200,000+

Australian small businesses protected

Australian small businesses protected

Public Liability and Tool cover

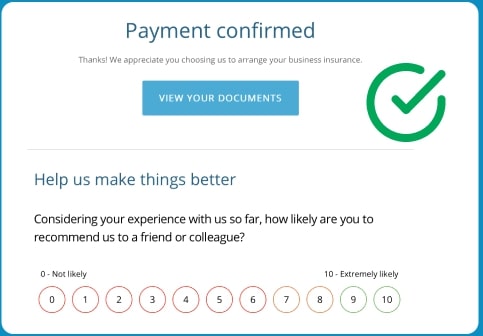

Pay by the month and policy documents emailed instantly

based on independent customer feedback

insurance partners

As a carpenter your business is exposed to a variety of different risks, so it is important to look at the different type of business insurance options available and how they can help provide protection. These are some examples of when business insurance can help:

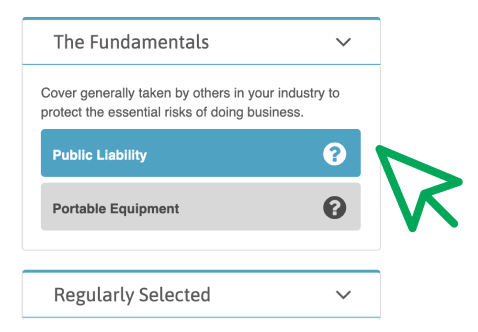

When it comes to business insurances for carpenters there’s a few to look at to ensure you have a solid framework for protecting your business. These are a few to consider to keep your business safe as houses.

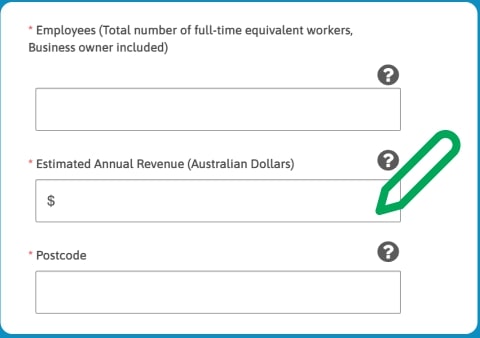

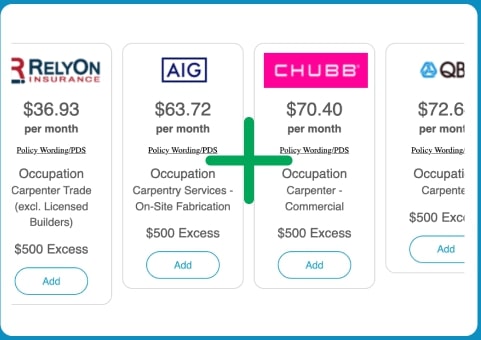

As a carpenter, you take pride in delivering high quality results. Luckily, protecting your hard-work and reputation with the right business insurance has never been easier. Whether it’s getting your Public Liability insurance sorted or protecting your valuable tools, having a plan in place to protect your carpentry business is a solid investment. At BizCover we offer a framework of insurance options from some of Australia’s leading insurers, with quotes and cover arranged in minutes.

Get Instant Quotes

Manage your insurance needs anywhere, anytime

If you are providing your clients with professional advice on all things carpentry, then it may be worth considering Professional Indemnity insurance. All it takes is for a client to claim negligence (actual or alleged) for damages caused as a direct result of your advice.

This is when you need to think of the potential financial impact a claim may have on your carpentry business. Fortunately, with Professional Indemnity insurance, the costs of things like the compensation if awarded and associated legal costs are covered by your policy.

Yes it does, and anywhere in Australia too. That means you can rest easy knowing your tools of trade are protected anywhere from Bondi to Bourke!

Each business is unique and different, so there isn't a one-size fits all Public Liability insurance policy. Things to consider when looking at the amount of coverage include things like: