PI Index: Premiums Decline 10 Straight Quarters

Business Insurance Premiums Decline 10 Straight Quarters, but have we seen the bottom?

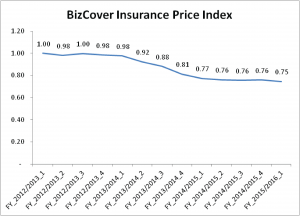

Australian SME’s continue to benefit lower premium rates due to the abundance of supply and healthy competition in the business insurance market. The BizCover Small Business Insurance Index has shown premiums continuing to fall in the first quarter of the financial year with prices dropping another percent since last quarter.

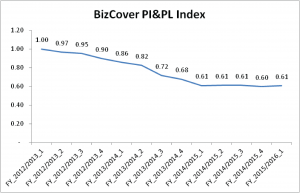

The major driver behind the continued drop in overall prices can be attributed to continued decreases in Professional Indemnity premiums. The index saw prices drop 4% compared to the previous quarter.

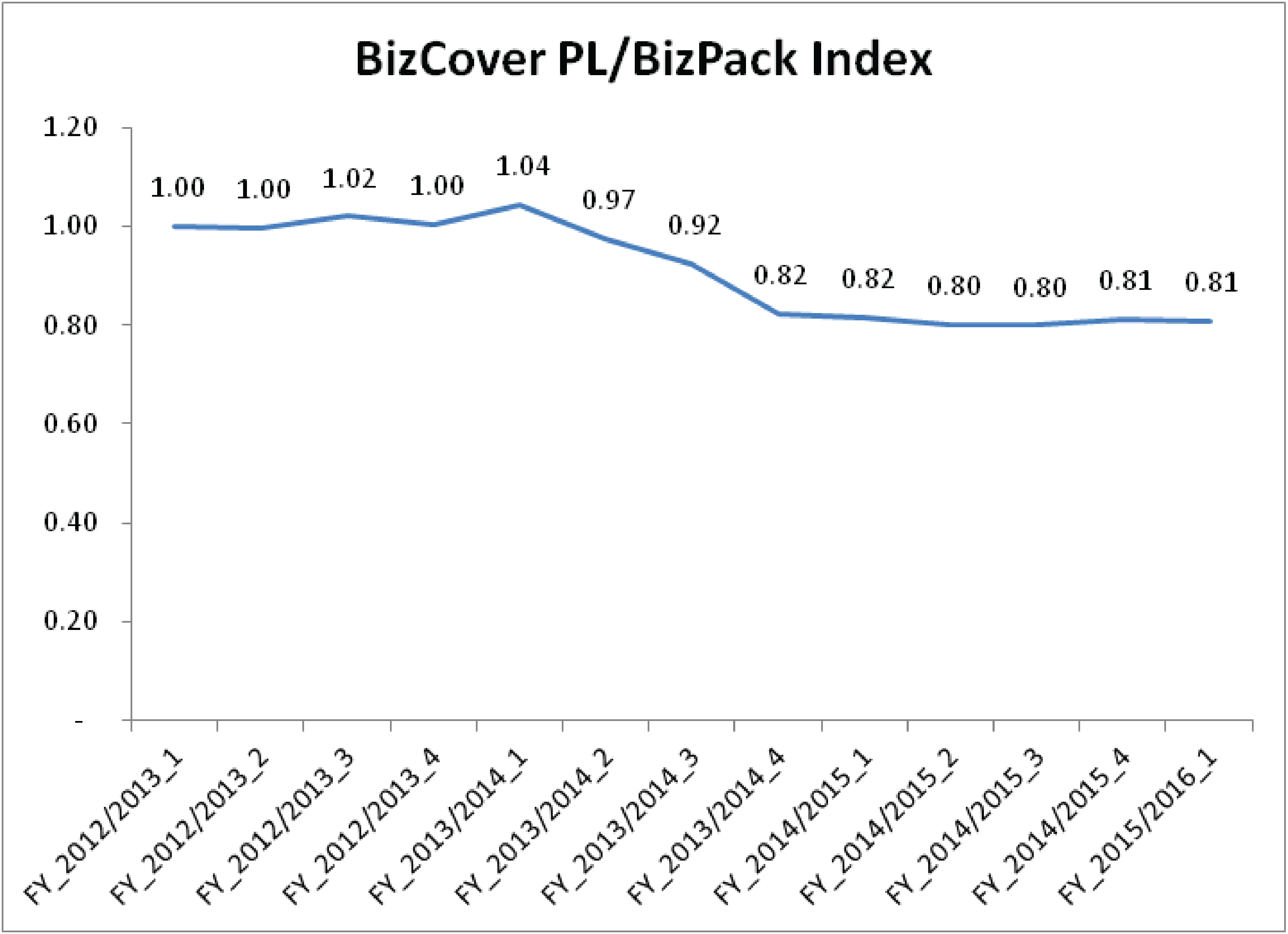

The index did highlight that prices across the other product groups, Combined Professional Indemnity/Public Liability and Public Liability/Business Packs are not seeing the same reductions and are instead levelling out this quarter.

The index did highlight that prices across the other product groups, Combined Professional Indemnity/Public Liability and Public Liability/Business Packs are not seeing the same reductions and are instead levelling out this quarter.

Michael Gottlieb, Managing Director and Co-founder of BizCover commented “While pricing continues to fall, the rate of reduction has slowed markedly and is more concentrated, pointing to a stabilisation in rates over the next few quarters.”

The combined PI&PL market, which is largely dominated by IT and allied health, experienced very large decreases in premium over FY2013/2014 and then remained quite stable over FY2014/2015. This quarter we have seen prices creep up 1%. It should be noted that premium prices are still a whopping 40% lower than the base value a mere 3 years ago.

Gottlieb says “Pricing for occupations that insurers regard as low risk have decreased disproportionately over the past 2 years and are now at levels where insurers are no longer willing to reduce any further. As an example, the cost of Professional indemnity insurance for some Allied Health professionals can be as low as $20 per month.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.

![[Press Release] Extreme weather poses growing threat to Australian businesses as storm and fire season approach](https://www.bizcover.com.au/wp-content/uploads/Press-Release-Extreme-weather-poses-growing-threat-to-Australian-businesses-as-storm-and-fire-season-approach-1.jpg)