How Accounting Businesses Are Adapting to AI in 2025

Artificial intelligence is steadily reshaping the Australian small business landscape. According to the Australian Small Business AI Report 2025, 80% of Australian small businesses are using or planning to adopt AI in the near future.

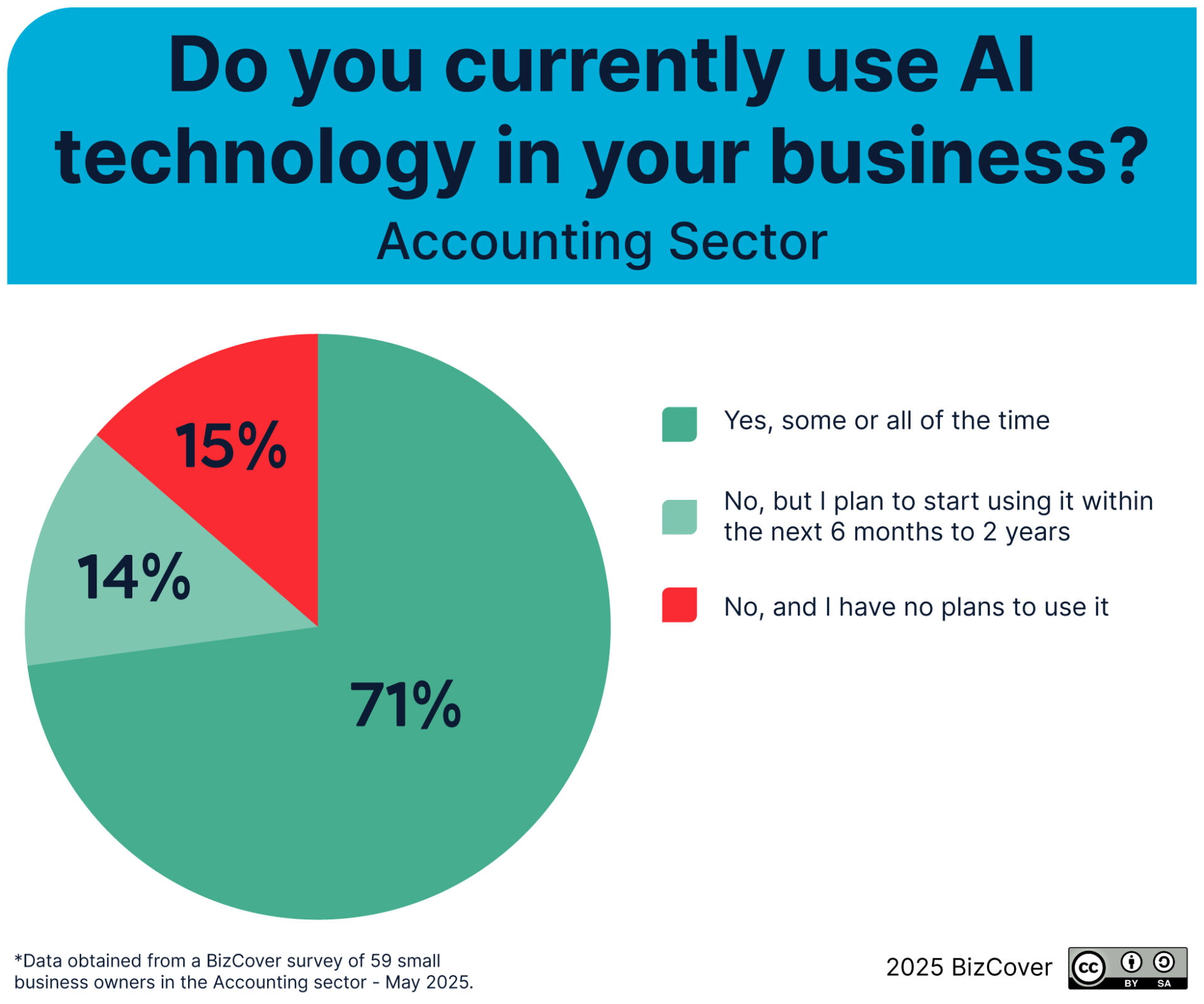

The accounting industry is no exception. 71% of small accounting businesses already use AI tools, and another 14% plan to adopt them soon.

While the rate of integration in accounting is slower than other industries, there is clear interest around AI and its advantages in business. The results of the survey show that accountants are measured in their uptake, leveraging AI to streamline admin and improve communication, while protecting the core of what makes their profession trusted: human judgement, compliance, and ethical responsibility.

