Compare quotes from our trusted insurance partners

What is insurance for tradesmen?

Whether you’re a carpenter, a handyman or a plumber, things like accidentally injuring or damaging a third-parties property or getting your tools stolen are real risks that tradies face every day. Business insurance for tradesmen is designed to give your tradie business the protection it needs and peace of mind knowing that you have a safeguard in place when things don’t stick to the blueprint.

What kind of tradesmen need business insurance?

These are just some examples of the type of trades industry’s which need to consider business insurance to protect their business.

Tradesman insurance covers a broad range of modalities, including:

- Carpenters & Woodworkers

- Electricians

- Handymen

- Plumbers

- Concreters

- Garden & Lawn Maintenance

- Painters

- Bricklayers

- Lawn Mowing Service

- Tilers

Why do Tradesmen need insurance?

The reality is as a tradie you are exposed to different kinds of risks, making it vital to look at the various types of business insurance options available and how they can protect your business. These are some examples of when business insurance can help:

- Protection against claims from third parties for accidental personal injury or damage to their property

- Protection for your tools of trade in case they are lost, stolen or damaged

- Certain types of business insurances may be required when taking on a contract

- Financial protection in the event you are faced with a claim

Don’t be a ‘hero’ and rock up to your next job without your insurance. With BizCover you can get multiple competitive quotes from some of Australia’s leading insurers online quicker than you can say “smoko” and grab yourself a feed from the tuck shop!

Why BizCover for your business insurance?

Built for small business

We know insurance and what makes

small businesses tick.

Clear and competitive pricing

You can compare and choose from a range of highly competitive prices right there on your screen. Seriously.

Cover to match your needs

You can tailor policies from selected Australian insurers to suit the needs of your business, and we are there to help!

Real people adding real value

Our friendly service team is on hand and

on a mission to make you smile!

Get the cover that’s right for your tradesmen business

Public Liability

Public Liability insurance may be a requirement for tradies well before you step foot on site and is one of the important types of cover you may need to look at. Even if you can talk your way out of a pile of rubble, you’re not going to....

be able to talk your way out of a Public Liability claim. Public Liability insurance is designed to provide protection for you and your business in the event a customer, supplier or a member of the public is injured or sustains property damage as a result of your negligent business activities.

Consider the possible personal injury claims from trip hazards created by your work activities or the risk of property damage claims – what about if you dropped a hammer and cracked some tiles? What if you forgot to turn the power mains off and electrocuted someone?

A personal injury and property damage claim could have a huge impact on your business, not only financially, but also to your company’s reputation.

If you’re working as a contractor, you should also consider your contractual obligations to carry a minimum amount of Public Liability insurance. You may also be required to hold Public Liability insurance if you are a member of a particular trade association.

What is typically not covered?

- Third-party personal injuries

- Damage to customer property

- Your legal & defence costs for covered claims

Business Insurance

Your tools of trade and other business assets help you get the job done, so consider protecting them with coverage options like Portable Equipment* and Contents* Insuring your tools, and your business against an instance when....

you have to down tools will ensure you still have a business,

Portable Equipment* – it’s likely you’ve accumulated a lot of tools over several years of work. If they were lost or stolen could you turn up to work the next morning and keep working? She’ll be apples with Portable Equipment cover – it insures items such as tools, business equipment or electronic items.

Read More

- Third-party property damage & injury claims

- Business property damage

- Unplanned business interruptions

Professional Indemnity

If you are an electrician, plumber of carpenter, sharing your tradie pearls of wisdom to your clients could lead to a potential claim if things don’t exactly go to plan and an accidental error occurs.

There’s no doubt you know your stuff ....

when it comes to all things tradie, and if you are an electrician, plumber of carpenter client’s may often seek out your advice on certain things. But did you know that if your advice causes them a financial loss you could be held responsible? That’s where Professional Indemnity insurance can provide a helping hand.

Professional Indemnity insurance covers you for losses claimed by a third party and defence costs due to alleged or actual negligence in your professional services or advice.

Read More

- Mistakes, errors or omissions in your work

- Professional wrongdoing

- Giving incorrect advice

Personal Accident & Illness Insurance

Working as a tradie you rely on being physically fit to your business going and getting the job done, so if accident or illness were to strike you need to think of Plan B to help provide an income while you’re off recovering. As a tradie you....

need to be fit and healthy to bring in the dough – but have you stopped to think about how you would keep on paying the bills if you were to injure yourself or fall ill and had to take time off work to recover? Accidents can happen anywhere, anytime. It could be at work or even on your own time; whether you are doing a bit of DIY around the house or playing a game of backyard footy on the weekend.

