BizCover SME Insurance Price Index Q1 FY21

BizCover clients buck the trend of insurance price hikes.

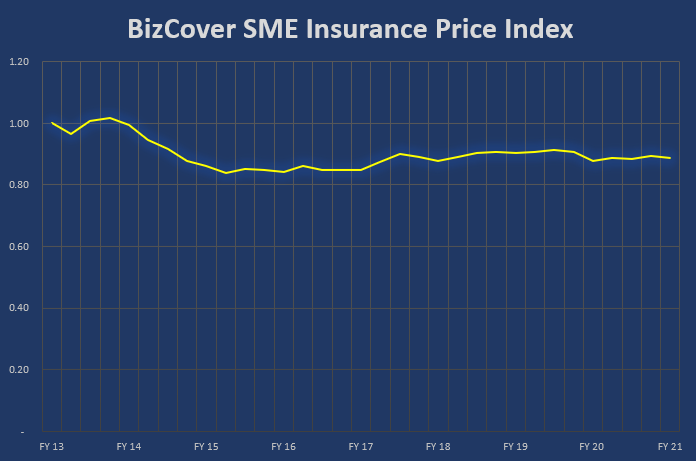

Whilst the Australian Small Business and Family Enterprise Ombudsman is running an inquiry into the availability and pricing of insurance for SMEs, BizCover can report that overall the 120,000 small businesses insured through its platform are benefitting from a continued period of steady pricing for their insurance with the release of the BizCover SME Insurance Index for Q1 FY21.

The Index has shown no increase in overall price levels in the quarter and this marks 15 quarters of relatively stable insurance pricing for SME’s. This is in stark contrast to the global insurance market which was reported by Marsh1 last quarter to have seen 11 quarters of increases in prices in the overall insurance market, with prices in Australia rising 31% over the previous quarter.

The Index has shown no increase in overall price levels in the quarter and this marks 15 quarters of relatively stable insurance pricing for SME’s. This is in stark contrast to the global insurance market which was reported by Marsh1 last quarter to have seen 11 quarters of increases in prices in the overall insurance market, with prices in Australia rising 31% over the previous quarter.

The BizCover SME Insurance Index is comprised of three industry groups who have purchased insurance through the BizCover platform, being Professionals, Trades & Services and Retail & Hospitality. Whilst all three industry indexes have remained relatively flat, when you drill into each the coverage within each group, there were some clear winners and some losers. The Full Report can be viewed here: SME Insurance Price Index

Public Liability insurance is an essential cover for SME’s and one that most can’t afford to operate without. Trades businesses insured through BizCover saw no changes in pricing whilst the Retail sector benefitted from a 4.1% decrease in prices and Professionals a 3.5% decrease.

Professionals were also able to capitalise on a 1.3% decrease in prices quarter on quarter for Professional Indemnity insurance.

The one area that has seen ongoing fluctuations and an increase in prices this quarter is in property, which has been particularly impacted this quarter due to bushfires and COVID concerns. Retail is showing an 8.3% increase for the quarter and Trades are seeing a 25.5% increase in covering their tools of the trade and 4.8% increase in portable equipment.

Simon Schwarz, Chief Financial Officer of BizCover, commented, “Now more than ever with economic pressure on SME’s, BizCover is committed to working with our insurance partners to ensure the cost of insurance for SME’s is fair. Despite increases in the broader insurance industry our application of analytics and collaboration with our insurance partners has managed to maintain stable pricing for Aussie SME’s for nearly 4 years.”

Download a copy of the Price Index here.

1. https://www.marsh.com/au/insights/research/global-insurance-market-index-q2-2020.html , accessed 14th October 2020

This information is general only and does not take into account your objectives, financial situation or needs. It should not be relied upon as advice. As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy wording or Product Disclosure Statement (available on our website). Please consider whether the advice is suitable for you before proceeding with any purchase. Target Market Determination document is also available (as applicable). © 2026 BizCover Pty Limited, all rights reserved. ABN 68 127 707 975; AFSL 501769.