The below report details findings from 59 businesses in the accounting sector, giving a rounded view on their stance towards AI, alongside commentary from BizCover’s Head of Finance, Ricky Prasad.

Key takeaways

- Strong yet considered AI uptake: 71% of accounting professionals already use AI, and 85% either use it or plan to. While this places the sector behind early adopters like Marketing and ICT, accountants are clearly engaging with AI, albeit with a measured approach.

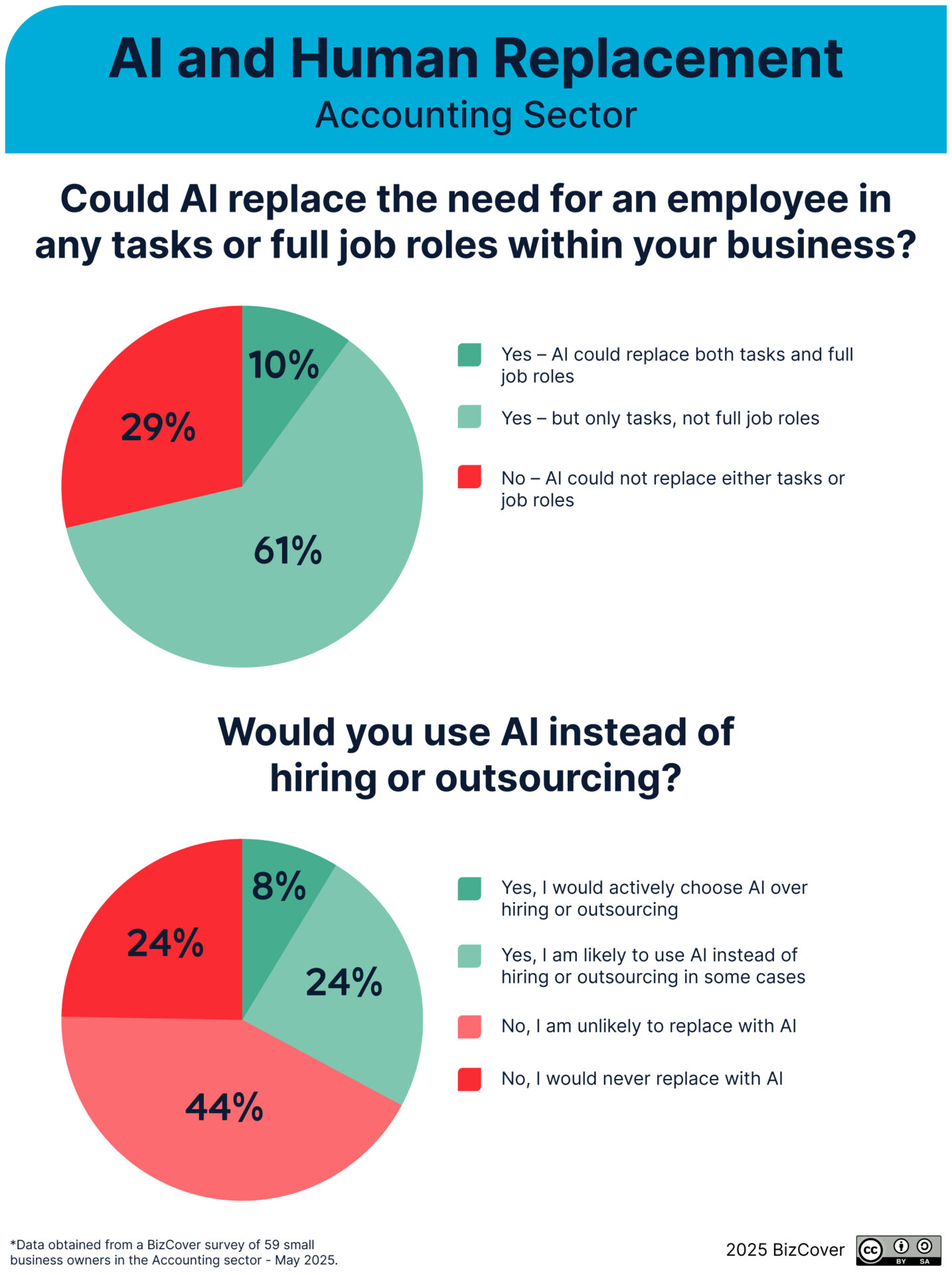

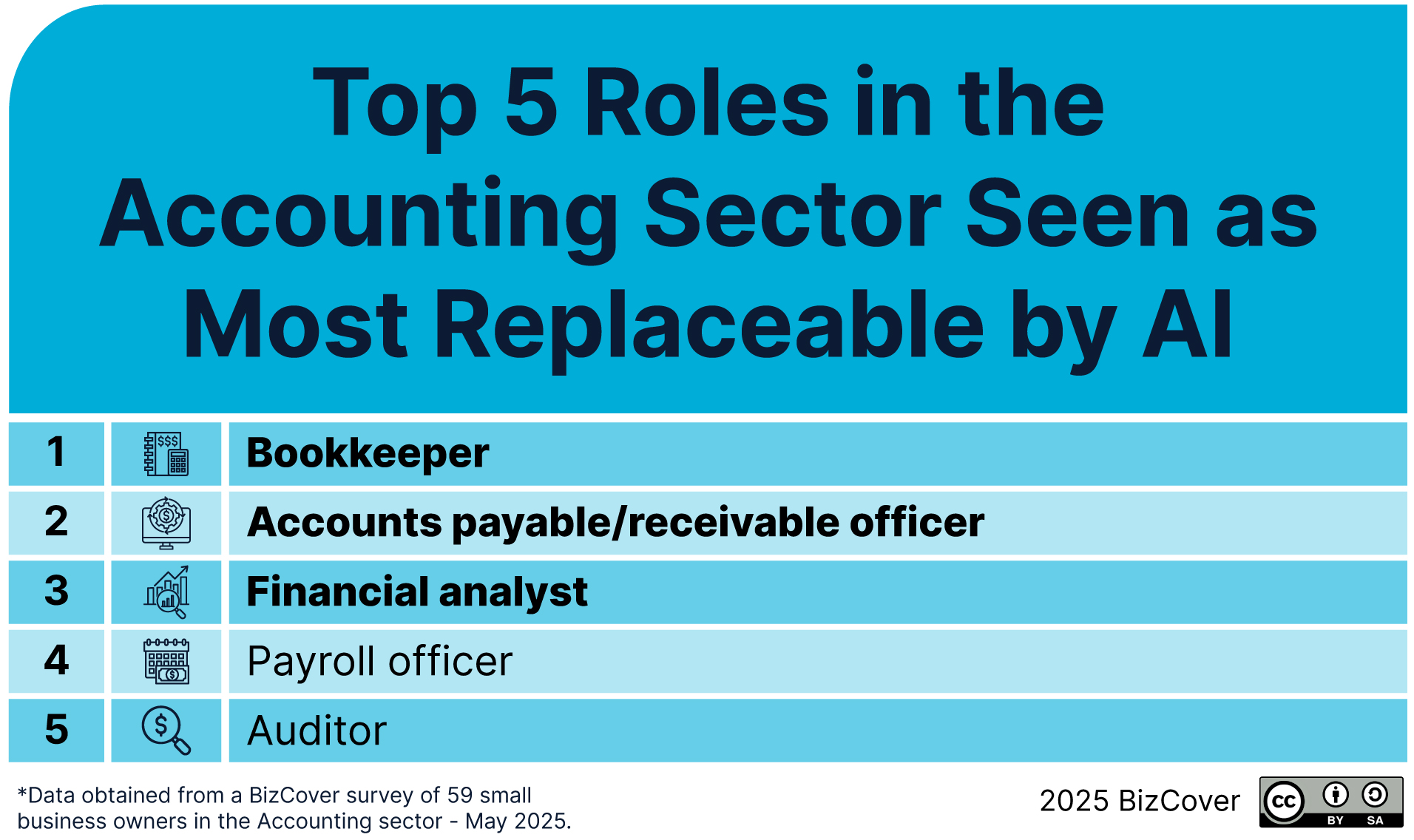

- Automation assistant, not a replacement: 62% believe AI could replace specific tasks, but only 10% think it could replace full roles. Admin, marketing, and client communications are seen as the most automatable areas, not core financial analysis or judgement-based work.

- Talent tightness in both hard and soft skills: 68% report difficulty finding hard and soft skills. Problem-solving, communication, and time management are most relied upon, while upskilling focuses on digital literacy, technical skills, and AI capabilities.