Personal Accident and Illness Insurance provides levels of cover for loss of income, permanent disablement and even death if you are unable to work as a result of an injury or illness.

Read More

- Loss of income if you are unable to work due to illness or injury

- You become permanently disabled or pass away as a result of an accident

Product Liability insurance

If your tradie business starts selling products, you may need Product Liability insurance to protect from claims from third parties for property damage or injury.

- Claims by third parties relating to property damage or personal injury caused by your products

- It is typically part of a Public Liability policy

Tax Audit

If your tradie business is investigated by the ATO it can be a stressful and time-consuming event. It’s a hassle and worry that you don’t need hanging over your head, and that’s where Tax Audit insurance can make things less .. stressful. If your accounts are audited by the ATO, you may need to hire external professionals, like an accountant to assist in the process. Tax Audit Insurance covers a business for specified costs in responding to an official tax audit. Read More

- Covers accountant’s costs incurred in responding to an audit or investigation by the ATO

An unwanted trade

A tradie working on a commercial building locked up his tools before leaving the worksite at the end of the day.

The next morning when the site was opened his tools were nowhere to be seen. A double whammy - no tools and potentially a contractual penalty for delaying the work.

- The insured’s claim was dealt with quickly and he was able to replace his tools in time to avoid all penalties.

The next morning when the site was opened his tools were nowhere to be seen. A double whammy - no tools and potentially a contractual penalty for delaying the work.

- The insured’s claim was dealt with quickly and he was able to replace his tools in time to avoid all penalties.

BizCover customer savings

Here is how much other nurses and Allied Health professionals have saved with BizCover

Andrew / QLD

Carpenter/Carpentry Services

on Personal Accident & Illness

Robert / VIC

Electrician/Electrical Services

on Public Liability

Renzo / NSW

Handyman

on Public Liability

Jacob / VIC

Plumber/Plumbing and Gas Services

on Public Liability &

Professional Indemnity

Anil / SA

Gardening and Handyman Services

on Public Liability

Christopher / NT

Painter/Decorator

on Public Liability

Peter / VIC

Lawn Mowing Service

on Public Liability

^ Savings made from January/2024 to June/2024. This information is provided as a guide only andmay not reflect pricing for your particular business, as individual underwriting criteria will apply.

How it works?

4 easy steps to get covered and protect your business.

How it works?

4 easy steps to get covered and protect your business.

