Small Business Index July 2015

SMEs benefiting from declining insurance rates but is the tide turning?

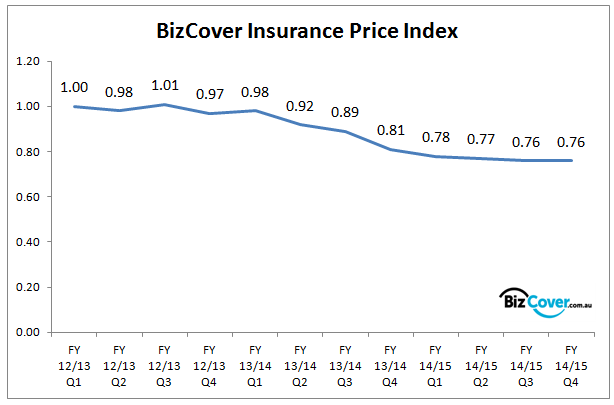

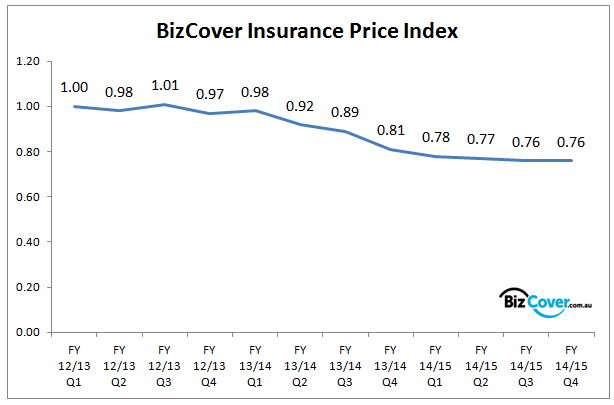

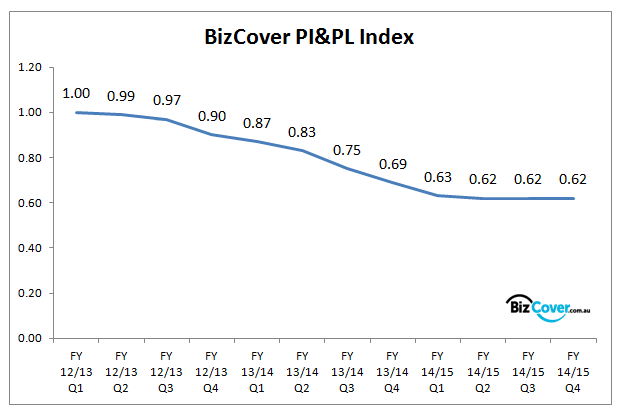

An oversupply of capacity and competition in the insurance market over the last few years has helped drive down the price of professional/business insurance for Australian SMEs. Since the start of FY 2012/13 SMEs have benefited by a drop in rates of 24 basis points.

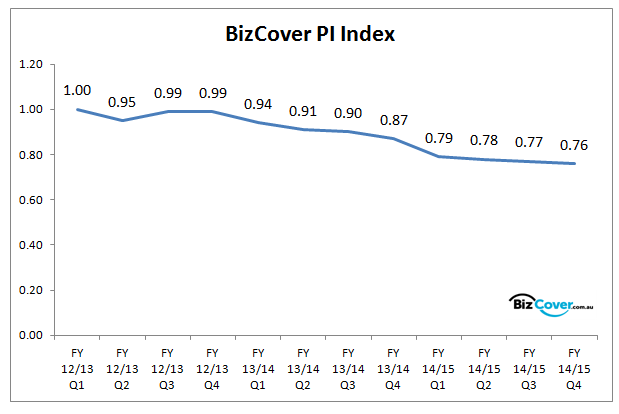

The majority of this decrease was driven in FY2013/14 where prices dropped 18%, however since the beginning of FY 2014/15 that rate decline has slowed and in fact it flattened over the last quarter, resulting in overall prices this financial year falling only 2%. This trend has been largely consistent across the 3 main product categories of Professional Indemnity, Combined Professional Indemnity & Public Liability and Public Liability /Business Packs.

Michael Gottlieb, BizCover Founder and Managing Director says “Prices have in fact been trending down over the last ten years due a number of factors including the low number of catastrophes and low interest rates, and those with capital chasing returns in insurance.”

The Professional Indemnity rates reduced the most this financial year finishing 3% lower. Over the time of the index it has strongly followed the trend of the overall index and has finished the year with a 24% decrease in price.

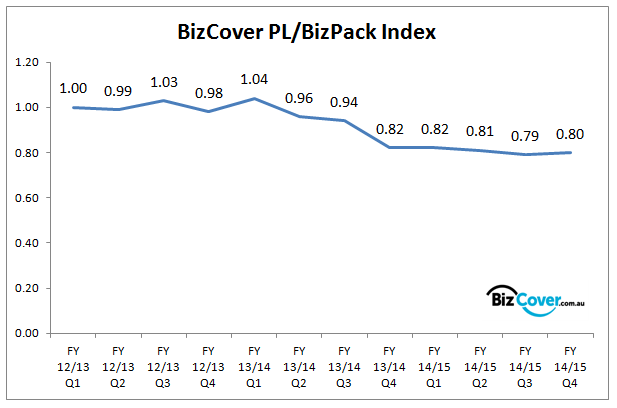

The Combined Professional Indemnity & Public Liability market, which is largely dominated by IT and Allied Health Professionals, remained flat over FY2014/2015. However this follows the biggest drop in prices since the index started of 38% lower than the base value only 3 years ago.

Public Liability /Business Packs have not enjoyed as much of a drop in prices, falling only 20 points since FY 2012/13, and in fact saw an increase in over the last quarter.

Gottlieb says “There comes a time when rates get to the point where they are just too low resulting in borderline underwriting profit at which point insurers start to walk away.”

He also added “The recent M&A activity of insurers Chubb and Ace, IAG and Lumley, as well as Catlin and XL are strong signals of the bottoming of rates, as insurers struggle for internal growth they look for growth opportunities through acquisition.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2025 BizCover Limited.