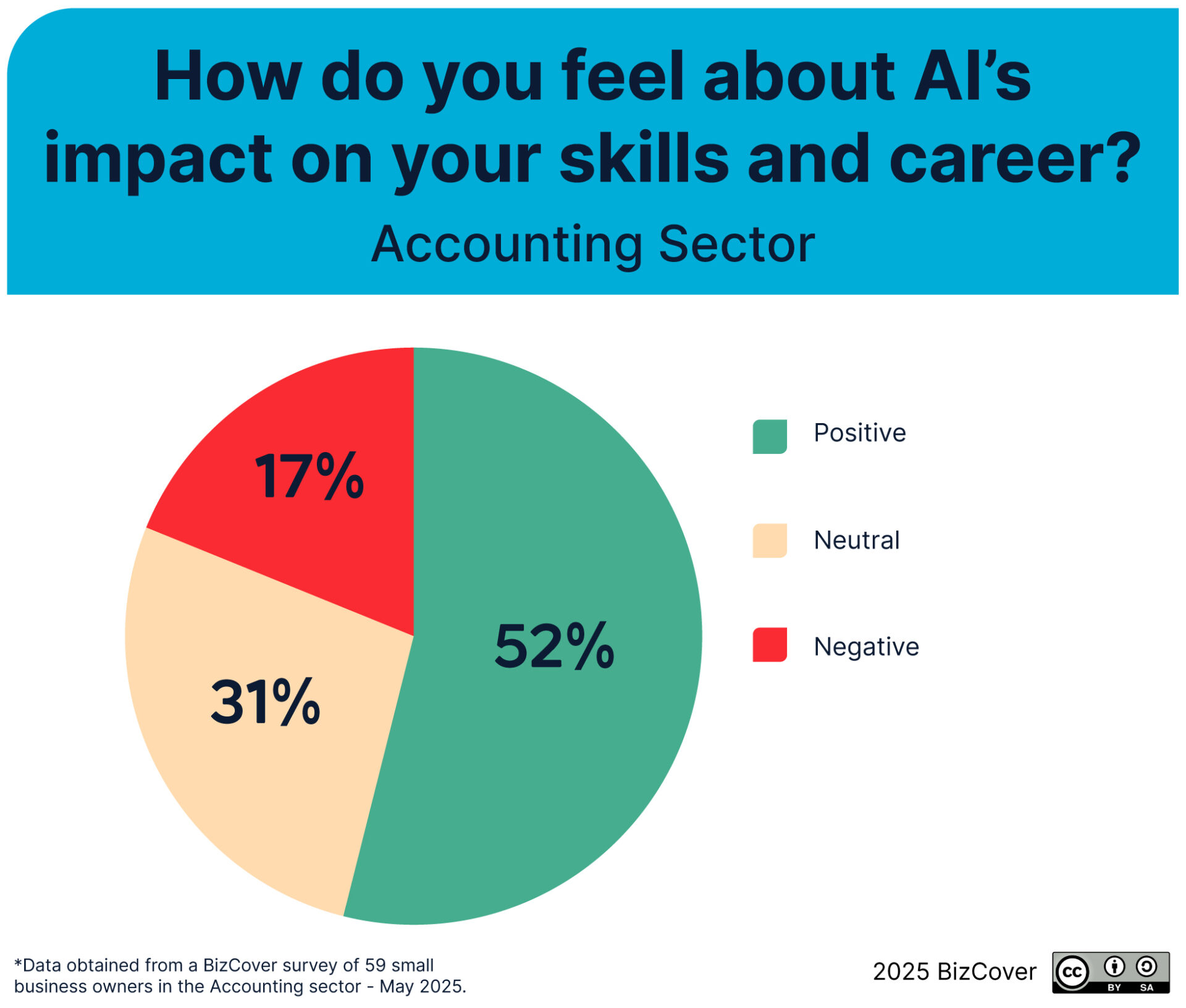

- Cautious optimism with clear boundaries: 53% feel positive about AI’s impact on their skills and career, while 17% express concern. Most see AI as a tool to automate routine work, not overhaul the profession.

- Core accounting roles are holding firm: Bookkeepers, accounts payable officers, and financial analysts are seen as most vulnerable, but 32% say no roles are at risk, highlighting strong belief in the enduring value of human expertise and trust in accounting.

AI adoption in the accounting sector: Current usage and trends

AI adoption is steadily growing in the accounting sector, with 71% of small accounting businesses currently using AI tools in their operations. A further 14% plan to adopt AI within the next two years, but 15% say they have no plans to use the technology at all.

While AI uptake in accounting lags behind leading sectors like marketing (91%), ICT (83%), and consulting (79%), it still sits above the national small business average of 66%.

“Adoption rates in accounting seem to be tempered by caution, which makes sense considering the highly regulated and detail-oriented nature of the field,” observes Prasad.

Accounting ranks fourth in AI adoption across the seven industries surveyed, placing it ahead of the retail, architecture and health sectors. While accountants may not be charging ahead with this tech in the same way that marketers or IT professionals are, they do see the potential of AI to streamline workflows and improve productivity.

