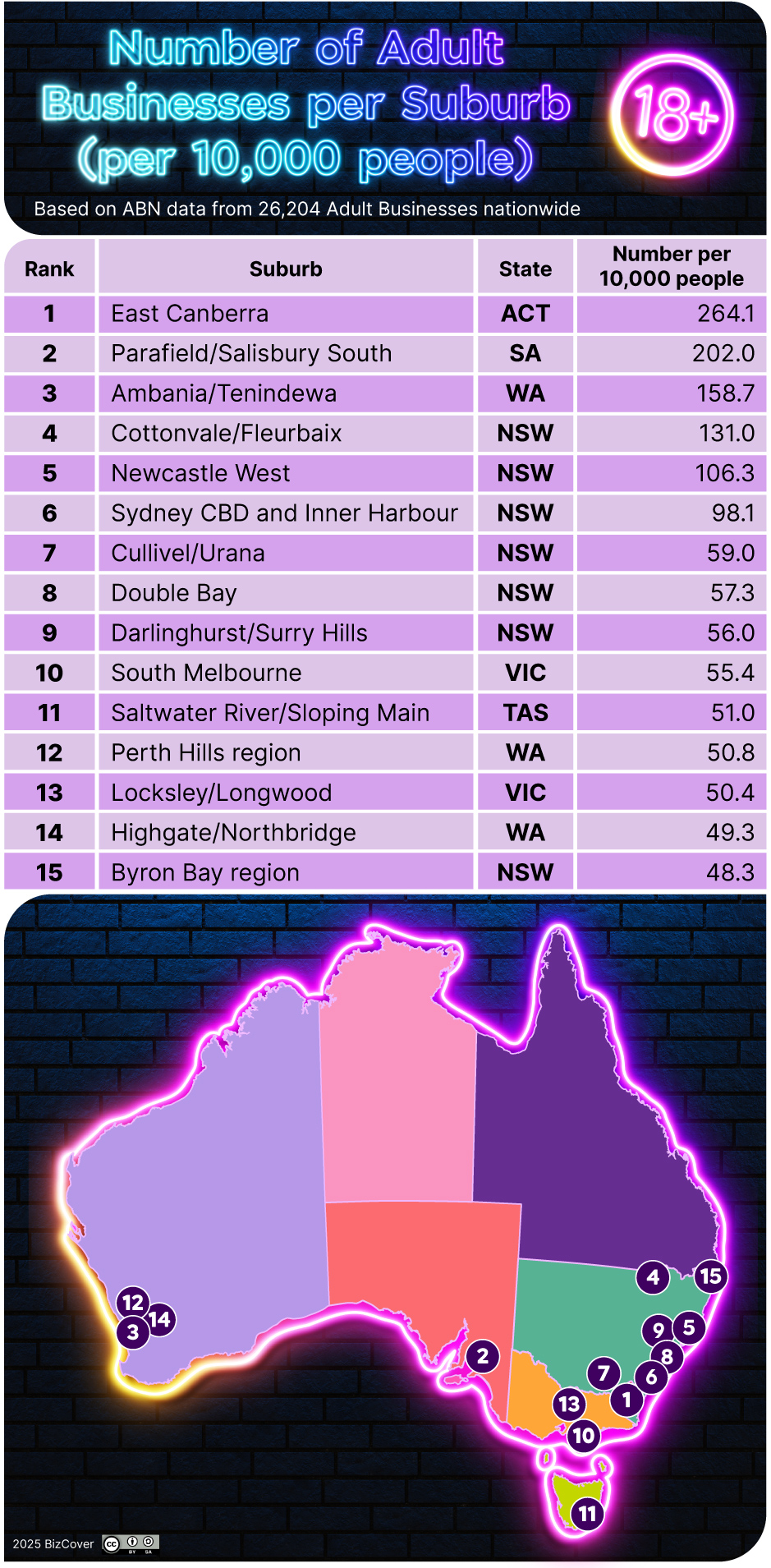

Looking only at total business numbers can be misleading, as bigger suburbs naturally stack up higher counts. To get a clearer picture, we also looked at businesses (per 10,000 people), which highlights smaller suburbs and regional areas where adult businesses are far more concentrated than you may expect.

