Australia’s SMEs play a crucial role in the country’s economy. They offer employment to a larger part of the Australian workforce. Furthermore, SMEs facilitate entrepreneurship and innovation as well as offering an avenue for providing niche and specialised products and services. Based on the significance of SMEs to the Australian economy, there is a need for the country to focus on the future of small to medium enterprises. The country should evaluate the increasing contribution of SMEs to Australia’s GDP, focus on lowering tax for Australia’s SMEs, rapidly digitise small businesses and encourage alternative financing for small businesses.

Increasing contribution of SMEs to Australia’s GDP

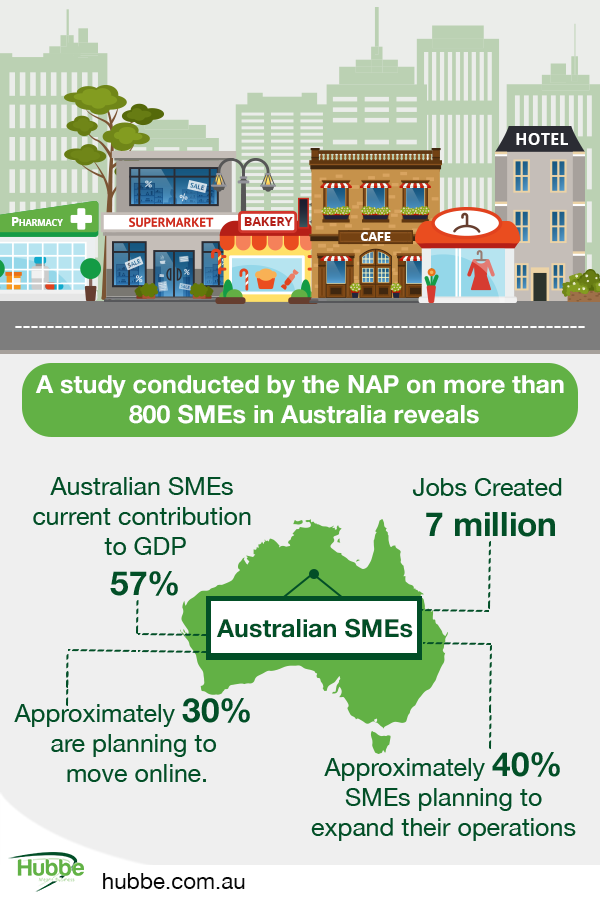

SMEs contribute significantly to Australia’s GDP. A particular study conducted by the NAP on more than 800 SMEs in Australia reveals that Australia’s SMEs currently contribute to 57% of the country’s GDP. Furthermore, the study discovered that these SMEs created approximately 7 million jobs in Australia. The creation of more jobs for Australian residents is increasing the rate of production and delivery of goods and services, consequently improving the country’s GDP. Australian SMEs continue to show signs of growth with the strategies adopted by many small and medium businesses. Apparently, 40% of SMEs are planning to introduce new products and services to expand their operations while approximately 30% are planning to create an online presence or commence selling online. These strategies are expected to boost Australia’s GDP further in the near future.

Lowering Tax For SME’s in Australia

Australian small businesses are expected to benefit from a reduction in the tax rates. Currently, there is a call by the Prime Minister of Australia, Scott Morrison, to reduce the tax rates for small and medium businesses by 2021 to 2022. The proposed tax cut strategy is expected to reduce the rate to 27% by 2018 financial year, and to 26% by 2020 to 2021 and subsequently to 25% in 2021 to 2022. This anticipated move has been acknowledged by experts including Peter Strong, the CEO of Small Business Organisations Australia as a likely positive contributor to small and medium businesses as well as the national economy. The lowering of tax for small businesses in Australia could enable many businesses to grow better and create adequate well-paying jobs.

Rapid Digitisation of Small Businesses

Presently, most SMEs in Australia have not adopted digitisation. A particular survey conducted by Cisco on more than 500 Australian small business owners reveals that 69% of small and medium business owners are afraid to adopt digitisation in their businesses. A majority of these business owners think that investing in business digitisation is very expensive. However, despite fears to spend a lot on business digitisation, most small business owners feel that digitisation could be of significant help to their businesses.

The Australian government has unveiled the Small Business Digital Taskforce to help small businesses digitise and apply digital tools to enhance their operations, access finance easily and find talent. This task will interact with small businesses in Australia regarding their ideas and concerns on how they can perfectly take part in the digital economy. Subsequently, small businesses are invited to share their challenges in the adoption of digitisation and submit ideas on how the small and medium businesses can be assisted to take part in the digital economy. This mechanism is expected to expedite the improvement of digitisation of small businesses.

The significance of Alternative Financing to the growth of SME’s

The continuous and easy access to finance by small businesses as a result of alternative financing is helping many Australian SMEs grow. Alternative financing for small businesses is one of the reliable methods of financing considered by a majority of small businesses. Alternative finance typically stretches beyond conventional assets such as cash, stocks and bonds. Borrowers are usually required to present their details when applying for a small business loan. Alternative financing makes it easier for small business owners to access business loans swiftly compared to traditional lenders. It is usually ideal for small businesses because it offers many loan options, features a quick approval process and has less strict qualifications, which eases access to business finance for small businesses. Hubbe Australia is one of the best and most reliable alternative lenders offering financial solutions to many small businesses in Australia aspiring to achieve a rapid business growth.

The bright future of Australia’s small businesses

Australia’s SMEs are proving to be critical to the country’s economy by equating to approximately 57 per cent of Australia’s GDP and employing around 7 million Australians. Today, small and medium businesses are considered among the most valuable resources in Australia. They have helped the country achieve a positive reputation as a hub for entrepreneurs and innovators. The future of small businesses in Australia is very promising thanks to the sustained efforts of the government to support and offer a viable working business environment for SMEs. The call by the Australian government to lower tax rates for SMEs would also boost small businesses significantly in the future. A particular report, The Moments that Matter, reveals that Australia’s SMEs are upbeat regarding the future of their businesses as indicated by the latest economic growth, which has instigated an improvement in the conditions of the construction, service, health and infrastructure segments. Most small and medium businesses feel that the improvement of these sectors of the economy will significantly boost their business operations; thus boosting their overall output.