AI usage within accounting businesses

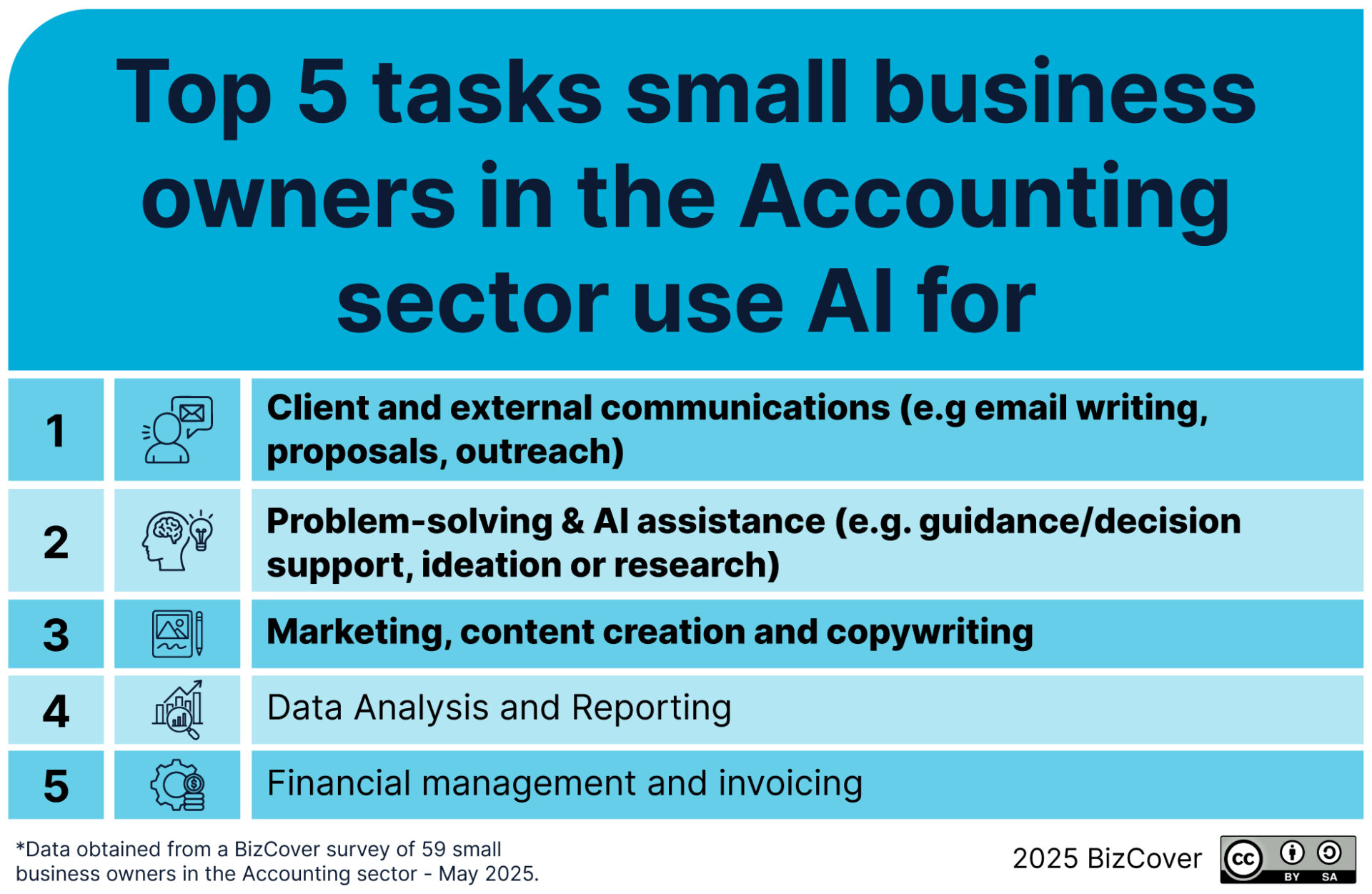

Small accounting firms are beginning to integrate AI into a wide range of everyday activities, with usage largely focused on improving communication, efficiency and client service. The top three ways accounting businesses are currently using AI are:

- Client and external communications.

- Problem solving and AI-assisted decision-making.

- Marketing, content creation and copywriting.

“Accountants are exploring ways that AI can help to free up time from admin-heavy tasks, so they can focus more on client strategy and compliance,” says Prasad. “It’s less about reinventing the accounting process and more about making the practice run smarter.”