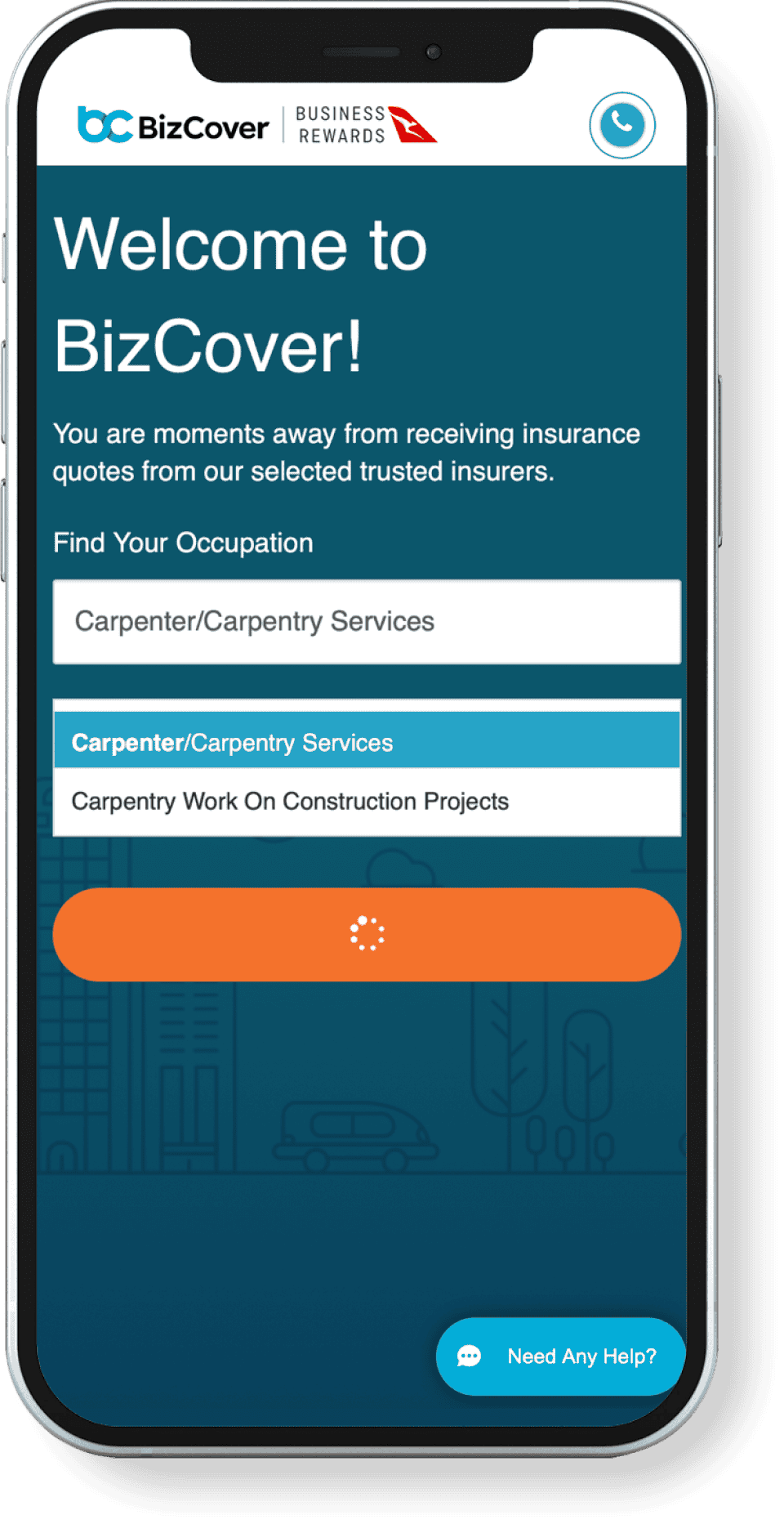

Select your occupation

Select your occupation to start comparing quotes.