Queensland leads the way with 12.1 businesses per 10,000 people, beating NSW (10.7) and Victoria (10.2). Western Australia follows with 9.9, while the Northern Territory isn’t far behind at 9.6. Tasmania and the ACT sit at the lower end, with 6.8 and similar averages, though both show strong localised hotspots.

Suburb hotspots for Australia’s adult industry: per 10,000 people

If we zoom in even closer, we find that the following areas punch well above their weight:

1. East Canberra tops the list with a staggering 264.1 businesses per 10,000 people.

2. Parafield/Salisbury South (SA) follows closely at 202 per 10,000 people.

3. Ambania/Tenindewa (WA) boasts 158.7 per 10,000 people.

These figures show how smaller or regional communities can outpace big cities in density, even if their states sit lower on the national average.

By contrast, the Sydney CBD and Inner Harbour (which dominates in total numbers) drop to sixth place on a per capita basis (98.1 per 10,000), proving that bigger cities don’t always mean higher density.

Tasmania, despite having the lowest overall state average, still features small hotspots like Saltwater River/Sloping Main (51.0, coming in at 11th highest per 10,000) and Birchs Bay/Woodbridge (45.0, making 17th highest), proving that size isn’t everything when it comes to concentration.

Somewhat unsurprisingly, tourist and lifestyle destinations also make the list: Byron Bay (48.3), South Melbourne (55.4), and Double Bay (57.3) all rank among the top 15. These spots suggest that visitor demand, as well as local populations, can drive a higher density of adult businesses.

The climax

Australia’s adult industry is bigger, bolder and more diverse than many might expect. With 26,204 adult businesses nationwide, the sector is strongly concentrated in New South Wales, Victoria, and Queensland, but per capita analysis reveals that smaller regional and suburban areas can often pack the greatest punch. Tourist destinations, coastal suburbs and small towns often have remarkably high business densities, proving that the industry is not confined to big-city nightlife.

Branding trends reveal a sector with personality, and while “Love” and “Play” dominate business names across the country, other keywords such as “Lingerie,” “Escort” and Pleasure reflect local preferences.

Overall, the data paints a picture of a sector that balances large city scale with vibrant local clusters, highlighting the fact that adult businesses have become a fixed part of many different Australian communities.

For business owners, investors and researchers, these insights are more than just fun facts, they can guide smarter decisions, from identifying opportunities to anticipating competition.

Whether you’re starting a new venture or looking to protect an existing business within the adult industry, BizCover can help you quote and compare insurance to fit your unique needs. Find out why more than 275,000 businesses across Australia already choose BizCover to help them sort their insurance and get a quote today.

Methodology

We analysed the adult industry across Australia to understand the geographic distribution of adult businesses. Using a list of 40 keywords associated with adult products and services, we searched the ABN Lookup database (https://abr.business.gov.au/) for businesses with these terms in their names.

This returned over 42,600 results, including ABN, business name, state, and postcode. After removing irrelevant entries and duplicates, the dataset was refined to 26,204 businesses. Population data from the 2021 Census was then used to calculate the number of adult businesses per 10,000 residents, identifying areas with the highest per capita concentrations.

Postcodes with fewer than 50 businesses or invalid formats were excluded to ensure statistical relevance. For readability, postcodes covering more than two suburbs were grouped under regional labels (e.g., “Far North Outback, SA”), while smaller postcodes retained individual suburb names.

This approach highlights both total and per capita concentrations, revealing city clusters and regional hotspots across Australia.

© 2025 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.

![[Press Release] Extreme weather poses growing threat to Australian businesses as storm and fire season approach](https://www.bizcover.com.au/wp-content/uploads/Press-Release-Extreme-weather-poses-growing-threat-to-Australian-businesses-as-storm-and-fire-season-approach-1.jpg)