AI’s importance to daily operations in accounting

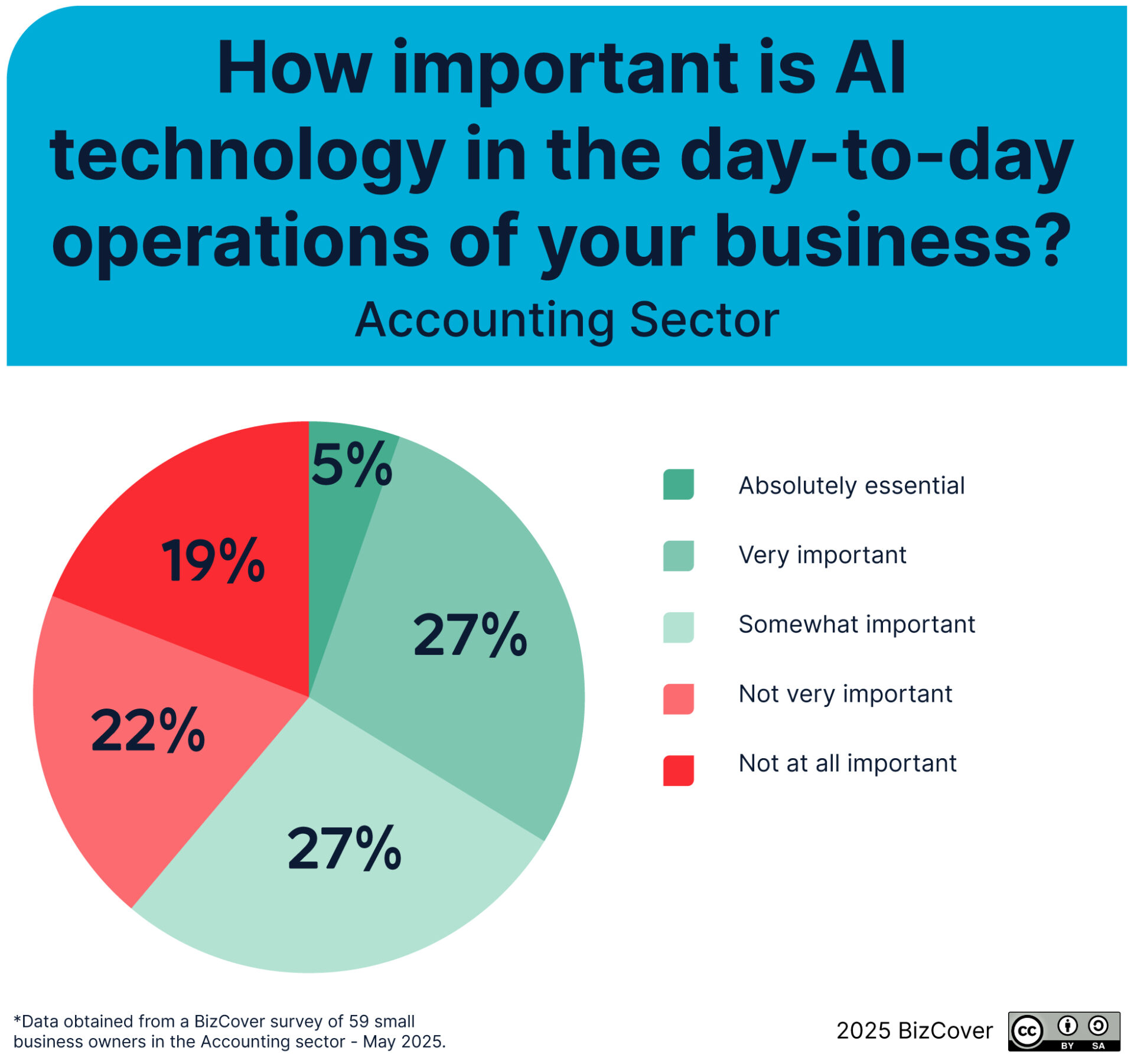

Just under 60% of accountants say AI is important or very important to their daily operations, while the remaining 40% consider it less important or not important at all.

When asked about AI’s impact on productivity, 44% expect it to significantly improve efficiency, while 31% believe it will enhance existing services without drastically changing operations. However, one in four (25%) remain unsure or anticipate minimal impact.