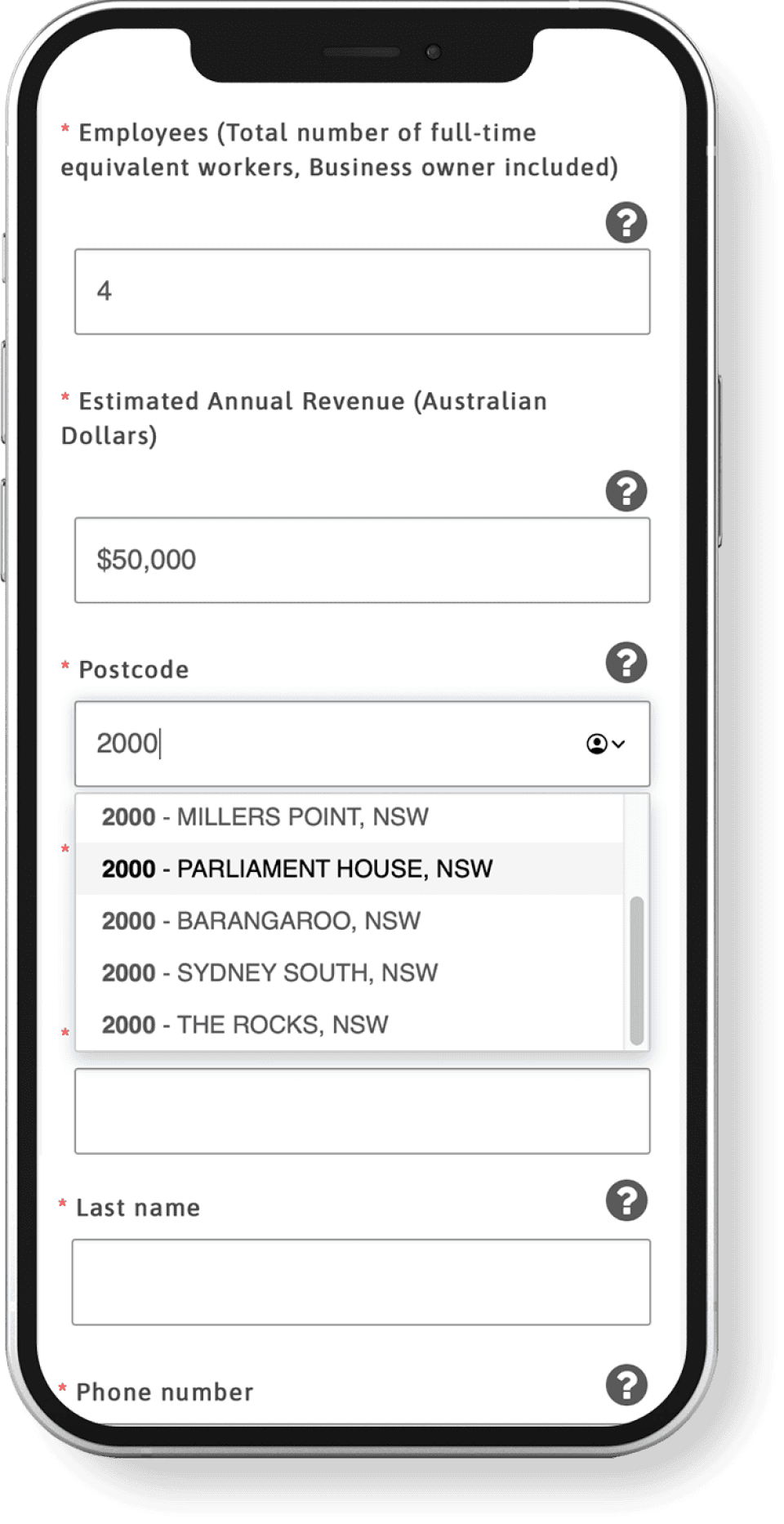

Enter your business details

Because your business is unique, we'll ask a few questions to help you compare quotes.

