QR Codes: Sharing Certificates of Currency just got easier

When you buy or renew AIG and RelyOn Business Insurance Packages with BizCover, you’ll now see a QR code at the top of your Certificate of Currency. This simple square is a convenient way to prove that your policy is active, should anyone need to know. It’s important to know that no personal information is shared when scanning the QR code in your policy.

What is a QR code?

A QR code is a square-shaped bar code that stores information. You may have used them to open a restaurant menu, view a website, or make a payment. This is no different!

BizCover is adding QR codes to some Certificates of Currency (CoC) as part of a new initiative to continue making insurance easy.

What is a Certificate of Currency (CoC)?

A CoC is your proof of insurance. It normally shows the date it was issued as proof of cover at that specific time. To ensure you have the most up to date version, you may need to download or request an updated CoC during your policy period.

How does the QR code help me?

As a business owner, people may ask for your CoC to prove you are insured. Sometimes, the person requesting your CoC may need to verify that your cover is up to date multiple times. That means downloading a new CoC every time they want to verify your policy. A common example is a tradie needing to pass induction before entering a worksite during long projects.

The new QR code solves this. Instead of handing over a new CoC for each check, you can simply request that the stakeholder scan the QR code included in the CoC you first shared. It will display a message that shows you are covered for as long as the policy remains active. It’s that easy!

It’s a time saver for both you and your business stakeholders. You no longer need to download and email multiple CoCs to the same person, and they don’t have to wait to check that you are insured.

Where can I find the QR code for my policy?

You’ll find your policy’s QR code at the top of your Certificate of Currency. It looks something like this:

QR codes are currently only available for Business Insurance Packages from AIG and RelyOn. QR codes will be available in other BizCover policies soon. Business Packs include two types of cover that stakeholders commonly want to check: Public Liability insurance and Glass cover.

How to scan your QR code

To scan the QR code, open the camera app on your smartphone, point it at the QR code, and tap the notification or link that appears at the bottom of your screen.

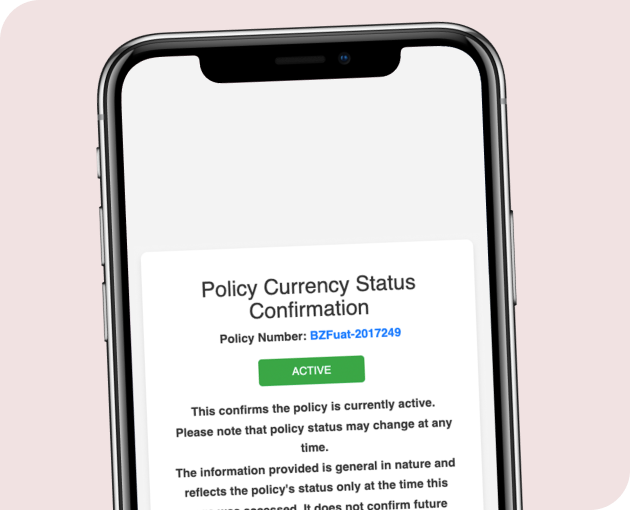

When the link opens, you’ll see a screen that shows the policy’s status. Green means the policy is “Active”. This tells the person scanning the QR code that your policy is active and you are currently covered. No worries!

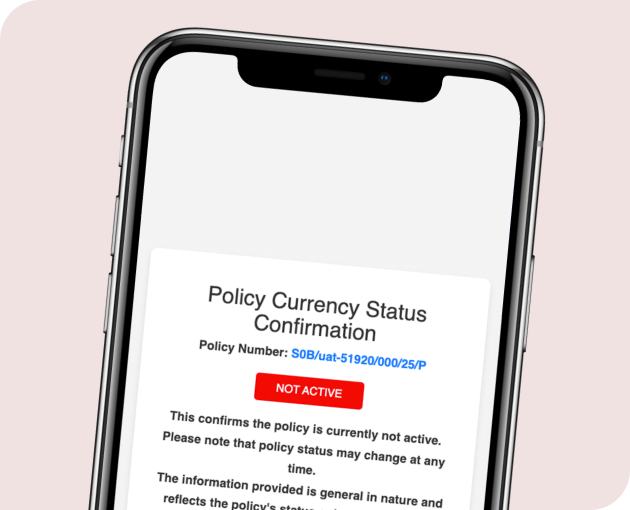

Red means the policy is “Inactive”. This means that either the policy has lapsed or has been cancelled (and you’re not currently covered). Don’t panic! You may have shared a QR code from an old policy, so this is the perfect moment to review and resend your CoC with the correct information. Easy!

When you renew a policy, a new Certificate of Currency with an updated QR code is created. Make sure whoever is scanning the QR code has your most recent CoC on file. You can download a copy of your CoC at any time by logging in to your BizCover account.

How many times can the QR code in my Certificate of Currency be scanned?

There’s no limit to how often someone can scan the QR code on a CoC. Anyone who wants to scan it can do so as often as they like—once a year, once a month, once a day—it’s completely up to them! Although you should note that you will need to provide them with a new CoC once your policy renews.

This comes in handy if you have business stakeholders who need to verify your cover or pass your details to third parties on multiple occasions. For example, a commercial landlord might scan the QR code on your CoC every month to ensure you’re meeting the terms of your rental agreement. A client may scan the QR code before making project payments to verify that you are not in breach of contract.

Who can use the QR code contained in my Certificate of Currency?

Anyone can use and scan your policy’s QR code, such as:

- Customers and clients – Do you have business contracts that require you to have cover? Your customers or clients can use the QR code to check that you’re making good on this part of the contract.

- Vendors and suppliers – Public Liability requirements are sometimes part of supplier and vendor contracts. The QR code is a quick, easy way for them to verify that you’re meeting this requirement.

- Your commercial landlord – Are you leasing commercial premises for your business? Certain types of cover, such as Public Liability or Glass, are often required in rental agreements.

- Local council field staff – Do you use council land for your business activities (think a personal trainer running sessions in a public park)? You may be asked to show proof of insurance to continue using these spaces.

- Members of the public – Accidents happen. If your business activities damage someone else’s property or injure them, you may need to share your CoC to prove you’re covered.

Business insurance made easy

Ready to start using the new QR code feature? Log in to your BizCover account and download the Certificate of Currency for your AIG or RelyOn Business Insurance Package. Share it with your business stakeholders and tell them to start scanning!

The QR Code provides general information only, and the policy status is subject to change at any time. Policy holders should refer to their policy documents for full coverage details. Please note that if your Certificate of Currency includes a QR Code, by sharing a copy of your Certificate of Currency and the QR Code with a third party, you acknowledge that they will be able to access that information.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.

![[Press Release] BizCover Shortlisted for 4 Excellence Awards by Insurance Business Australia in 2026](https://www.bizcover.com.au/wp-content/uploads/Press-Release-BizCover-Shortlisted-for-4-Excellence-Awards-by-Insurance-Business-Australia-in-2026.jpg)

![[Press Release] Extreme weather poses growing threat to Australian businesses as storm and fire season approach](https://www.bizcover.com.au/wp-content/uploads/Press-Release-Extreme-weather-poses-growing-threat-to-Australian-businesses-as-storm-and-fire-season-approach-1.jpg)