Compare quotes from our

trusted insurance partners*

Our Customers Savings from Cleaner Industry

Fotini / VIC

Cleaning: Commercial Premises, Shops or Offices

SAVED

$200

*

Personal Accident & Sickness, Business Pack

by switching to a policy purchased through BizCover.

*Savings made in Jun 2023. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Loretta / TAS

Carpentry Work On Construction Projects

SAVED

$300

*

on Business Pack

by switching to a policy purchased through BizCover.

*Savings made in Jun 2023. This information is provided as a guide only and may not reflect pricing for your particular business, as individual underwriting criteria will apply.

Compare savings on insurances for cleaners

Compared with previous insurers’ premiums, customers across Australia who switched to BizCover (from a comparable product) saved an average of:

SAVED

$300

*this information is based on

Why do cleaners need insurance?

While you wipe away the mess that your clients make, we’ll wipe away your worries with business insurance. With just a few clicks or a single phone call you can get multiple competitive quotes from some of Australia’s leading insurers. Just select your preferred policy and you’ll be covered in a jif!

Get quotes >Key features

Protection against claims from third parties for accidental personal injury or damage to their property

Keeping your tools protected

A requirement of a contract

Financial protection

in the event you are

faced with a claim

What are the most common insurance policies for cleaners?

If you operate as a sole-trader you may be personally responsible, both legally and financially, for all aspects of the business. In other words, you may be exposed to risks that have the potential to affect your personal assets if things go wrong.

When it comes to business insurances for carpenters there’s a few to look at to ensure you have a solid framework for protecting your business.

Business

Insurance*

If you rely on your own cleaning equipment to run your business how would you cope if it was damaged or stolen? The good news is you can protect it with General Property (portable equipment) cover.

General Property insurance can cover specific items such as commercial cleaning tools.

Public Liability

Insurance*

Do you need it? The short answer is yes. Thankfully, Public Liability insurance is there to provide protection for you and your business in the event a customer, supplier or a member of the public is injured or sustains property damage as a result of your negligent business activities.

Whether you clean domestic... or commercial properties, there are plenty of things that could potentially go wrong and could leave you facing a public liability claim for personal injury or property damage.

All it takes is for you forget to display a ‘wet floor’ sign and your customer slips over injuring themselves; a passer-by trips over the cord from the vacuum cleaner that you left out; you spill a cleaning agent which leaves permanent damage to a bench top or floor; or you accidentally knock over your client’s antique vase smashing it to pieces – the list could be endless.... Read more

Personal Accident

and Illness insurance*

You rely on your physical ability to get the work done – but have you stopped to think about how you would keep on paying the bills if you were to injure yourself or fall ill and had to take time off work to recover? Accidents can happen anywhere, anytime. It could be at work or even when you’re out and about in your spare time...

Personal Accident and Illness insurance can provide cover should you become permanently disabled or pass away as a result of an accident. Cover can also include a weekly benefit for loss of income if you are unable to work as a result of an unexpected injury or illness (even if it occurs outside of your employment).... Read more

*As with any insurance, cover will be subject to the terms, conditions and exclusions contained in the policy document. The information contained on this webpage is general only and should not be relied upon as advice.

Our customers review

from Cleaner industry

Get quotes for your business >

Richard A

Trades & Services

Sarah W Woodland

Trades & Services

Why BizCover?

Built for small business

We know insurance and what makes small businesses tick.

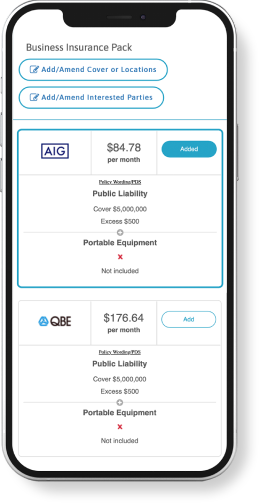

Clear and competitive pricing

You can compare and choose from a range of highly competitive prices right there on your screen. Seriously.

Protect Over 200,000 Small Businesses

4.7 / 5 Feedbacks from our customers

Cover to match your needs

You can tailor policies from selected Australian insurers to suit the needs of your business.

Real people adding real value

Our friendly service team is on hand and on a mission to make you smile!

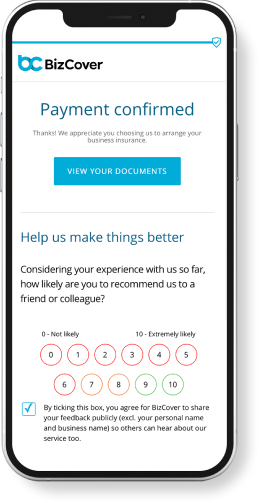

Ready to be covered?

Try our quick and easy instant quotes, Get a free,

no-obligation quote in seconds.

We'll secure your competitive quotes for 30 days

so you can compare and choose the best option

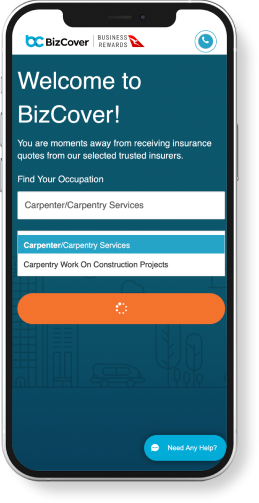

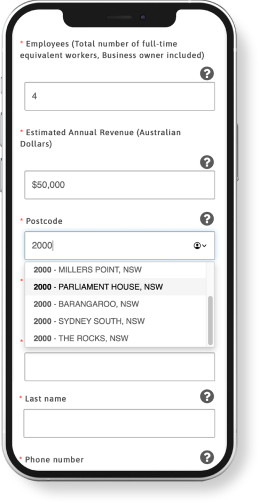

So,how it works?*

4 Easy steps

to get covered and secure your

business at BizCover.

Enter your

business details

Compare and

Select Quote

Get covered

in 5minutes

You just have stared your business and

not sure what your business needs?

Call 1300 920 874 and speak to

one of our insurance specialists.

or try our quick and easy instant quotes

Get quotes for your business >* The information provided on this page is general guide only and does not take into account your personal objectives, financial situation or needs. This information should not be construed as any form of advice. Consider your own personal circumstances, objectives, financial situation, needs, Product Disclosure Statement (PDS), and full policy terms and conditions before making a decision. Product descriptions on this page are intended only as a guide to coverage terms and conditions, and should not be relied upon to determine policy coverage. Policy coverage is subject to the specific terms and conditions of each policy wording.Price Promise Terms and Conditions apply. Refer to https://www.bizcover.com.au/price-promise/ for full details.BizCover Pty Limited ABN 68 127 707 975, AFSL 501769