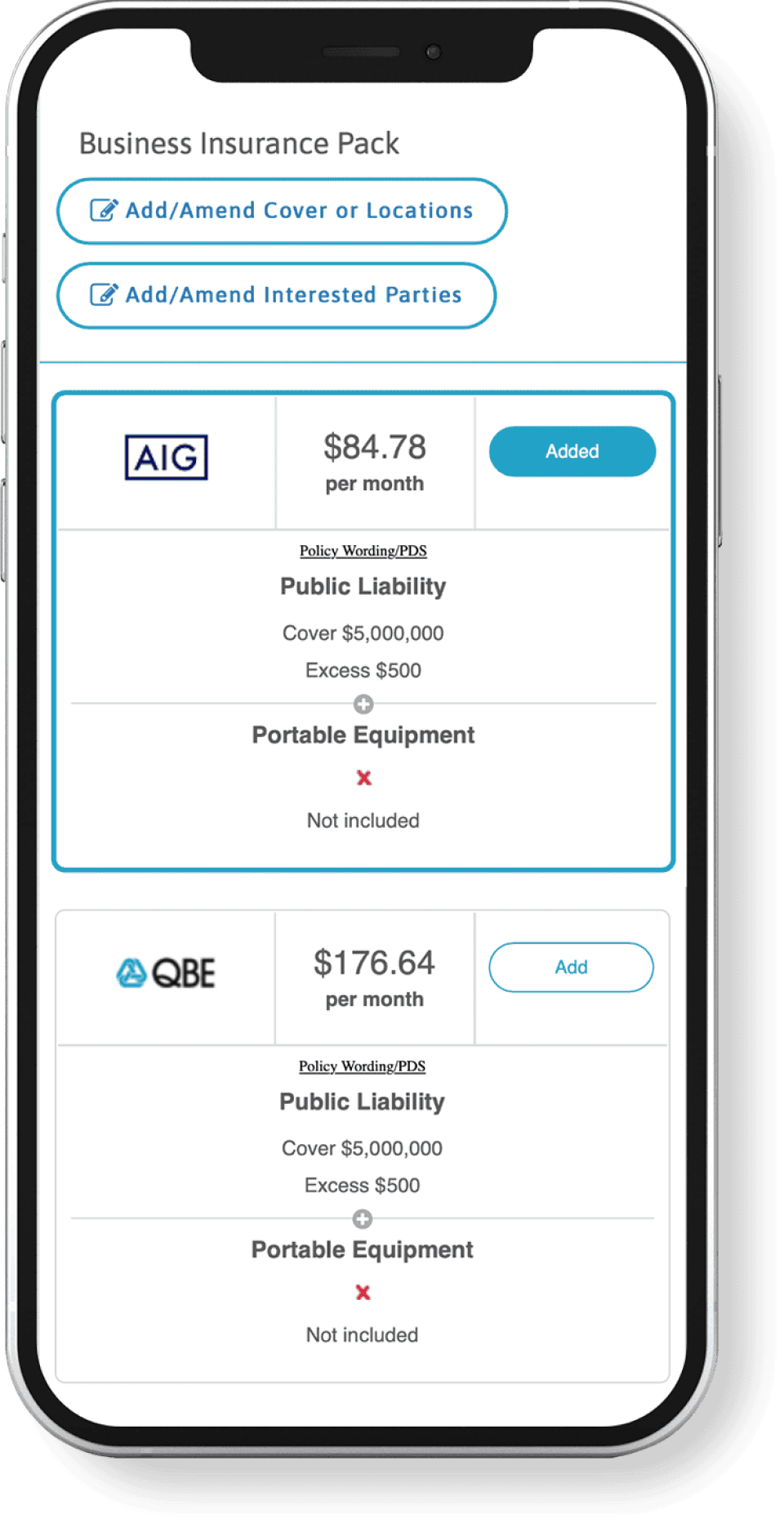

Compare quotes

Find out how much you can save and select the cover that best fits your business.

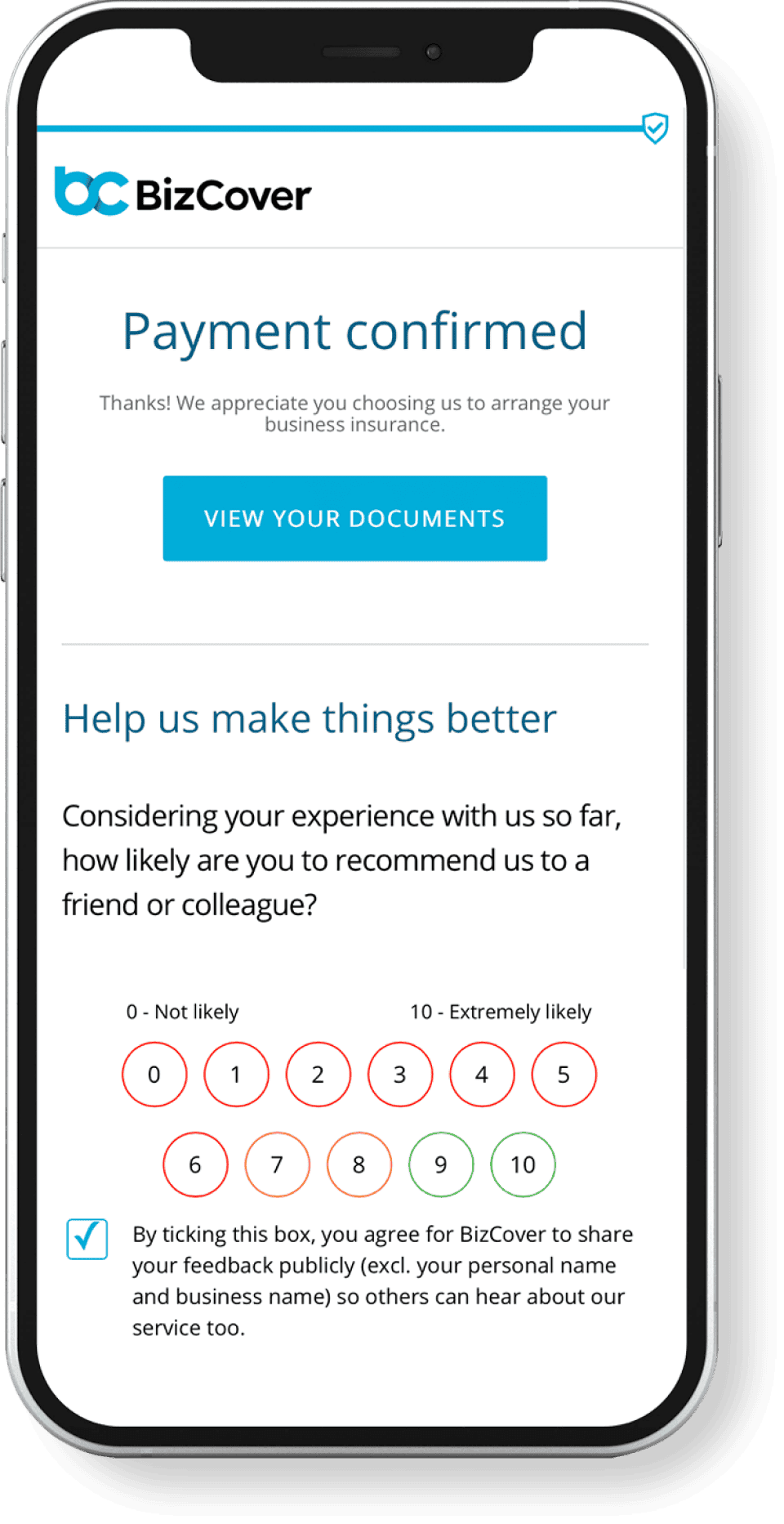

Covered in minutes

That's all!