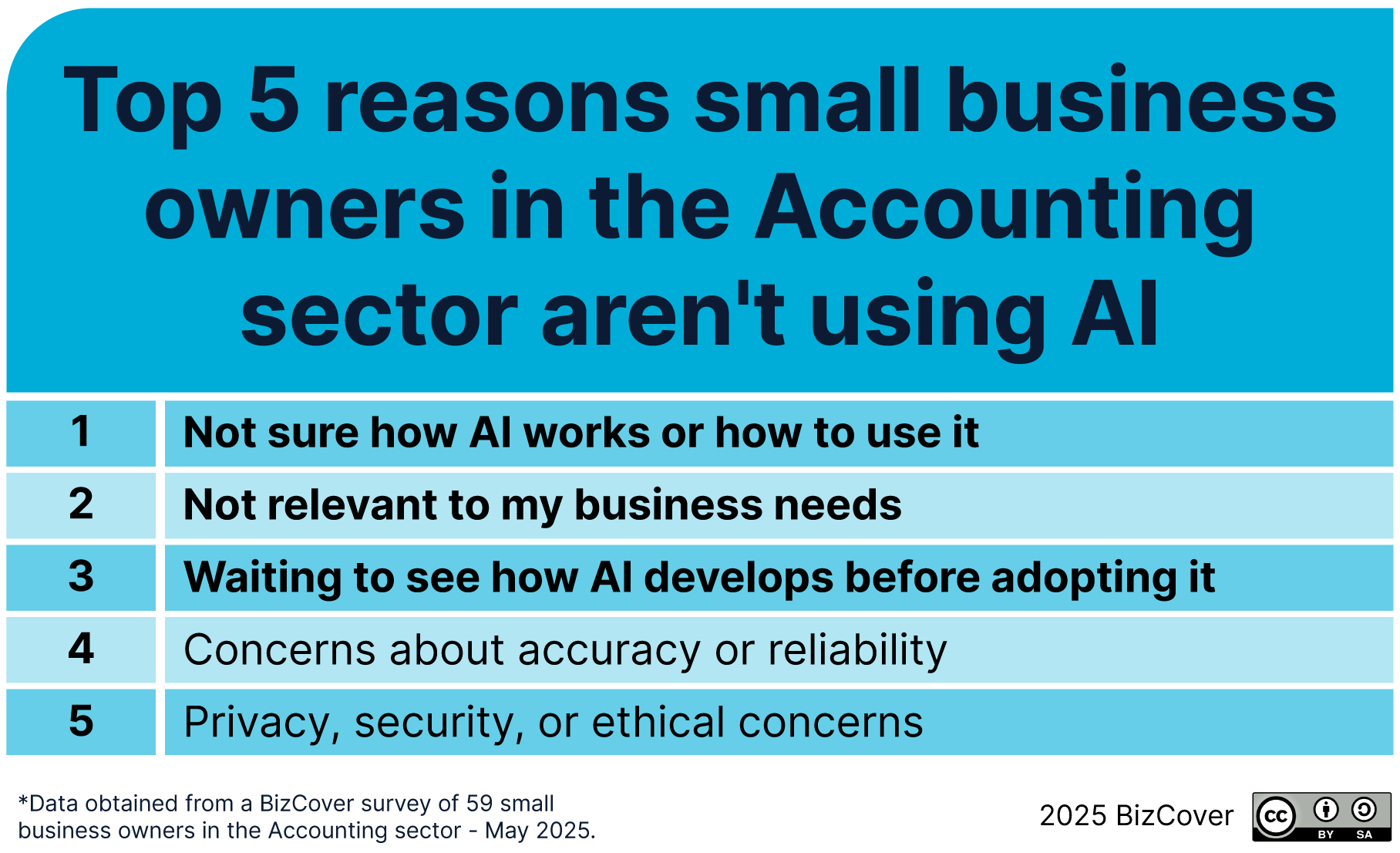

So, what is holding such a large number of accounting firms back from integrating AI into their operations? The survey found that the most commonly cited barriers include:

- Uncertainty around how AI works or how to use it.

- Perceived lack of relevance to their business needs.

- A wait-and-see approach to how AI develops.

“Accountants are trained to weigh risk carefully, so it’s no surprise that many are taking their time to assess AI’s practical value,” points out Prasad. “If they invest in something, they want to be sure it delivers real benefits before making big changes.”

However, given that the majority (44%) expect it to significantly improve efficiency in the future, accounting firms that are slow on the uptake could be left behind.

AI’s impact on skills in the accounting sector

Accounting professionals surveyed said that the top three skills they relied on most in their business were:

- Problem-solving and critical thinking

- Communication

- Customer service.

These top skills reflect the profession’s dual focus on technical skills and relationship management. As AI tools become more integrated into accounting workflows, these human-centric abilities are likely to remain essential, even as the demand grows for technical competencies like data analysis and digital literacy.

Could AI replace the human workforce in the accounting sector?

