How much does Public Liability Insurance cost?

On average, small business owners can expect to pay around $63.53 per month^ for Public Liability insurance. Public Liability insurance is one of the most popular types of insurance for businesses. In fact, it is important for almost every kind of business from those that operate in the trades and service industries, to businesses that are predominantly office-based, such as consultancy occupations.

Given the various industries and occupations Public Liability insurance can cover, also means the cost of it can vary greatly. This is due to a number of key factors including:

- The type and nature of your business

- Your business turnover and size

- The amount of insurance cover your business needs

Other factors that may play a part in determining the cost of your Public Liability policy are the location your business; what is included and excluded by the policy; and the insurance provider you choose.

We have put together a snapshot of how much Public Liability insurance can cost for a small business, by analysing data from policies sold by BizCover during the 2018/19 financial year. The sample we analysed included more than 110,000 businesses across many different occupations, each of which had 10 or fewer employees.

However, the most accurate way to find out the cost for your business is to simply get an instant online quote.

What is the average monthly premium for Public Liability insurance?

On average, small business owners can expect to pay around $63.53 per month^ for Public Liability insurance.

From our analysis, we found that around 62% of small businesses pay less than $50 per month; while around 25% pay around $51-100 per month for their Public Liability insurance.

Below is the full breakdown:

^Data based on approximately 110,000 BizCover customers with less than 10 employees who purchased during the financial year 2018 / 2019

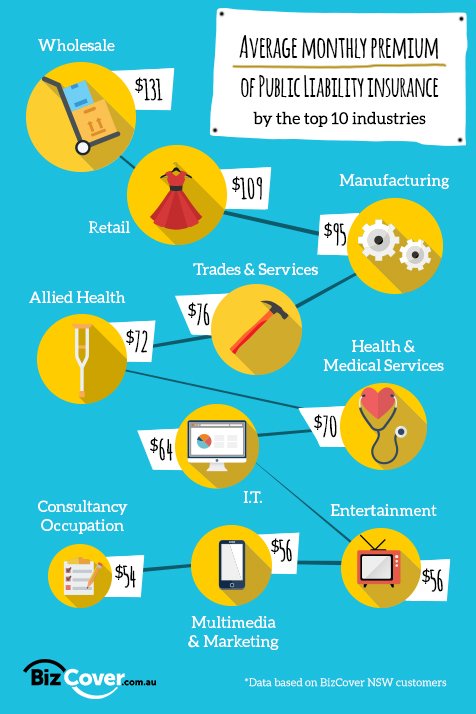

What is the average cost of Public Liability insurance by industry?

One of the biggest factors influencing the cost of Public Liability insurance is the type of industry your business operates in, and the nature of your occupation. The higher an insurer determines the risk associated with your business potentially causing personal injury or property damage, the higher the premium.

For example, cafes and restaurants present a higher risk due to a combination of dozens of people passing through the doors each day, and the number of things that could potentially go wrong which could lead to a public liability claim being made. For instance, food poisoning; slips and falls on wet floors; and scalds caused by hot liquids.

Meanwhile, an office-based business, such as an accounting firm or marketing agency, is typically considered less risky as there is generally less foot traffic moving through the premises, and their work is less likely to cause injury or property damage to clients or members of the public.

It is important to note that each insurance company assesses risk in different ways. What one insurer may consider as a high-risk occupation may not be considered as risky by the next. This is partly due to the number of claims each insurance company has received for each given occupation.

Data based on approximately 110,000 BizCover customers with less than 10 employees who purchased during the financial year 2018 / 2019

As you can see from our data, businesses that operate in the wholesale, pharmacies and retail industry have the highest base premium, which is predominantly due to them being potentially liable for personal injury or property damage that may be caused by the products they manufacture or sell, under the liability provisions of the Australian Consumer Law.

How much do Tradesmen pay for Public Liability Insurance?

There are many different types of occupations that operate within the Trades & Services industry, each with a different level of risk, which means the premiums can vary greatly from one trade based occupation to another.

We have analysed our top 10 most popular trades and services occupations. You can see from the results below that commercial cleaning businesses are one of the occupations with a high average premium.

Whilst commercial cleaning may not sound like a dangerous profession, they are considered particularly risky by insurers as they are often required to clean office buildings and public spaces, such as shopping centres, during opening hours which puts them at greater risk of causing bodily injury to somebody. Consider what could go wrong when wet floors, vacuum cleaner leads and hazardous chemicals are mixed with members of the public.

Here are the average premium our top 10 Trades & Services occupations are paying for their Public Liability

Data based on approximately 110,000 BizCover customers with less than 10 employees who purchased during the financial year 2018 / 2019

Does the size of my business affect the premium?

The number of employees and the amount of revenue your business turns over can have an impact on the cost of your Public Liability policy.

Unfortunately, the old ‘safety in numbers’ principle doesn’t apply when it comes to insuring your business. In fact, the higher the number of employees you have means there are more people in your organisation who could potentially cause an accident such as bodily injury to a customer or member of the public, or damage to a third party’s property.

For example, you own a real estate agency which has grown from having just 3 employees to 10 employees. You now have 10 agents going out visiting multiple properties each per day resulting in a higher chance that something could go wrong.

Generally speaking, insurers will look at the number of employees when determining the cost of Public Liability insurance for trade and service-based businesses, whereas revenue plays a more important role when it comes to pricing for office-based businesses.

Data based on approximately 110,000 BizCover customers with less than 10 employees who purchased during the financial year 2018 / 2019

Does the level of cover affect the premium?

As with most things in life, the more you buy of a particular product or service, the more it will cost. When it comes to Public Liability insurance however, the cost does not rise too significantly with an increase in the amount of coverage. Fortunately, double the amount of cover does not mean double the premium.

The most popular level of cover amongst our customer base for Public Liability insurance is $10 million. However, some businesses prefer to take $5 million, whereas others take as high as $20 million.

The amount of cover you elect to take can be influenced by a number of things, such as the type of risks your business is exposed to, as well as any work contracts you take on and/or industry-based requirements.

What is the average monthly cost of Public Liability insurance by level of cover?

| Coverage level | Number of customers with this level of cover | Average Public Liability premium (Monthly) |

| $5 Million | 26369 | $45.9 |

| $10 Million | 46415 | $57.1 |

| $20 Million | 36219 | $91.1 |

Data based on approximately 110,000 BizCover customers with less than 10 employees who purchased during the financial year 2018 / 2019

How does the location of my business affect my premium?

The location of your business will have an effect on the cost of your Public Liability policy, as each Australian state and territory charges varying levels of stamp duty on insurance premiums ranging from 0% to 11%. Therefore, depending on which state you are based in the stamp duty will be charged accordingly. If you have multiple offices throughout Australia the rate of stamp duty you pay will be determined by the state in which your head office is located.

According to our data, businesses in NSW and Queensland pay higher average base premium for Public Liability insurance. However, this is most likely due to a combination of greater sample size in NSW and Queensland, compared to all other states, with a higher proportion of businesses that operates in industries with a higher perceived risk.

What is the average cost of Public Liability insurance by state or territory?^

| State | Average monthly premium |

| New South Wales | $67.94 |

| Victoria | $67.32 |

| Queensland | $68.27 |

| Western Australia | $54.57 |

| South Australia | $55.61 |

| Tasmania | $50.61 |

| Australian Capital Territory | $59.02 |

| Northern Territory | $55.81 |