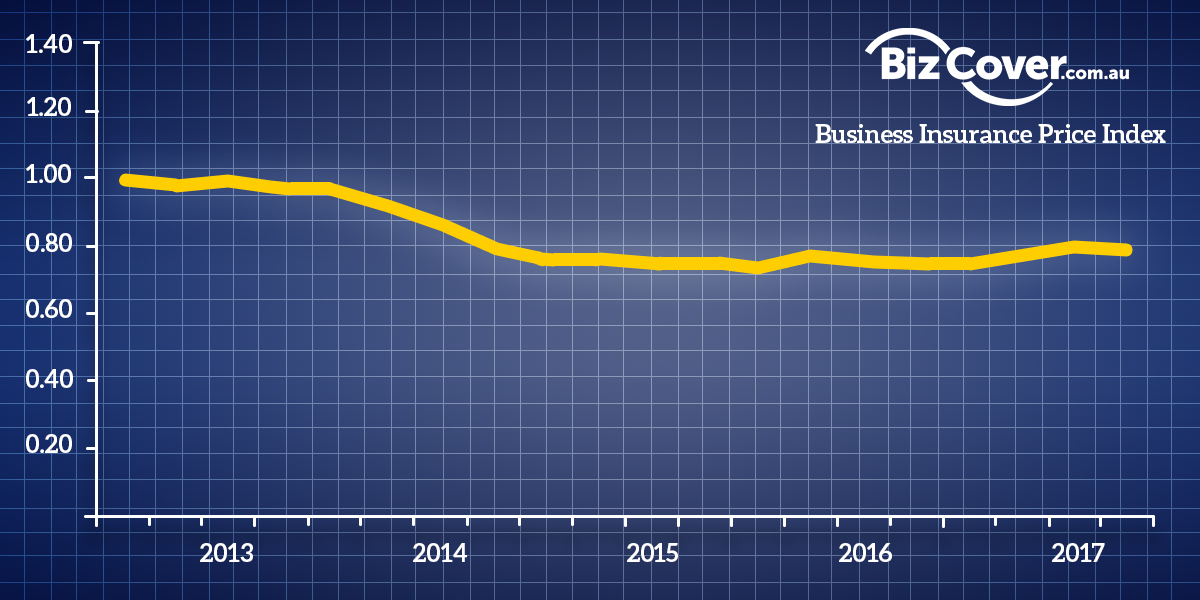

SMEs continue to benefit from low premiums; despite talk of price rises.

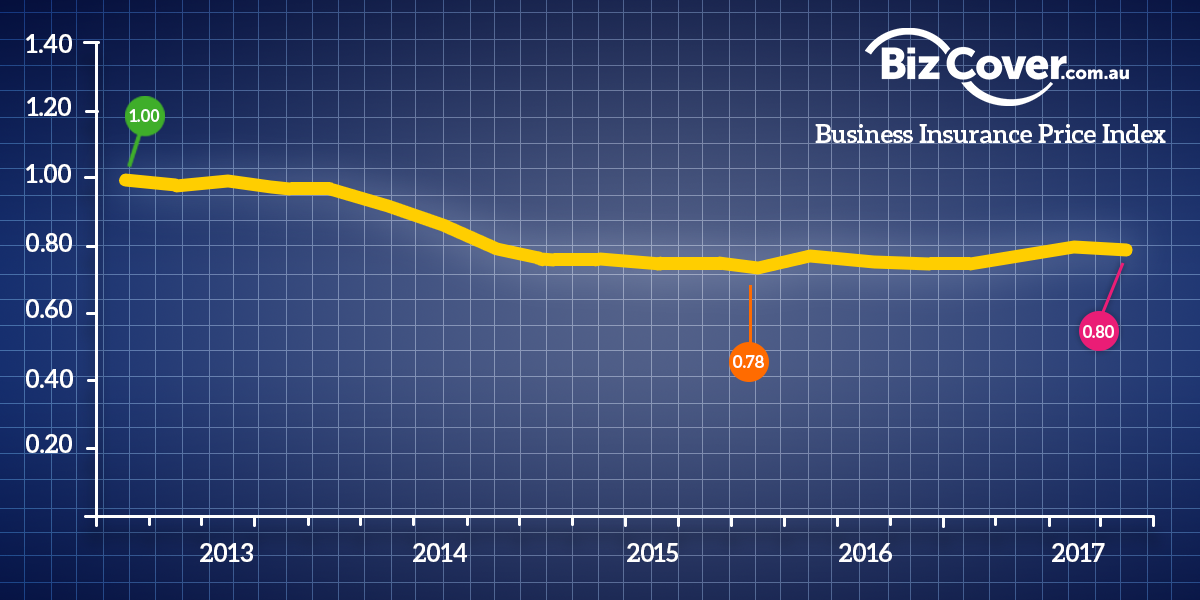

Whilst the market seems to be hardening for insurance for larger businesses, the latest BizCover Small Business Insurance Price Index is showing no change in pricing for the SME sector, with the index remaining steady at 80 points.

The SME space is still profitable, which means that the industry is seeing continued competition which is keeping prices down. Professional Indemnity and Public Liability, including multiple section business packs, remained consistent at 78 points and 87 points respectively.

The good news for insurers is that where they have made small gains over the last couple of quarters, they have been able to maintain these gains. However, no new gains have been made and instead insurers have managed to push up premiums for large business.

These increases have resulted from poor loss ratios driven by high claims. Insurers have been able to drive up prices for listed D & O and exposed property. While these price increases have been welcomed by insurers, they are not likely to be enough to satisfy them. However it’s unlikely that they will be able to extract price rises in the short term from the highly profitable small business sector.

Michael Gottlieb, Managing Director of BizCover commented: “The continued competition and low loss ratios in the SME segment is keeping prices at historically low levels. It is unlikely SME’s will see material rises in their insurance cost anytime soon and not before the end of the year. Insurers will likely continue to push prices for exposed sectors with poor claims experience but competition will ensure that SME’s benefit from continuing low prices.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording. © 2025 BizCover Limited.