Routine administrative tasks are widely seen as the most likely to be automated in the accounting industry, such as admin duties, marketing and client communications.

“The focus isn’t on replacing people, but on using AI to improve efficiency, reduce admin, and ultimately create more space for high-value work,” says Prasad.

He continues, “By automating certain tasks, accountants can free themselves up to focus on more human-centric strategic and advisory roles, and as such provide greater value-added service.”

To keep up with this predicted workforce shift, many professionals are investing in skills such as:

- Digital literacy and technical skills

- AI, automation, and data analytics

- Communication and creative problem solving.

Notably, 41% believe AI will improve skills related to data analysis and interpretation, reinforcing the view that AI can be a valuable analytical partner.

But concern remains around the human side of accounting, with 44% worrying that interpersonal and social skills could decline. Further to this, 41% fear a negative impact on decision-making and judgement. That said, a third believe these skills will be unaffected.

Overall, however, sentiment is optimistic: 53% feel positive about how AI will affect their career, compared to 17% who are concerned, and 31% who remain unsure.

Hiring challenges in the accounting industry

When it comes to hiring, 32% of accounting firms report no difficulty sourcing talent. This is a comparatively high score when compared to other industries, such as ICT (13%) and architecture (17%).

However, among those who do face challenges, 27% struggle to find both hard and soft skills. 19% report shortages in hard skills, and 22% report shortages in soft skills.

These hiring challenges could have a flow-on effect. 32% of professionals expect AI to create demand for entirely new skills within the next 3 to 5 years, but 47% believe it will reduce the need for some existing skills.

So, if accountants are struggling to find the right talent, does that mean they will turn to AI to fill the gaps? Not necessarily.

When asked if they would consider using AI tools instead of hiring employees or outsourcing, 68% said they were unlikely or would never replace people with AI. This was the highest rejection rate of all sectors. 24% said they would be likely to choose AI over people in some cases, and only 8% said they would actively do so.

“This shows the importance of human judgement, compliance and trust in accounting,” says Prasad. “AI can help to improve efficiency by undertaking admin tasks, but human experience and interpersonal skills are still highly valued in the industry.”

Sentiment towards AI’s future impact in the accounting sector

Over half of the accountants surveyed (53%) feel positive about the impact it could have on their careers, especially when it comes to automating routine tasks and freeing up time for more strategic, high-value work.

However, a significant number of workers (17%) are worried that AI could make their skills less relevant, or even replace parts of their role altogether. Another 31% remain neutral, unsure whether it will really change the way they work.

These mixed feelings reflect the balancing act many in the profession are facing: welcoming the benefits of new technology, while also keeping a close eye on how it could reshape the future of accounting.

Conclusion: Mixed feelings, but momentum is building

AI adoption in the Australian accounting sector is progressing with confidence – but also care. With 71% of small accounting businesses already using AI and another 14% planning to follow, the momentum is clear. Still, the profession is taking a thoughtful approach to integration.

“While there are still a lot of mixed feelings around AI, it seems like accountants are mainly positive about its benefits and capabilities,” says Prasad. “It’s true that the accounting industry is one that hasn’t changed drastically over the years – but this doesn’t mean accountants are unwilling to embrace innovative new technology.”

He continues, “The accounting industry is adjusting to AI more slowly than others; but this just means that the sector is approaching this in a measured, practical and responsible way.”

For most accountants, AI is less about replacing people and more about enhancing the way they work. It’s being used to streamline administrative tasks, speed up data processing, and support clearer communication – which in turn frees up time to focus on complex analysis, compliance and client relationships.

The result? A sector that welcomes AI’s potential, but still wishes to remain firmly grounded in the human skills that clients count on.

Need help protecting your accounting business as technology evolves? BizCover makes it easy to compare business insurance tailored to your needs – fast, online and hassle-free. For on the go cover, go BizCover.

Methodology

This research was conducted via an online survey distributed to Australian business owners in April 2025. A total of 1,323 responses were collected. For the purposes of this analysis, only responses from small business owners (defined as those with 20 or fewer employees) were included, bringing the final sample size to 965.

These respondents represented seven industries, after excluding two industries with low response rates (fewer than 50 responses each) to ensure meaningful comparison. The remaining industries include Accounting, Marketing and Communications, Consulting and Strategy, ICT, Healthcare and Medical, and others. There were 59 respondents from the Accounting sector.

Respondents were asked a mix of multiple choice and checkbox questions covering AI adoption, its impact on operations and roles, and evolving skill requirements. The data has been analysed to highlight trends across small business owners, industries, and anticipated future use of AI in the small business sector.

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.