Insurance prices remain steady despite market predictions of higher premiums

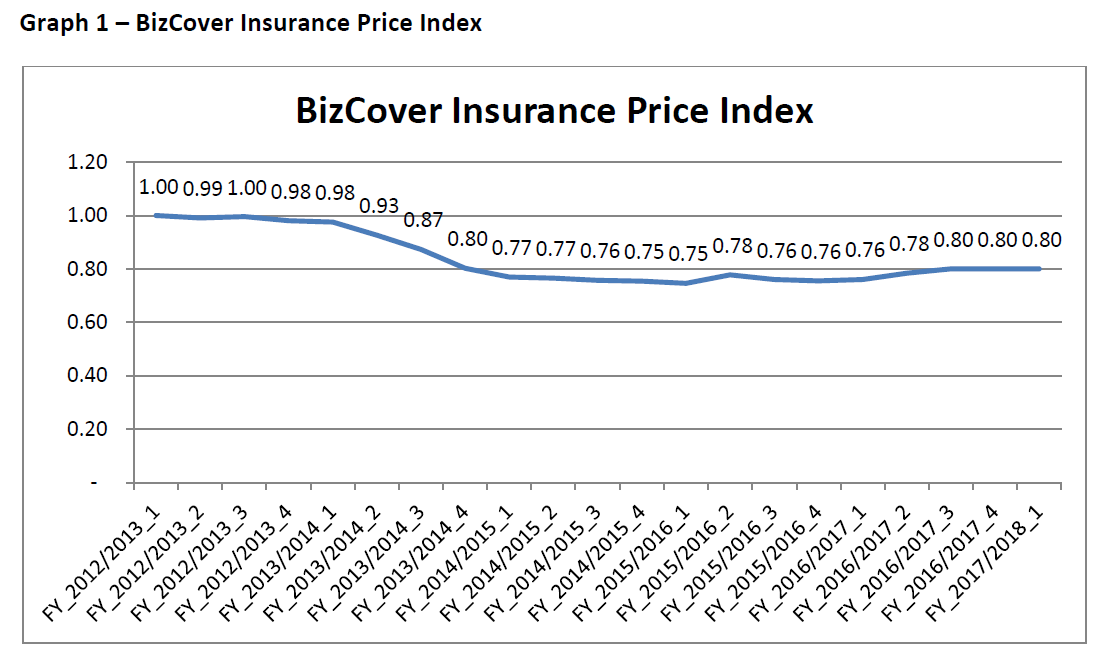

Whilst the market at large has been talking about hardening rates over the last few months, the latest BizCover Small Business Insurance Index is showing little change, with prices again remaining steady at 80 points.

Despite industry predictions of stricter underwriting criteria and higher prices, excess capacity and good levels of profitability have resulted in stable prices and coverage. The result is in line with BizCover CEO Michael Gottlieb’s mid-year assertion that “It is unlikely insurers will be able to extract price rises in the short term from the highly profitable small business sector.”

Public Liability and Professional Indemnity prices have seen no significant movement in the quarter. Insurers have pushed some price increases through in non-compulsory areas of cover like property, which has resulted in slightly lower client conversion rates on these policies. This is consistent with expectations as clients typically have more scope to pull back on non-compulsory business pack options.

Overall, positives can be drawn from the results for both SMEs and insurers; business owners will continue to benefit from historically low prices, whilst providers can be encouraged that their previous gains have not been eroded and the market remains relatively robust.

Michael Gottlieb sees no sharp change in the immediate future, commenting: “There is still a lot of competition in the market and insurance profitability remains strong, so I don’t see the cost of business insurance increasing in the short term. Loss ratios in areas like property that is exposed to natural catastrophes and listed D&O have been high, and therefore prices are likely to continue to move upwards. However, prices in the SME sector should remain stable for the foreseeable future.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.

![[Press Release] BizCover Among Australia’s Best Managed Companies 2025](https://www.bizcover.com.au/wp-content/uploads/Best-Managed-Companies-LI-social-card-template-2025-1-scaled.jpg)

![[Press Release] BizCover Shortlisted for 4 Excellence Awards by Insurance Business Australia in 2026](https://www.bizcover.com.au/wp-content/uploads/Press-Release-BizCover-Shortlisted-for-4-Excellence-Awards-by-Insurance-Business-Australia-in-2026.jpg)