Your policy documents have been delivered to your inbox.

How much does insurance cost for tradesmen??

Every tradie is different with their own unique features and types of potential risks. There isn’t a one-price fits all kind of tradie insurance policy, the pricing is dependent on your individual factors and circumstances.

These factors can be things like:

- Your claim history

- The type of business operations you perform

- Your annual turnover

- The number of staff

- Level of cover

- Claims history

To receive an accurate idea of how much business insurance will cost for your tradie business have a chat to our friendly team to get a quote.

What our customers say about us

Customer Reviews

4.6/5

Independent Feedback based on verified reviews.

Simple & easy

The process was easy & simple to navigate, I found the cover I needed & received a quote, then purchased my insurance policy within minutes.

Great product - options, customer service and the product!

From the start - was easy to find, web site had all the information I required concise and in plain english. My options were available quickly and also the availability to customise those options - which I did. Payment options as well - again I choice an option. Also the expanse of insurers made me secure I had picked a site that knew the business and what customers needed - so thank you! Appreciated and it all came together within a day or two. NB Added bonus when I checked on a detail a Bizcover staff member answered the call quickly with all the info - they knew the product.

Convenient stress-free quote & insurance

Online setup is easy and convenient, especially with today's busy pace. One of the times I could not get an online quote for different insurance due to one of the questions I had answered, and they rang within the hour to assist ...

They're thorough, helpful and the staff are great!

Online setup is easy and convenient, especially with today's busy pace. One of the times I could not get an online quote for different insurance due to one of the questions I had answered, and they rang within the hour to assist ...

SIMPLE AND QUICK. RESPONSIVE CUSTOMER SERVICE. REASONABLE RATES

SIMPLE AND QUICK. RESPONSIVE CUSTOMER SERVICE. REASONABLE RATES

Affordable, convenient and stress free

So easy and convenient with very little wait time. Very impressed with the simplicity and price is very affordable.

Pleased with Bizcover online

Ease of use online but access to consultants if required. Quick quotes. Easy to pay online.

Instant quote and business up and running the next day!

I was able to purchase my insurance online and was available to start work that next day.

Very helpful. Very attentive. Good communication.

Very helpful. Very attentive. Good communication.

I appreciated the follow through phone calls ascertaining if assistance was needed. Thank you.

Friendly site, variety of insurance covers

Easy to use website, useful information and okanetynof choices and options

Good service, thank you.

very helpful with insurance advice. Easy to follow directions online for my insurance renewal.

Great platform

Fast and easy platform to find your PI & PL Insurance. Thanks and well done!

Excellent

Great friendly and efficient operator. Courteous and informative during the process topped off by a good price

Thanks for making this so, so simple.

I liked the simplicity of things, the modularity too. Some companies over do this, leading to an almost "fast food" feel to their products. This was not evident here, and the amount of choices reflected useful changes between options.

The prices are fair, half what I've paid when undertaking other business activity at a similar scale. It seems the customer wins here as well as the underwriter. I like that.

We will protect your

competitive quote for

30 days

Prefer to talk?

Call 1300 920 874 to speak with one of our business insurance

specialists. and speak to one of our insurance specialists

Compare quotes online or with one of our friendly agents.

If you're not ready to buy, we will protect your competitive quote for 30 days!

Frequently asked questions

Certain types of business insurance like Public Liability insurance may be a requirement before you can work on a job. It is always important to check your contract or agreement to see if a minimum level of cover is also stipulated.

If you rent your business premises, Public Liability and even Glass cover may be outlined as a requirement of your rental agreement by your landlord.

Just like any other self-employed business, insurance is something which you should consider as part of your business plan to help you stay in the tradie game for the long haul. While some types of insurance may be a requirement, there are a variety of coverage options designed to protect the things that matter most to your tradie business.

Just like the cost of business insurance, there isn’t a blanket cover for all tradies. However, there are a few factors that you can keep in mind when trying to calculate your level of cover. For example:

- The size of the jobs that you are working on. The higher the cost, the higher risk and you may want to look at increasing your Public Liability insurance accordingly

- Is there a minimum amount of cover stipulated in your contract?