Insurance Premiums for Retailers Continue to Climb

Insurance Premiums for Retailers Continue to Climb

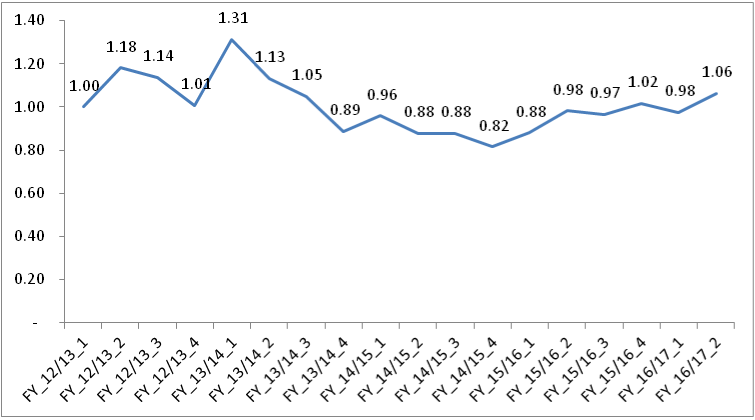

The latest BizCover Small Business Insurance Price Index has been released (Graph 1), and similar to quarter 2 of last financial year, the index is showing an increase in small business insurance rates, with the index rising 3 points over last quarter. This increase however is not universal.

Graph 1 – BizCover Insurance Price Index (Financial Year 2017 2nd Quarter)

There was no change in the Professional Indemnity sector, but the index for Public Liability and Business Packs increased 4 points. This was predominantly being driven by the retail sector which saw rates jump a massive 8 points for Public Liability and Business Packs, most other industries saw little change over the quarter in pricing. This is a reflection of the fact that loss ratios have been significant and retail is more complex to underwrite coupled with the fact that there is not the same level of competition here as in other areas which has allowed insurers to push increases through.

Retail prices also saw a jump in the same quarter last year, and this is one area where the insurers have been able to hold onto their gains throughout the year. The question remains as to whether this further increase is sustainable or whether insurers will be forced to decrease prices.

Graph 2 – BizCover PL/BizPack Retail Index (Financial Year 2017 2nd Quarter)

Michael Gottlieb, Managing Director of BizCover commented: “There has been a lot of discussion around insurers needing prices to increase to compensate for lack lustre financial results. With overall competition and capacity as it is, it is unlikely that they will be able to do this in the broader market, however it is likely that insurers will start to look at areas like retail, where they are able to push the rates and make gains whilst keeping the more competitive sectors flat.”

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.