Protect your business with Statutory Liability Cover

There are many different types of insurance policies available to small businesses to protect against countless number of unexpected events, such as injury caused to clients and customers, and damage caused to other people’s property or your own. However, many business owners are unaware that there is insurance designed to protect against fines and penalties resulting from the operation of a business, such as a breach in legislation, including occupational health and safety laws, which can be purchased as optional cover with your Business Insurance. In this post, we will explore the facts, benefits and features of Statutory Liability insurance.

Australia and the law

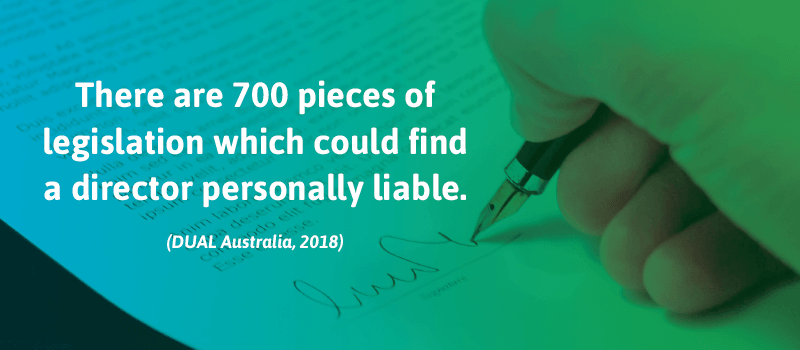

There are many acts of legislation in Australia, in fact, there are over 5000 pieces of legislation which can result in a fine or penalty. Of these 5,000 pieces of legislation, approximately 700 of these can find a Director personally liable. (Dual Australia, 2018)

Below are some of the main acts to become familiar with as a small business owner.

Company Laws

Every company is subject to the Corporations Act, which contains 350 sections that can attract a fine or penalty. Some of those sections include:

- Anti Money Laundering & Counter-Terrorism

- Financing Act

- Privacy Act

- SPAM Act

- Fair Work Act

- Environmental Protection Act

There are also industry-specific pieces of legislation, and some examples include:

- ASIC Act

- Transport Act

- Therapeutic Goods Act

- Mining Act

- Building Professionals Act

- Electricity Act

What is Statutory Liability?

A lot goes into running your own business, from the day to day tasks, accounting, marketing and everything else! But when it comes to the legal side of things, it doesn’t need to be too overwhelming or complex.

So while you may not need to know every single piece of legislation, there are some key things to understand when it comes to complying with the law. A breach of legislation could turn out to be a very costly mistake, both financially and reputationally – not one that many small businesses’ want to or can afford to make.

This is where Statutory Liability insurance comes into play – designed to help cover the costs and expenses which can be incurred from an official investigation or inquiry made against your business

Adding the Statutory Liability option* to your Business Insurance policy can help cover:

- Monetary sums (penalties) payable to any regulatory authority upon unintentional breach of an act that is covered under the policy

- Legal costs and associated expenses incurred with official investigations, defence (including appeals), and settlements of claims

What is not covered?

- Wilful, intentional or deliberate breaches, including failure to comply with any lawful notice, direction, enforcement action or proceeding under any Act

- Gross negligence or recklessness

- Dishonest, fraudulent or malicious acts or omissions

- Traffic offences

- Fines and Penalties which the insurer is prevented from paying by law

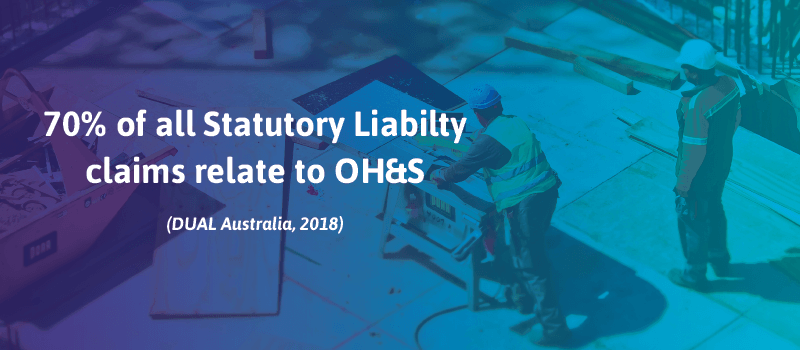

Did you know?

Claim example

A manufacturing company contracted a team of 25 factory hands to work at the company’s production line. Upon starting, the contractors received a 2-hour training course on safety and procedure. On the first day, two of the workers suffered serious injuries.

One of the workers suffered a deep laceration to his hand and the other worker lost partial hearing in his left ear which was caused by failing to wear the safety equipment correctly.

The action taken against the company included a full Occupational Health and Safety investigation by the WorkCover Authority, and prosecution against the insured company. The company faced a fine for breaches of the OH&S legislation.

The company’s insurers appointed solicitors to represent them throughout the investigation, which resulted in the company avoiding prosecution. The company agreed to pay the $5000 administrative fine, which was covered by their Statutory Liability policy. The policy also covered the $20 000 defence costs which were incurred. No conviction was recorded against the company.

*The Statutory Liability option is only available as part of a QBE Business Insurance policy via the BizCover platform.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2025 BizCover Limited.

![[Press Release] BizCover shortlisted for 5 Insurance Business awards](https://www.bizcover.com.au/wp-content/uploads/IBA-Shortlist-Awards-thumbnail.png)