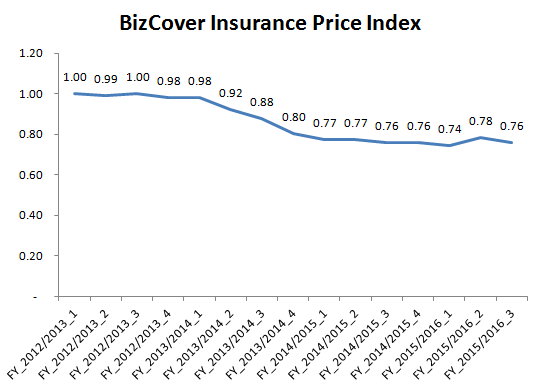

Small Business Insurance Price Index Q3

Insurers hold on to SME Insurance Premium Price Increases!

Despite a drop in some rates, some insurers are holding on to pricing gains made last quarter.

The latest Quarterly BizCover Small Business Insurance Price Index has shown insurance rates dropping back two points. Despite this drop, some insurers have managed to maintain the increased rates from Quarter 2 (2015/16).

The driving force behind last quarter’s rate increase was the hardening of rates in the non professional sector, primarily around Public Liability and Business Packs (predominately covering perils and theft), with the retail sector being hardest hit.

This quarter we have seen a decline in rates in sectors where there is abundance of capacity and strong distribution channels, predominantly around trades and services. However insurers have managed to hold the rates increases from last quarter in the retail sector.

Insurance pricing to the professional sector saw no significant changes over the quarter.

Michael Gottlieb, Managing Director of BizCover commented “While there is still an abundance of capacity and fierce competition in the insurance market, insurers have managed to hold onto their rate increases from last quarter. I suspect given the June quarter is a substantial renewal season we will see insurers compete aggressively which may put short term pressure on rates. This will be more exacerbated in the insurance segments that have significant competition while insurers will likely have more success in maintaining their rates for perils and theft in the SME retail/wholesale sector.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.